Is It "Foolish" To Bet on an Early Rate Cut? What Is the Fed's Current Stance on Lowering Interest Rates?

Even as the S&P 500 closed last Friday at an all-time high, investors are still contending with data that signals US economic resilience and Fed officials who've pushed back against reducing interest rates too soon.

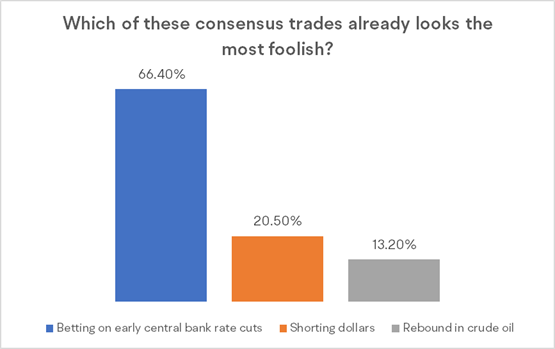

According to a Bloomberg survey, two thirds of Bloomberg Markets Live Pulse respondents said that betting the Federal Reserve will loosen monetary policy early is the “most foolish” among popular trades heading into 2024.

Source: Bloomberg MLIV Pulse survey Jan.15-19 with 440 responses

To Janet Mui, head of market analysis at RBC Brewin Dolphin, the re-acceleration of inflation in some major economies and resilience in US employment data result in an important challenge for the market’s interest-rate expectations.

How does the Fed view about interest rate cuts now?

• San Francisco Fed President Mary Daly on Friday, said it’s “premature” to think rate reductions are around the corner, noting she needs to see more evidence that inflation is on a consistent trajectory back to 2% before easing policy.

• "With economic activity and labor markets in good shape and inflation coming down gradually to 2%, I see no reason to move as quickly or cut as rapidly as in the past," Fed Governor Christopher Waller said in a speech at the Brookings Institution in Washington.

• Meanwhile, New York Fed President John Williams said that he only sees cuts happening when the Fed is confident inflation is sustainably moving back to its 2% target - repeating a view he expressed in December.

"I expect that we will need to maintain a restrictive stance of policy for some time to fully achieve our goals," he said in a speech.

• The worst outcome would be for policymakers to lower rates and have to raise them again later if inflation moves higher, Atlanta Fed President Raphael Bostic told business leaders on Jan. 18. “We do not want to go on these up-and-down or a back-and-forth pattern,” he said.

Powell and his colleagues can take their time because they won’t be cutting rates to counteract an economic contraction - as has often occurred in the past. Instead, they will be calibrating policy to reflect a surprisingly steep drop in inflation from a multidecade high 1.5 years ago.

Based on that, the market's expectations for a rate cut in March have significantly decreased. As of last Friday, investors are placing a 46% chance on a March interest rate cut, according to the CME Fed Watch Tool. Just a week prior, investors had placed an 81% chance on a cut in March.

Source: CME FedWatch

Moreover, traders who ended 2023 with an optimistic forecast of six rate cuts for this year have pared down that wager to five.

What should we keep an eye on next?

As the Fed has entered its official blackout period starting from the last weekend, it is widely expected to hold interest rates steady for the fourth straight meeting when it gathers in Washington on Jan. 30 and 31. However, the guidance on future policy actions in its post-meeting statement will attract widespread attention.

Moreover, policymakers will receive fresh data on their preferred inflation gauge on Friday, as well as a first read on gross domestic product in the fourth quarter on Thursday.

Economists expect annual "core" PCE - which excludes the volatile categories of food and energy — to have clocked in at 3% in December. Over the prior month, most economists expect "core" PCE to come in at 0.2%.

Atlanta Fed President RaphaelBostic said on last Friday that he is open to changing his views on the timing of interest-rate cuts depending on the data, though he wants to be sure inflation is “well” on the way to the central bank's 2% goal before easing policy.

Source: Bloomberg, Yahoo Finance, CME FedWatch

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Asphen : buy the rumour sell the news

点石成金 : Whether interest rates are cut or not will not have much impact on US stocks. Anyway, it will rise in one word; if it falls, it will rise back up, not like the Chinese stock market

73057611 : the bet is not on interest rate cut. The bet is on too big to fail. That is the only reason a stock could raise 20% in three months.

But the problem is would it be too big to rescue?

With the average 40 times on leverage and 34T debt. No way to rescue such amount!!!

102813028 : Greedflation or price gouging by corporations who are using inflation to raise prices by a greater percentage rise than inflation is one of the main reasons for inflation rate staying for longer (now 3.2%?).

OceansWave : My own actual view is that these analyst and market makers stir up the idea of when rate cuts will happen as an additional catalyst to make the market more volatile.. though I hate this move, I do find that opportunities to make money is more as well.. but that saying you also got to keep track of how the economy is doing

razo2 点石成金: you have no idea how long china has gone through recession. why china government is not printing bigger than JP money printer is due to the Russia Ukraine war.

ask yourself a question why china is dumping US bonds like crazy since the war started. and you be foolish to think China is a peanut. 99% of the things around you is made in china. and don't underestimate china ability to reverse engineer products. there is a dam good reason why companies moved their manufacturing plants there.

why you think US sends Yellen and Blinken to china? for magic mushrooms? or because china didn't go on a frenzy to print money during COVID and is something US government needs as the last life line to save the US market? guess who bailed out US during 2008 GFC?

I work in a fortune 500 company and I worked with asia closely to the teeth. you want results as a management, china is by far the best place to do it, followed by India