Microsoft Attracts $115M Options Block Trades as Stock Pauses Record-Breaking Rally

$Microsoft(MSFT.US$ saw three unusual block trades totaling more than $115 million as the stock takes a breather from its record-breaking rally that allowed the tech giant to surpass $Apple(AAPL.US$ as the world's biggest company by market value.

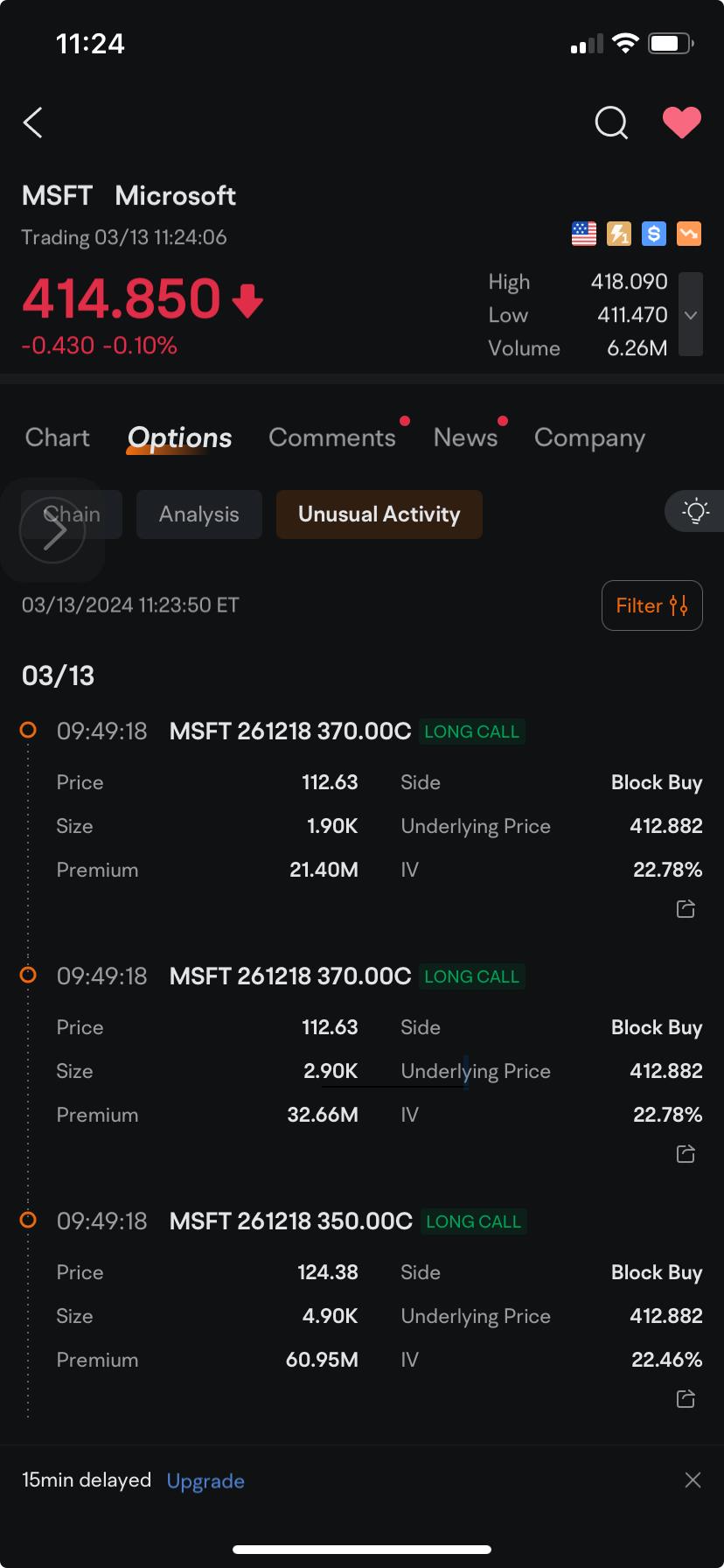

At 9:49:18 a.m. in New York, three block trades of long call options were posted giving the holders the right to purchase Microsoft by Dec. 18, 2026. The biggest block cost the buyer a $60.95 million-premium for the right to buy 490,000 shares at $350 each. That's the largest block trade for all options posted as of 12:50 p.m. on Wednesday.

Another Microsoft block trade had a premium of $32.66 million for 290,000 shares at a strike price of $370. And the smallest involved a premium of $21.4 million for 190,000 shares also at a strike price of $370.

At 9:49:18 a.m. in New York, three block trades of long call options were posted giving the holders the right to purchase Microsoft by Dec. 18, 2026. The biggest block cost the buyer a $60.95 million-premium for the right to buy 490,000 shares at $350 each. That's the largest block trade for all options posted as of 12:50 p.m. on Wednesday.

