MooMoo Announcement! 3/14/2024 (Celebration Give Back To Followers Part 1)

Good morning everyone, and what a good morning it is!

-

It is with my own upmost excitement to announce that I have been awarded and credited as MooMoo's newest Moo Contributor ![]()

![]()

![]()

![]()

![]()

![]()

-

At only 898 followers, I....no, WE have managed to average at least 10K views per article post, and on our larger research from The Market / Deep Posts, we average anywhere from tens of thousands to hundreds of thousands of views per article. Words cannot express how grateful I am for you all and for the support you have shown me since I began posting my research in the markets. Thank you.

-

I want to also thank MooMoo and @Mooers Lab for this incredible offer. Since the day I joined MooMoo, I had immediately liked the platform. Their FREE level 2 options book was unmached, 0 comission, and the developer's consistent devotion to keeping the platform up to date was really ahead of its time. Sure there are other platforms like Webull, but MooMoo's UI outshined the rest in my opinion.

-

From there, I began diving further into the market. I would post charts and other market analysis. I enjoyed doing it and I asked you guys if I should continue to post my research.

With that we wrote our first DeepDive as some of you know as The Palantir Deep Dive where we talked about Cathy Wood's position and why I thought she was investing again. We also discussed the history of the company, talked about military contracts, sentiment and of course we posted the charts in a story telling format.

You can read that here.

The article, needless to say, blew up and currently sits at around 90,000 views. I had no idea that writing this article would light a fire in me to continue to post my research and continue to onwards the creation of one of my personal favorite articles. I bet some of you can guess which one it is!

-

The C3.AI article I wrote took forever to do research on. Thankfully, the AI boom was just beginning and the company had a great website with a bunch of useful information. Especially the page where it listed the fortune 500 companies they worked with. I introduced Tinfoil into my articles which I was nervous about since I prefer to just write research I can cite my sources to if asked, but my worries were for not. That article sits at 129,000 views and I think we leaped to 300 followers by the time I wrote my next Deep Dive.

-

Articles aside, middle of last year I dove into the Futures market. Furtures are hard, really hard. It is an entirley different ball game. My upmost respect goes to those who are arctivly trading Futures or Forex / daytrading. Daytraders are at a constant disadvantage, more so than Options traders. Options are also no joke at all, but Futures and Forex trading is as close to the actual "gambling" in the markets as it comes. You can hold a stock from the lows with deep ITM or OTM Options contracts, but with Futures if you don't take profit that very day I don't know what to tell you lol. I know everyone wants to make money quick, but I would never recommend for anyone to try Futures trading if they are beginners in the market. Forex trading is even crazier. Some even call it a scam due to who actually controls and makes the markets, and with that reason I never went into Forex. Futures is the furthest I have travelled, and I am happy with that because it taught me a lot.

-

The 1000 Followers celebration is still in the works! You won't want to miss that. However, in celebration for this accplishment achieved today, I am going to tell you some things that really and actually helped me get to the place where I am today in the markets.

Alkaline Give Back

I want to let everyone know before we begin that I might participate in the "Mooer's Stories" spotlight where some of this information about what helped me in markets, learn the markets, and when I began my journey in markets may be reitarated or seem redundant. However, you all will get this information today and more from the 1000 Follower celebration. So you get it first, the rest will get it after we achieve 1000 followers ![]()

-

As most of you know, I have a saying. "What I know could help you, and what you know could help me" followed by "so lets make some money" or something, but it is true. I don't like to gatekeep information or resources, however it happens in the markets. It's just about playing the game and knowing how to play and as much as I post my lessons on IRS Tax Harvesting, Liquidity, Market Sentiment, Open Interest, and more, there are still some tools that are helpful that I want to share with you today. Let's start with research.

1. Research

Believe it or not, there is a time a place when doing research. Whether looking to take a position in a stock, or to exit a position, the best time to do any research is pre-market. Not only scientifically backed, but when you want to analyze a stock, the most profitable times to do so are before the market opens. That's what inspired my The Market series. So if you have time to do research, the morning before the market opens is the best time to do it. A lot of traders may disagree with me and argue that after-hours is the best time to find a play, which it is! However, the best time to do any sort of extensive research is in the morning.

Some sources I use:

Great for catching up with the news in a friendly written, professional and effecient manner.

Provides trade ideas, seasonality updates, niche opportunities, and has a news scanner or wire. It's not the best, but it works.

2. Charts

I already made a post on this, but you can find my MooMoo charts and a complete in-depth tutorial here.

or here.

In addition to this, on MooMoo, I use a series of very helpful indicators.

-The Sequential 9 for reversals

-The 9 or 12 EMA for day trading

-VWAP of course

-RSI for larger time frames

Combining these together can help you take a trade whether to the upside or downside.

Furthermore, just looking at chart patterns and memorizing them will improve your recognition of patterns.

3. Float

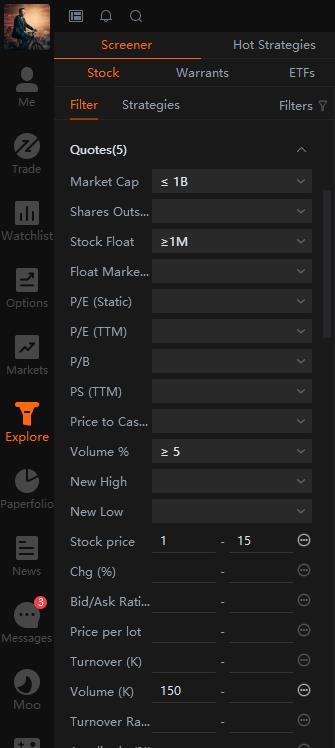

My settings for MooMoo's Float Screener

Although I don't take trades based off this alone, it gives me a list of stocks priced from $1-15 with a float over 1 Million which are above 5% trading volume that are on the move. A really helpful took tool to find stocks to research further on. The name of the game is to be early to these stocks, but some of them have a greatrer probability to continue a possible rally, it's about finding those and doing further research on it.

