Lennar Earnings Recap: Why There Are Few Signs of Slowdown in the U.S. Housing Market

On March 13, 2024, Lennar Corporation, the second-largest publicly traded homebuilding company in the US, disclosed its 8-K filing, which reported robust results for the company's performance in the first quarter of 2024, although shares edged lower in premarket trading on Thursday.

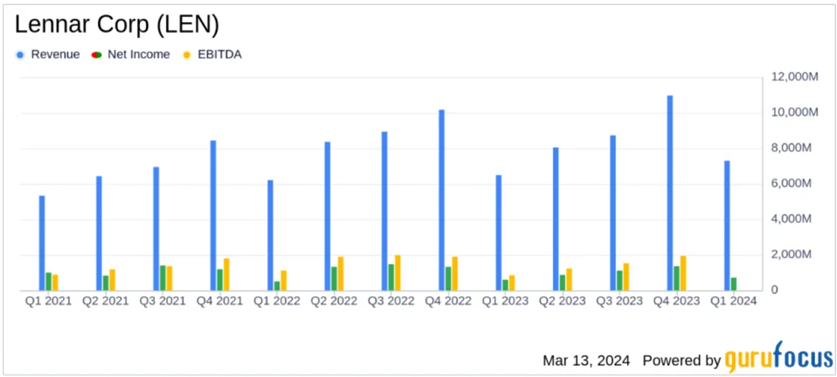

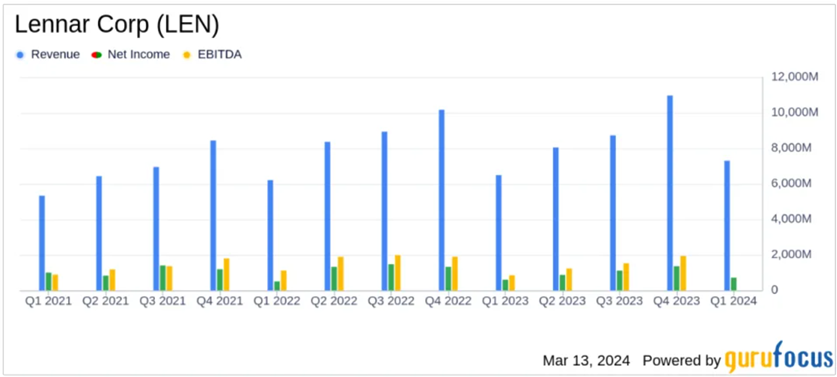

The company's net earnings increased by 21%, reaching $719 million. Earnings per share saw a rise of 25%, hitting $2.57 per diluted share. The company reported a 28% jump in new orders, which amounted to 18,176 homes. Home deliveries also grew, with a 23% increase leading to 16,798 homes delivered. Total revenues for Lennar went up by 13%, totaling $7.3 billion. The gross margin on home sales improved notably, reaching 21.8%. In terms of balance sheet strength, Lennar reported a solid position with homebuilding cash and cash equivalents of $5.0 billion and no outstanding borrowings.

Lennar's performance indirectly reflects the resilience of U.S. real estate demand in the face of high interest rates.

■ US home sales rebounded in recent months

The residential market appears to be adjusting to higher interest rates, with the existing home market rebounding in recent months.

NAR released a summary of existing home sales data showing that January's housing market activity increased 3.1% from December 2023. January's existing home sales reached a seasonally adjusted annual rate of 4 million. New home sales showed a similar trend, as purchases climbed 1.5% in January to a 661,000 annual pace. At the same time, the 30-year mortgage rate is hovering at a high level, always above 6.5%.

From the perspective of demographic factors, as of the fourth quarter of 2023, rolling four-quarter new household formation totaled just over 1.6 million, representing a 47.0% increase over the long-term average.

As the market widely believes rates are likely to have peaked, this in turn could support sales activity in 2024. CBRE research shows that more than half of institutional investors expect to increase their investments.

■ Supply is still insufficient

Contrary to strong demand, homebuilders have been fairly cautious. Having been scarred deeply by 2008-2009, builders are reluctant in periods of uncertainty to overbuild and be left with excess supply. Although building permits remain at a certain level, new housing starts have declined for two consecutive months, which may limit the supply of housing in the coming period. In addition, the active listing count is far lower than before the epidemic.

In December 2023, the United States had an inventory that would last for 8.2 months at the current sales pace for new houses, above its 2020-2021 level. However, existing home sales in the United States account for more than 80% of total sales. The supply of existing homes on the market was only enough to cover 3.2 months of sales at the current rate as of December 2023.

■ What is the real reason for the housing market rebound amid high interest rates?

The chase for real assets often indicates market apprehension about the potential devaluation of currency in history. Real estate and similar tangible assets are traditionally viewed as a hedge against inflation, as they have the propensity to retain or appreciate in value, providing a contrast to the diminishing purchasing power of currency.

This inclination to invest in hard assets is driven by the desire to safeguard wealth in the face of inflationary pressures, where the nominal value of these assets might increase, offering capital gains to investors, especially now that the Federal Reserve is still struggling in the last mile of fighting inflation. Additionally, properties that generate rental income can become more lucrative as inflation pushes rents higher, enhancing the allure of these investments.

CBRE's survey showed that, among institutional investors, multifamily is still a favored investment target. Such financial behaviors reflect a broader strategy to counteract the erosion of currency value and preserve capital in uncertain economic times.

While central banks attempt to manage inflation and stabilize currency through monetary policy, the movement of investments into real assets can be a barometer of public confidence in these measures and an effort to stay ahead of anticipated currency devaluation trends. This may be the underlying reason for the recent gains of developer companies such as Lennar Corp.

Source: CBRE, FRED, Newmark Research

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

耐心等待2024 : Doomsday Madness

104004619 : good luck

Tan Chin Seng klang : the reason is very simple. borrow to invest in property!