Another Microsoft block trade had a premium of $32.66 million for 290,000 shares at a strike price of $370. And the smallest involved a premium of $21.4 million for 190,000 shares also at a strike price of $370.

It's always difficult to conclude that the trades that were posted at the exact time, right down to the second, were part of a strategy unless you're involved in the transaction. One could argue it was just coincidence. So I leave that to you, my readers, to make your own conclusion.

Call options totalled 157,920 as of 12:40 p.m. in New York, more than double the put options which reached 62,320.

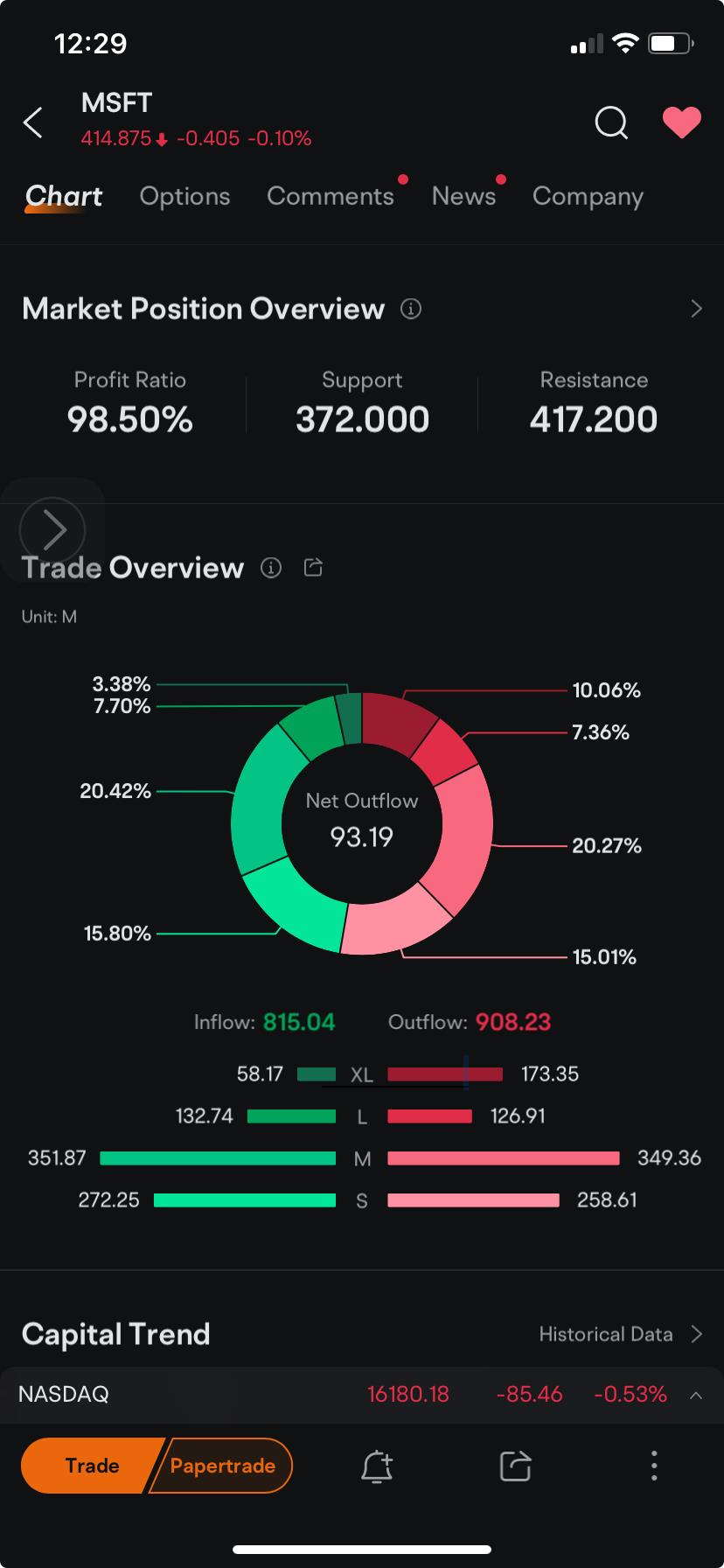

The capital trend in Microsoft showed there are more investors pulling their money out of the stock than those pouring in, according to data compiled by Moomoo over the past 200 days.

The stock saw an inflow $815.37 million over that period, Moomoo data as of 12:29 p.m. Wednesday showed. However, that was more than offset by a total outflow of $908.23 million, resulting in a net outflow of $95.21 million. Extra large trades accounted for the bulk of the money being pulled out of the stock.