You can combine this with numerous other tools like Market Chameleon for more research into a position.

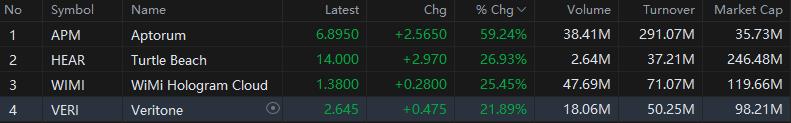

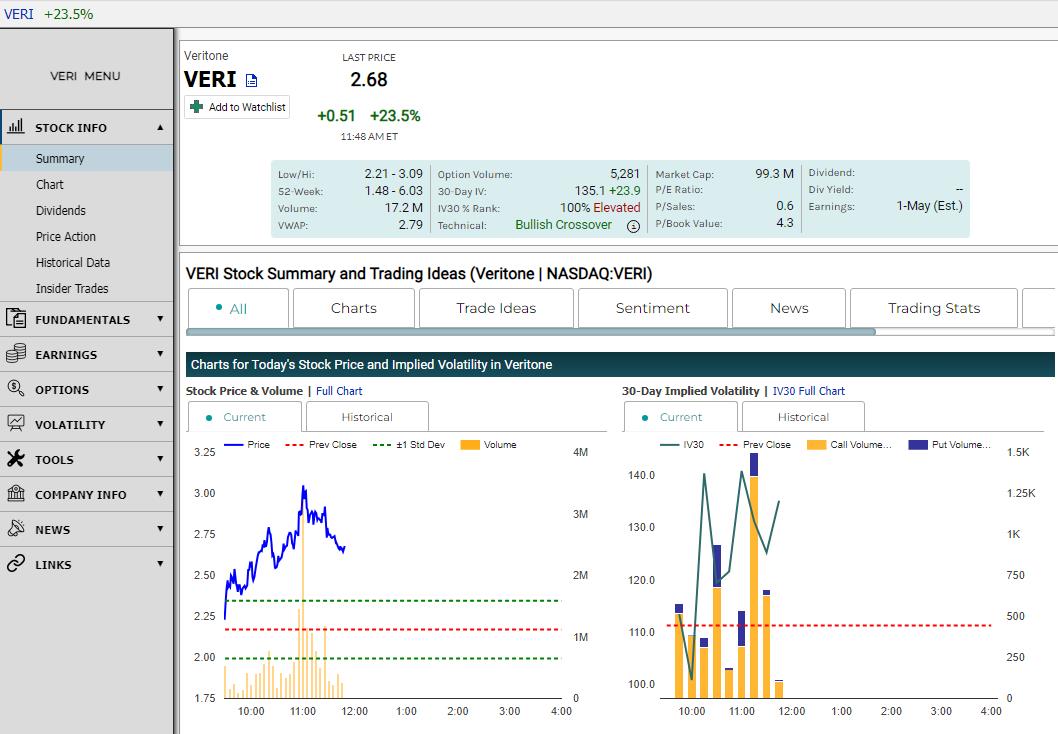

Take a look at the chart

Heavilyyyy shorted. Why? A good guess is non-profitabiliy. A risky bet, but as is any penny stock. Remember, a penny stock is a stock that is under $5. Congradulations to $SoundHound AI(SOUN.US$ for achieving that $10 mark and finding support at the sentiment level of $5 where investors / traders make up their mind on whether to go/swing long or go/swing short.

Then head over to Market Chameleon, or Finviz or something like that and look at the data.

There is a lot of other information you can use to determine if you think the stock will squeeze or not.

Of course you don't need to use my settings or my resources, but if you look into the stock screener you could even rival famous short squeeze finders like Alvin if you tune it correctly. Since the last time I updated my screener, which was a while ago, there were 0 tutorials on how to set it up. So I thought I might as well give you my setup as a head start into your own independant research.

4. Community Resources

Right off the bat, if you want to learn more about the markets, I can easily recommend you two users.

I have shouted them out before, but I am going to again here. If somehow you have not come accross these investors / traders, then you're missing out.

SpyderCall is all over the map. His research and posts are consistant and complex, but worded in a way that even someone who isnt in the markets at all can pick up what he's putting down. I have had the pleasure of having a couple conversations with him here and there and his intellegence in markets is one you can't ignore.

iamiam is a seasoned investor who provides updates about larger companies and indexes such as $SPDR S&P 500 ETF(SPY.US$ or $Invesco QQQ Trust(QQQ.US$, the economy, futures contracts, and has experience in markets like none-other. He has helped me in the past and is responsive to comments or any questions user have, regardless of investment experience.

Both of these individuals have at one point helped me, if not inspired me to conduct robust research, write it in an article, and post it here on MooMoo. Go check them out if you have a chance and you'll be suprised by just how much you will learn by going through their articles.

Conclusion

There are other resources that I use in markets. Such as TradingView, Ortex, and other niche tools that helped me along the way and still do. However, those I am saving for the 1000 Follower day, so I apologize if the list was short or lower than you expected.

A big thank you to MooMoo, and to you all for helping me achieve one of this years goals in becoming a Moo Contributor. I am bullish on 1000 followers, and cannot tell you how appreciative I am for this opportunity.

I hope you all enjoy your day in the market with cash ready to hit the routing number. $Bitcoin(BTC.CC$ found some new sellers and dipped below $70,000 for a few minutes, but is finding support at the current price of $70,264 for now.

Thank you ![]()

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment