Nikkei 225 Recently Hit a Record 40,000. Where Does Technical Analysis Say It Might Go From Here?

The Tokyo Stock Exchange's benchmark Nikkei 225 index recently crossed 40,000 for the first time ever, some 34 years after its 1980s rally topped out at38,957.44 – a level it would take decades to regain. What might technical analysis tell us about where the index could go from here?

The Nikkei 225 is one of the Tokyo Stock Exchange's benchmark indexes, roughly equivalent to the U.S. S&P 500. It's a price-weighted index that tracks the performance of 225 large Japanese stocks spread across multiple market sectors.

Let's look at the Nikkei 225's charts as of March 6:

Relative Strength Index

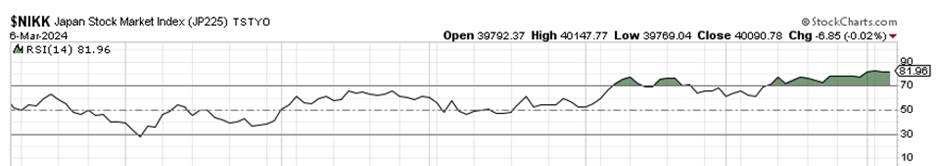

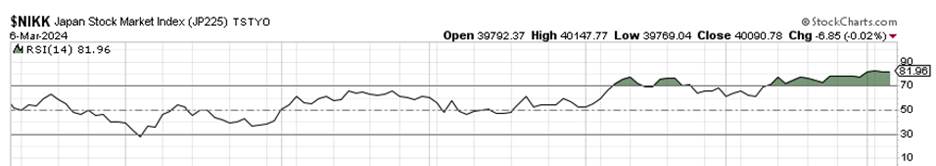

The Nikkei's six-month Relative Strength Index chartshows that the index is very overbought technically:

The RSI is a momentum indicator that uses the speed and magnitude of a stock's recent price moves to calculate a security's "relative strength" on days when its price goes up compared to days when its price goes down.

Plugging this information into a mathematical formula generates a number in between zero and 100. Historically, technical analysts consider a stock "overbought"(overpriced) when its RSI tops 70, or "oversold" (underpriced) when the number drops below 30.

As I write this, the Nikkei is up 19% year to date and has really" been trading almost constantly higher without taking time to consolidate since October. The index's RSI has been above 70 for over a month (the green shading in the chart above). As noted above, that’s usually considered a technically overbought condition.

Moving Average Convergence/Divergence

Next, let's look at the Nikkei 225’s March 6 daily Moving Average Convergence/Divergence chart (MACD):

MACD is a technical indicator that can show investors potential "buy" and "sell" signals for a given stock or index.

The indicator subtracts a stock's 26-day Exponential Moving Average from its 12-day Exponential Moving Average to create a trend line.

Technical analysts then create a nine-day Exponential Moving Average of this trend line to create a "signal" line. A move above the signal line historicallyrepresentsas a "buy" indicator, while a reading below the linecould serve as a "sell" signal.

As you can see, the Nikkei' s 12-day Exponential Moving Average (the black line above) crossed over the 26-day Exponential Moving Average (red line above) in early February, as denoted with a green circle above. It has yet to come even close to crossing back. That's historically considered bullish.

Moving Averages

Now let's look at the March 6 Nikkei's six-month chart and its:

-- 50-Day Moving Average (the blue line below)

-- 200-Day Moving Average (the red line)

-- 21-Day Exponential Moving Average (green line)

The Nikkei has not come in toward its own 21-day EMA (the green line above) recently. That's frozen swing traders in place since a near miss in early February (denoted by a green circle). In fact, it has not touched that line since New Year's Eve (the red circle above).The fact that the Nikkei held above the 21-day EMA in February would historically be seen as bullish.

Next, let's look at the March 6 histogram of the Nikkei's nine-day exponential moving average, denoted by the areas below that are shaded in blue:

This technical indicator was above zero when I wrote this, which is historically another a bullish sign. However, it looks to be losing a little juice since peaking about three weeks ago.

Factoring in Currency Conversion

Part of the Nikkei's year-to-date strength is due to weakness in the Japanese yen. Take a look at this chart of the U.S. dollar vs. the yen going back to 2023's start:

Unless one follows currency markets, this may surprise casual followers of financial markets.

One U.S. dollar bought you about 138 yen a year ago, but gets you about 148 yen today -- and in February, it bought 151 yen.

So, if you invested in the Nikkei 225 last year using U.S. dollars, you aren't up nearly as much as you think. You probably have to reduce what you think your profits are by 7% to 8% to adjust for exchange rates.

The Nikkei 225 Has Seen Two 'Basing Periods' Since 2021

It's also worth noting that since the start of the pandemic, the Nikkei 225 has gone through two basing periods of consolidation, as denoted by the blue lines below:

The first basing period lasted from early 2021 into early 2023 and sloped mildly downward. The second was an old-fashioned flat base that lasted from Summer 2023 into the end of that year.

The Bottom Line

Two potential key takeaways from the above charts and Japan's macroeconomic situation are:

-- The Nikkei 225's RSI reading appears to be very overbought historically speaking, especially when compared to where it was at the start of the Nikkei’s 2023 base

-- The Bank of Japan is just starting to go through the earliest stages of normalizing monetary policy after a very long period of looseness

Added together, this might mean that the Japanese stock market is looking at the onset of a new basing period of consolidation. If that's true, it could be time to be more selective on Japanese stocks rather than initiating a broad position in the Tokyo market.

This presentation discusses technical analysis, other approaches, including fundamental analysis, may offer very different views. The examples provided are for illustrative purposes only and are not intended to be reflective of the results you can expect to achieve. This article is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. Investing involves risk regardless of the strategy selected and past performance does not indicate or guarantee future results. Furthermore, there is no guarantee that any statements, estimates, price targets, opinions or forecasts provided herein will prove to be correct. Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. In the U.S., investment products and services available through the moomoo app are offered by Moomoo Financial Inc., a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) and a member of Financial Industry Regulatory Authority (FINRA)/Securities Investor Protection Corporation (SIPC). In Singapore, investment products and services available through the moomoo app are offered through Moomoo Financial Singapore Pte. Ltd. regulated by the Monetary Authority of Singapore (MAS). Moomoo Financial Singapore Pte. Ltd. is a Capital Markets Services Licence (License No. CMS101000) holder with the Exempt Financial Adviser Status. This advertisement has not been reviewed by the Monetary Authority of Singapore. In Australia, financial products and services available through the moomoo app are provided by Futu Securities (Australia) Ltd, an Australian Financial Services Licensee (AFSL No. 224663) regulated by the Australian Securities and Investment Commission (ASIC). Please read and understand our Financial Services Guide, Terms and Conditions, Privacy Policy and other disclosure documents which are available on our website. In Canada, order-execution-only services available through the moomoo app are provided by Moomoo Financial Canada Inc., regulated by the Canadian Investment Regulatory Organization

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment