Monthly Buzz: Spooktober freaks the market out

Hey, mooers! Welcome back to Monthly Buzz. ![]()

October was another crazy month for the markets. Seasonally, this tends to be a tough time for the stock market. Combined with many macroeconomic and geopolitical issues across the world, the markets were filled with uncertainty. ![]()

This year, the "magnificent seven” mega-cap tech stocks have been supporting the Nasdaq 100 and the S&P 500, but Q3 earnings reports have ultimately given the short-sellers the upper hand. Despite the fact that some big companies have exceeded expectations, the stock price has fallen rapidly because of their cautious expectations. All three major indexes finished the month in the red. The Dow was down 1.36%, and the S&P 500 was down 2.20% during the month. The tech-heavy Nasdaq 100 dropped 2.08% (Data as of Oct 31, 2023). ![]()

Meanwhile, consumer goods and energy led the way lower, while utilities and technology gained slightly. For now, interest rates and earnings continue to drive sector performance.

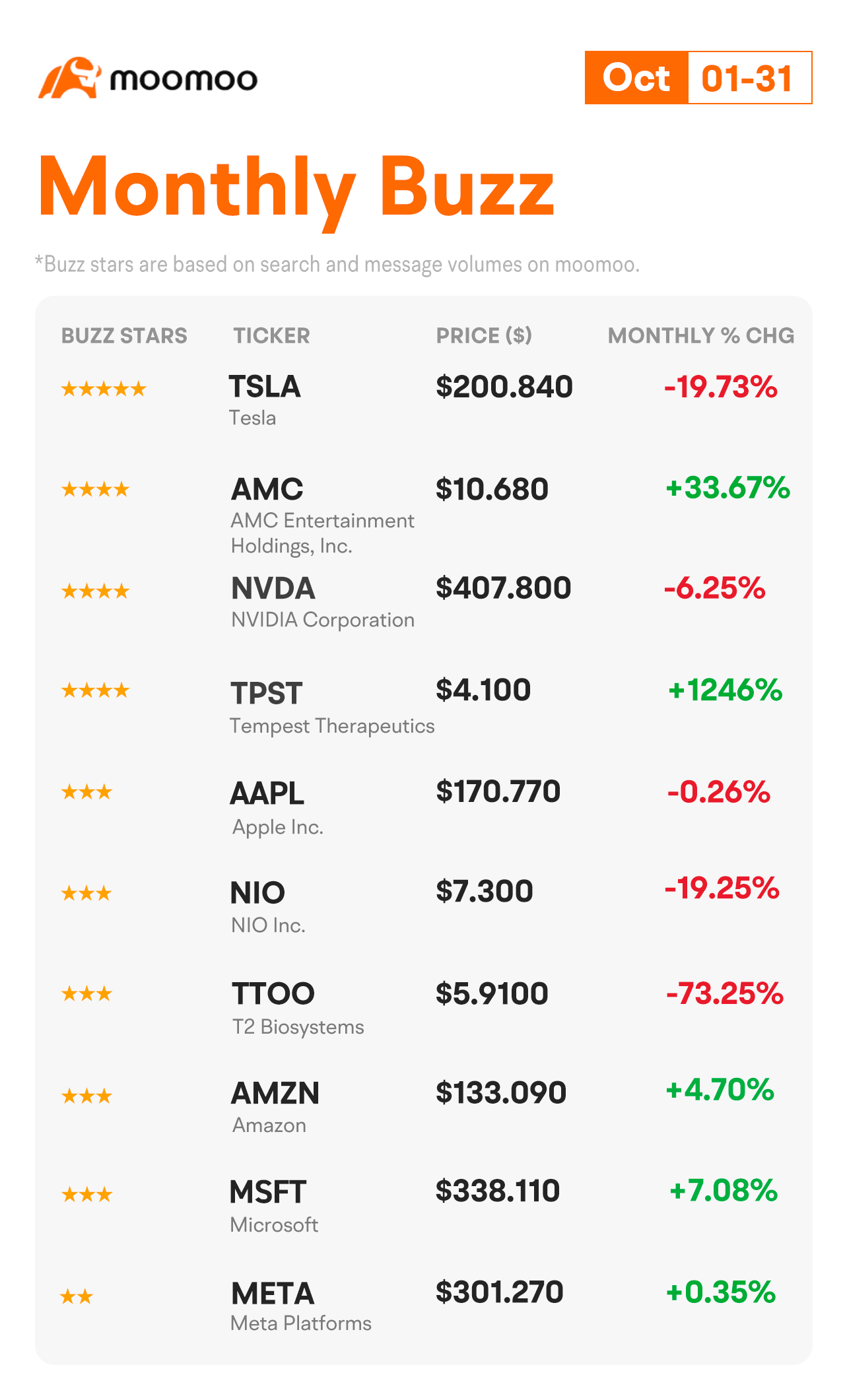

Let's take a look at how the stocks that created the most buzz on the moomoo app performed during the month.

Note: The number of buzz stars is based on the search and message volumes of the stocks on moomoo (data as of Oct 31, 2023).

1. TSLA – Buzzing Stars: ⭐⭐⭐⭐⭐

Oct 04: Tesla shares soared 5.93% after trending lower to start the week on the back of weak production and delivery numbers. The EV maker delivered 435,059 vehicles in the quarter, down from 466,140 in the previous quarter.

Oct 19: Tesla shares dropped 9.3% after reporting disappointing third-quarter financial results missing analyst estimates on both the top and bottom line for the first time since the second quarter of 2019. Its soft quarterly results are weighing on several other EV companies including Lucid and Rivian.

Oct 30: Tesla shares fell 4.79% following strong earnings from its Chinese competitor, BYD, which reported an 82.2% year-over-year increase in profits and a 36.5% jump in revenues.

2. AMC – Buzzing Stars: ⭐⭐⭐⭐

Oct 06: AMC shares soared 11.57% amid a flurry of anticipated new theatrical releases. The company said late Thursday that the upcoming Taylor Swift: The Eras Tour concert film had sold more than $100 million in advance tickets globally.

Oct 13: AMC shares fell 13.64%. The stock may be pulling back following recent momentum in anticipation of the debut of the Taylor Swift Eras Tour concert film.

Oct 30: AMC shares climbed 8.85% as Taylor Swift's concert film set another record. The film has brought in an estimated $203 million worldwide since its release, making it the first pure concert film in history to record more than $200 million in global box-office receipts.

3. NVDA – Buzzing Stars: ⭐⭐⭐⭐

Oct 17: Nvidia shares plummeted 4.68% after reported that the U.S. intends to tighten restrictions on AI chip exports to China and Nvidia’s H800 chip, citing a U.S. government official and industry sources.

Oct 25: Nvidia shares fell 4.31% Wednesday. Semiconductor stocks are feeling the impact of Texas Instruments Inc.'s third-quarter results. The chip maker, which is viewed as an industrial bellwether, cited weakening industrial demand Tuesday afternoon as it underwhelmed with its forecast.

Oct 23: Nvidia shares gained 3.84% following a report suggesting the company will make Arm-based PC chips, which could challenge Intel.

4. TPST – Buzzing Stars: ⭐⭐⭐⭐

Oct 11: Tempest Therapeutics shares soared 3972.53% after it reported Wednesday updated results from its phase 1b/2 study showing that a triple combination therapy including TPST-1120 delivered improved results from earlier interim data in treating patients with resectable or metastatic hepatocellular carcinoma, a type of liver cancer, compared with the standard of care.

5. AAPL – Buzzing Stars: ⭐⭐⭐

Oct 02: The shares of Apple increased 1.48% after they reported considering making a bid for Formula One global TV rights. The company said over the weekend it plans to release an iOS 17 software update to improve overheating issues with the recently released iPhone 15.

Oct 26: Apple shares were down 2.46% after it raised the prices for Apple TV+, Apple Arcade, and Apple News+ in the U.S. and select international markets, following similar moves from other entertainment giants amid a competitive streaming environment.

6. NIO – Buzzing Stars: ⭐⭐⭐

Oct 10: NIO Inc. shares climbed 5.88% after saying in an X post that it achieved 30 million battery swaps as of Monday. The company said that it delivers over 60,000 swaps every day with a fully charged NIO car leaving a power swap station every 1.4 seconds.

