Is Cash No Longer King? Record Money-Market Fund Assets Poised to Drive Up Risk Asset Prices

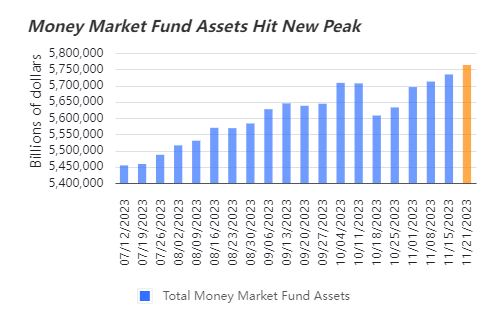

More than a year after the Fed's tightening monetary policy, more and more money has flowed into attractive money market funds, and the regional banking crisis that broke out in March accelerated the pace. The latest data from the Investment Company Institute (ICI) shows that investors now hold $5.7 trillion in money market funds, marking another milestone high.

With optimistic expectations for easing monetary policy and economic growth, some analysts are hopeful that the large amount of funds accumulated in the monetary fund market will flow into the stock and bond markets as market risk appetite improves, providing room for future growth.

With the benchmark federal funds rate at a 22-year high of 5.25%-5.5%,the approximately 5% interest rate offered by money market funds remains a magnet for investors, driving an influx of cash. Based on ICI data, approximately $29.12 billion flowed into money market funds during the week ending November 21, pushing total investor investment in cash-like money funds to a new record of $5.7 trillion.

1. Goldilocks Hopes Return Amid Cooling Inflation and Fading Recession Worries

The U.S. inflation rate cooled more than expected in October, with the overall CPI rising by 3.2% year-on-year, lower than the anticipated 3.3%, and significantly slower than the 3.7% in September. Simultaneously, a growing number of market participants believe that the United States will avoid a recession. According to FactSet data, the percentage of S&P 500 companies mentioning "recession" in their Q3 earnings calls dropped to around 11% from 50% in Q2 last year. Moreover, Goldman Sachs' 2024 macro outlook report indicates that the probability of a future recession in the U.S. economy, according to the median market forecast, is about 50%, down from 65% at the end of 2022. The bank has expressed greater optimism about economic growth and reduced the chance of an economic recession to only 15%.

The prominent effects of curbing inflation and rising expectations of a soft landing for the economy are the primary driving forces behind the recent market's upward trend.

2. The Fed's Dovish Tone Boosts Confidence That Interest Rate Hikes Are Nearing an End

On Tuesday, Christopher Walle, the Fed's hawkish representative, made a rare dovish statement, indicating that if inflation continues to slow down over the next three to five months, the Fed may begin to cut interest rates. This statement undoubtedly reinforced the market's belief that U.S. interest rates have peaked. The $U.S. 2-Year Treasury Notes Yield(US2Y.BD$, which is most sensitive to monetary policy, dropped 15 bp on that day.

According to CME's forecast path released on November 27th, the likelihood of the Fed not continuing to hike rates in December this year and January next year is 97% and 87%, respectively. Additionally, swap market data suggests that traders anticipate an 80% probability of an interest rate cut in May 2024.

Billionaire investor Bill Ackman holds a more optimistic view than the market forecasts, betting that a rate cut could happen as early as the first quarter.

"I think there's a real risk of a hard landing if the Fed doesn't start cutting interest rates soon," said Ackman, noting that a real interest rate of around 5.5% would be very high when inflation trends below 3% if the Fed keeps interest rates in that range.

3. Wall Street Banks Offer Highly Optimistic 2024 S&P 500 Outlook

Recently, several major Wall Street banks have offered their outlook on the future trend of the $S&P 500 Index(.SPX.US$. According to MarketWatch's calculations, sell-side strategists' average target for the S&P 500 by the end of 2024 is 4,836, which is 6% higher than Tuesday's closing price. Deutsche Bank and BMO Capital Markets are particularly optimistic, forecasting a rise to 5,100 points, reflecting a 12% upside from current levels. The bullish sentiment among analysts may provide positive feedback to the market, further boosting risk appetite.

1. After a Downturn, Small-Cap Stocks Back in the Spotlight for Investors

High-risk small-cap stocks have regained the favor of funds recently, propelling the $Russell 2000 Index(.RUT.US$ to resume its rise after falling for three consecutive months. This month, the index rebounded significantly, surging by 7.85%.

2. Capital Inflows from Corporate Bonds, Especially High-Yield Bonds, Experience a Surge

The rebound in the global bond market is also a significant indicator of improving risk appetite. The Bloomberg global bond index saw returns of 4.9% this month, on track for its second-largest monthly gain since the peak of the recession with a 6.2% gain back in December 2008. Additionally, EPFR data reveals that funds are flowing into U.S. corporate bond funds at their fastest rate in more than three years, with nearly 70% concentrated in low-grade high-yield bond funds, also known as "junk" bond. The sentiment in the bond market has broadly recovered.

3. Hedging Demand Gradually Fading as Market Volatility Remains Low

The current $CBOE Volatility S&P 500 Index(.VIX.US$ has dropped to 12.65, reaching its lowest level since before the outbreak in January 2020. Simultaneously, both retail and institutional investors have decreased their demand for risk hedging. The cost to shield against a market selloff has reduced by roughly 10%, reaching its lowest point since data collection began in 2013. Furthermore, demand for tail-risk hedges is hovering around its lowest level since March.

Despite high cash returns, Goldman Sachs' Macro Outlook 2024 suggests that returns in rates, credit, equities, and commodities will surpass cash in 2024 under its baseline projection, as different asset classes provide protection against different tail risks. The bank encourages replacing cash-focused asset allocations with balanced asset mixes in 2023 and allowing duration to play a more significant role in the portfolio.

Goldman Sachs specifically believes that if the risk of an economic recession increases, bonds will be a valuable tool for hedging against the recession. Additionally, oil prices and other commodities will experience upside potential under a strong global economic growth environment with escalating geopolitical instability risks. Moreover, stocks are likely to outperform should the central bank cut rates earlier than expected.

Source: Bloomberg, Goldman Sachs, moomoo, WSJ, MarketWatch, EPFR, FactSet

By Moomoo News Irene

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

stefanita :

safri_moomoor : thanks