The stock saw an inflow $815.37 million over that period, Moomoo data as of 12:29 p.m. Wednesday showed. However, that was more than offset by a total outflow of $908.23 million, resulting in a net outflow of $95.21 million. Extra large trades accounted for the bulk of the money being pulled out of the stock.

The biggest net outflow came from extra large orders amounting to $115.17 million, Moomoo data showed.

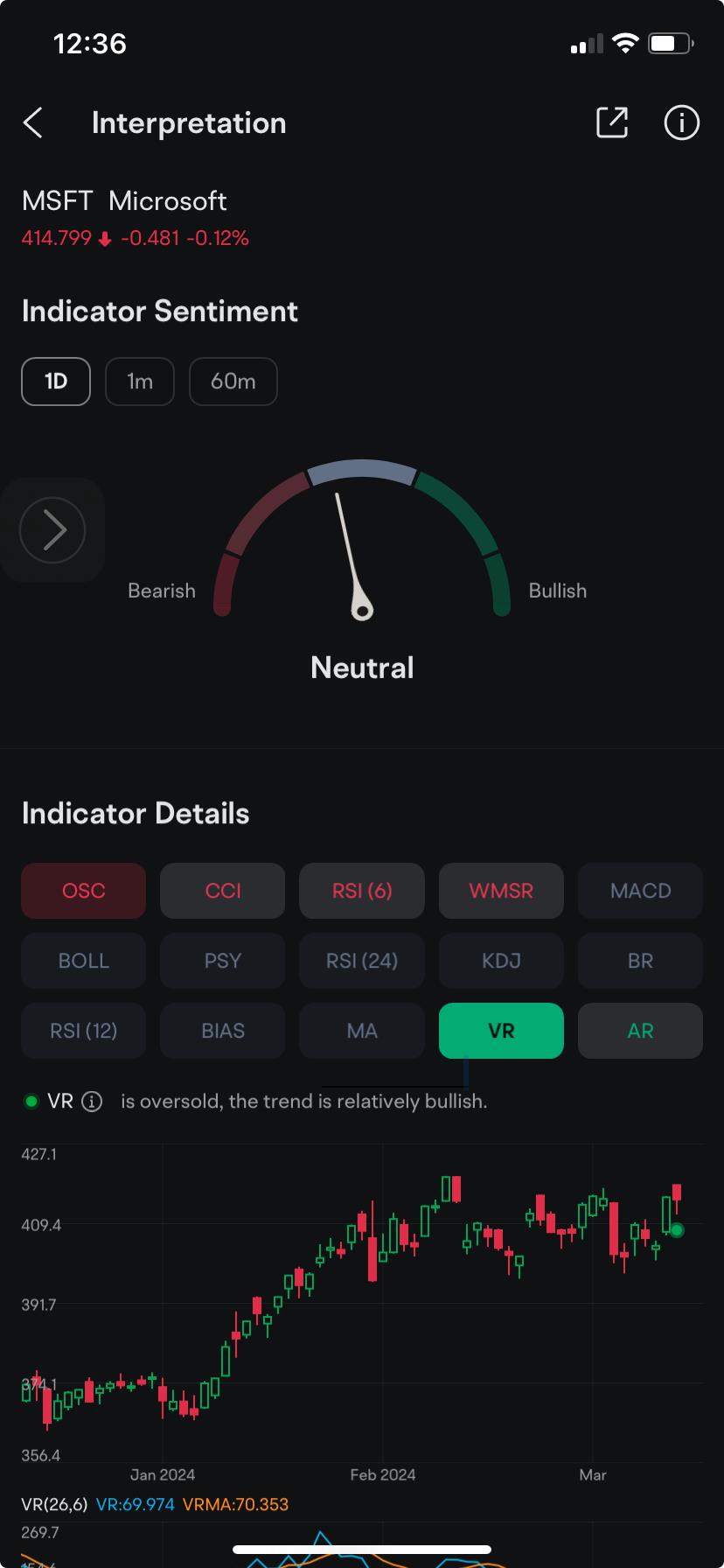

The daily technical indicators are showing mixed signals. Four of the 11 indicators tracked by Moomoo signal the stock is overbought and the trend is bearish. Another two showed the stock is oversold and the trend is "relatively bullish." The majority, nine indicators are neutral.

Disclaimer:Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Marcio Cyrillo : That was a long call not a long put

venkym : how can u confirm long call as bull sign, they took Deep ITM where it can be stock protection like sell call. Are you sure how accurate momo can confirm it as long call? Did momo show ask, bid,Mid values?

ET Rodriguez : Deep ITM