Oct 18: NIO Inc. plummeted 7.27% after the company is reportedly considering a dealer network in Europe, which if true would signal a departure from the company's previous insistence on moving its direct sales model overseas.

7. TTOO – Buzzing Stars: ⭐⭐⭐

Oct 06: T2 Biosystems shares were trading 35.67% higher after the company announced today that it issued inducement awards to nine new employees. The awards were made on October 2, 2023, under the T2 Biosystems' Inducement Award Plan, which was adopted in 2018, amended and restated in February 2023, and provides for the granting of equity awards to new employees.

Oct 12: T2 Biosystems shares slid 43.87% after the company announced a reverse stock split, effective today. The reverse stock split will be at a ratio of 1 post-split share for every 100 pre-split shares, effective on October 12. The company says this move is primarily aimed at meeting the minimum bid price requirement for maintaining its Nasdaq Capital Market listing.

8. AMZN – Buzzing Stars: ⭐⭐⭐

Oct 03: Amazon shares dropped 3.66% as stocks sold off amid rising yields. Amazon and Microsoft are set to face a push by UK media regulator Ofcom for an antitrust probe into their alleged dominance of the cloud computing market in the country.

Oct 25: Amazon shares slid 5.58% amid overall tech sector weakness after Alphabet Inc and Microsoft Corp reported earnings during Tuesday's after-hours session, which showed disappointing cloud-computing sales.

Oct 27: Amazon shares soared 6.83% as investors reacted to better-than-expected revenues and profits. Amazon reported revenues of $143.1 billion in the third quarter, which was 13% higher than the corresponding quarter last year, and ahead of the $141.4 billion that analysts expected. Revenues were also slightly higher than the top end of Amazon’s guidance.

9. MSFT – Buzzing Stars: ⭐⭐⭐

Oct 06: Microsoft stocks soared 2.47%. Rumor has it that Microsoft will launch an artificial intelligence chip at the annual developer conference next month to reduce costs.

Oct 25: Microsoft stocks were trading 3.07% higher after the company reported better-than-expected fiscal Q1 results amid a still-volatile information technology spending backdrop, which demonstrates the technology giant's "differentiated position" in the market, according to Morgan Stanley.

10. META – Buzzing Stars: ⭐⭐

Oct 25: Meta stocks plummeted 4.17% amid overall tech sector weakness after Alphabet Inc and Microsoft Corp reported earnings during Tuesday's after-hours session, which showed disappointing cloud-computing sales.

Oct 26: Meta stocks plummeted 3.73% despite reporting an earnings per share (EPS) and revenue beat in their recent financial results. The decline in share price was attributed to weak guidance provided by the company for future performance.

That's all for today's Monthly Buzz. Thanks for reading!

Source: All the news events mentioned above are from moomoo news. The percentage change data of the above stocks are from moomoo's daily quotes.

Disclaimer:

This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal. Moomoo makes no representation or warranty as to its adequacy, completeness, accuracy or timeliness for any particular purpose of the above content

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc.

In the U.S., investment products and services available through the moomoo app are offered by Moomoo Financial Inc., a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) and a member of Financial Industry Regulatory Authority (FINRA)/Securities Investor Protection Corporation (SIPC).

In Singapore, investment products and services available through the moomoo app are offered through Moomoo Financial Singapore Pte. Ltd. regulated by the Monetary Authority of Singapore (MAS).Moomoo Financial Singapore Pte. Ltd. is a Capital Markets Services Licence (License No. CMS101000) holder with the Exempt Financial Adviser Status. This advertisement has not been reviewed by the Monetary Authority of Singapore.

In Australia, financial products and services available through the moomoo app are provided by Futu Securities (Australia) Ltd, an Australian Financial Services Licensee (AFSL No. 224663) regulated by the Australian Securities and Investment Commission (ASIC). Please read and understand our Financial Services Guide, Terms and Conditions, Privacy Policy and other disclosure documents which are available on our websites https://www.moomoo.com/au. Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd. and Futu Securities (Australia) Ltd are affiliated companies.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

xXxTheBoujieManxXx : , I