Money Market Funds Saw First Decline Since Oct 18, Where Could Money Flow to?

On Thursday, the Dow Jones Industrial Average achieved a new historical high, while the S&P 500 index reached its highest point in nearly two years.

The dovish stance from the Federal Reserve during Wednesday's FOMC meeting and Powell's speech contributed to a boost in the markets. Risk-free rates declined, leading to a "Goldilocks" period that could result in the recovery of industries previously suppressed by high interest rates.

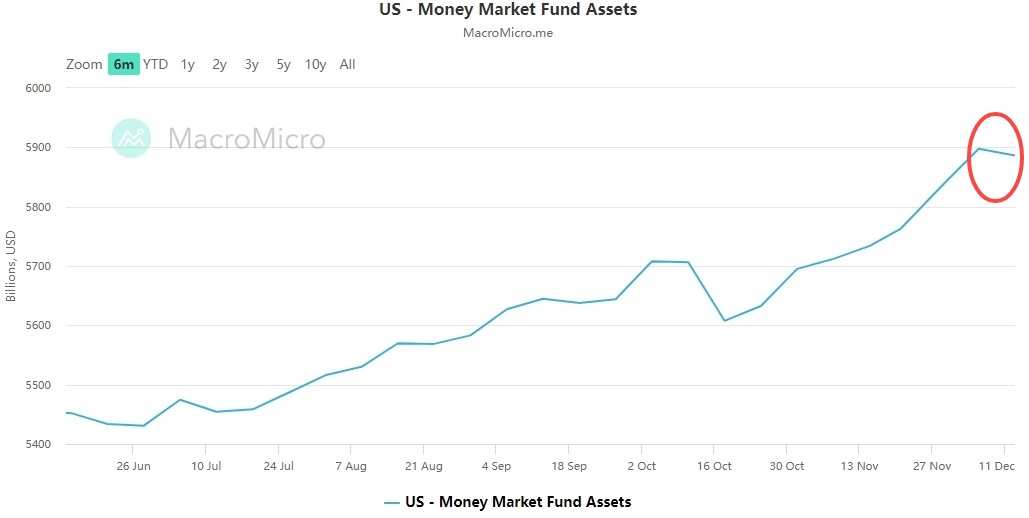

Money-Market Fund Assets Fall as Interest-Rate Cut Prospects

Investors are turning to riskier assets for higher returns as the possibility of interest-rate cuts looms in the coming year. As a result, US money-market funds experienced an outflow of $11.6 billion during the week that ended on Dec 13, according to data from the Investment Company Institute. This led to a drop in total assets from $5.898 trillion to $5.886 trillion, marking the first decline since theweek of Oct 18.

Since the start of one of the most aggressive tightening cycles in decades by the Federal Reserve last year, retail investors have been pouring money into money funds. But this week, the Fed signaled the end of its tightening cycle by projecting deeper interest-rate cuts in 2024.

This is a turning point and you do start to see money move out of money markets, into riskier assets, into term rates to lock in higher rates," Jeffrey Rosenberg said, a portfolio manager at BlackRock Financial Management.

Where Might Money Flow After the Withdrawal of Money Market Funds?

● Dividend-Paying Stocks and Funds

Josh Brown, co-founder and CEO of Ritholtz Wealth Management, recommends that investors consider dividend-paying stocks as a viable option for reallocating their cash.

This is where the money is flowing right now because everybody understands this: You can buy stocks without buying the [magnificent] 7 stocks and that’s the trade right now,” he said. “That trade carries us through.”

● High-Yield Bonds

Barry Glassman, founder and president of Glassman Wealth Services, also suggests high-yield bonds, which can yield more than 7%.

Even if we clip the coupon over the next two years and principal winds up the same, that will be an attractive total return,” he said.“If we see a soft landing where the economy continues to chug along at the same time interest rates come down, that should benefit high yield," Glassman said.

Source: Bloomberg, IBD, CNBC

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment