How to Safeguard Yourself Wisely in High-Risk Trades? Unveiling the Path to Hedging Survival in Options Trading

1. Avoid 0DTE

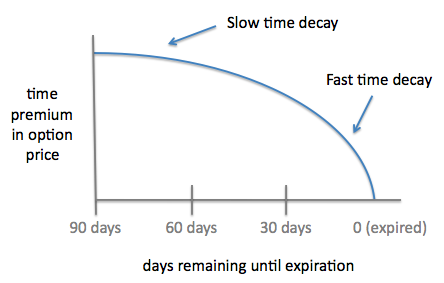

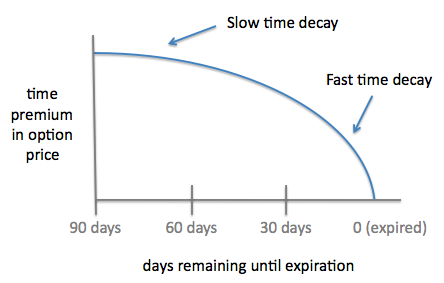

0DTE (Zero days to expiration), as the name suggests, are options close to their expiration dates, such as opening an option expiring on March 27th when it's already March 25th.

0DTE (Zero days to expiration), as the name suggests, are options close to their expiration dates, such as opening an option expiring on March 27th when it's already March 25th.

For 0DTE, the primary factor influencing them is the stock price. By this time, time value has essentially eroded, and even if some remains, it will rapidly diminish in the coming days until it reaches zero.

In other words, significant stock price fluctuations are necessary for these options to turn profitable.

Taking Tesla $Tesla(TSLA.US$ options as an example, suppose the Tesla stock price is $216.52, and I want to buy a call option expiring on March 27th with a strike price of $222.5 for $1.83.

At this point, the option has no intrinsic value (stock price < strike price), and the $1.83 premium is entirely time value, which will diminish within two days.

If Tesla manages to rise by 3.6% over the next two days to $224.33, then the option could break even ($222.5 + $1.83). Otherwise, it's essentially worthless.

In the world of options, time = volatility = opportunity = money. 0DTE can yield substantial returns if you're confident in significant short-term stock price fluctuations. However, if purchased casually, they can leave investors powerless.

2. Rolling Over

Rolling over, as the name implies, involves extending the duration of an option's existence and is the most common method for adjusting option positions.

Its purpose is to delay option exercise, preferably avoiding it altogether.

The specific process involves closing the current option position and then reopening a new position with the same directional exposure and quantity but with different strike prices and expiration months.

Let's delve into a covered call strategy to explain rolling over:

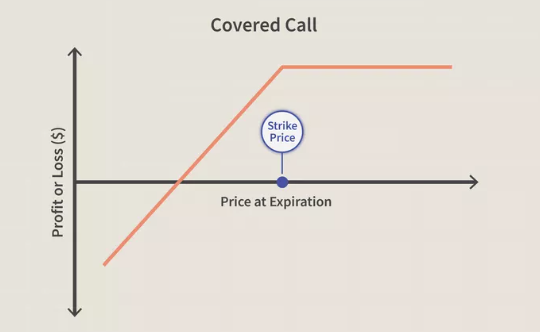

Covered Call:

Holding stock + Selling a call option with a strike price above the stock price.

If the stock price doesn't rise above the strike price by expiration, you keep the premium. If it rises, you still keep the premium but might have to sell the stock at a higher price, yielding a profit.

However, this strategy carries risks:

- Loss Risk: A decline in stock price may diminish the premium income or even lead to losses exceeding premium income.

- Reduced Profit Risk: While setting up covered calls locks in maximum profits if the stock rises, rapid and significant stock price increases could limit potential gains.

- Loss Risk: A decline in stock price may diminish the premium income or even lead to losses exceeding premium income.

- Reduced Profit Risk: While setting up covered calls locks in maximum profits if the stock rises, rapid and significant stock price increases could limit potential gains.

Suppose you sold a call expiring on November 24th with a strike price of $420 and a premium of $20 at the end of September while holding Nvidia stock priced at $410.

As the expiration approaches, the stock rises to $450. If it remains at this level, the option will be exercised, forcing you to sell the stock at $420, risking reduced profits.

The only way to avoid exercise is to buy back the $420 call before exercise. By then, the option price has risen to $23, resulting in a $3 loss per option.

To offset this loss and extend the strategy, you aim to raise the strike price and extend the expiration. By selling a new out-of-the-money call with a strike price of $460 and an expiration 60 days out, priced at $24.74, you generate $1.74 per option.

From a cost perspective, this rollover is advantageous. However, it's essential to consider that there are still 60 days until expiration, during which the stock price could change unpredictably.

If the option expires worthless, you'd earn $1474 in total, but if the stock price surges in the next 60 days, you might consider rolling over again.

This is why 0DTE is not recommended. As long as there's time until expiration, there's an opportunity to roll over and potentially recover. But without time, there's no chance.

It's crucial to emphasize that rolling over is just one method of risk mitigation and should not be seen as a lifesaver. Remain rational before each rollover.

Each rollover could result in losses when buying back previous-month options, and future-month options might not guarantee profits as stock prices could move unfavorably.

Rollover is not just a double-edged sword; it's essentially a four-layer razor.

That's all for today's sharing. If you have other risk management measures, feel free to discuss them in the comments.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

EnjoyTheProcess : Thanks for the clear explanation. Do u know the step by step of selling a covered call on moomoo? assuming u already have the 100 shares in ur portfolio, do u sell option as "single option" or "covered stock" option?

Pinkiii : Thank you soo much for this detailed explanation. I haven’t yet ventured into options. I found ur article very helpful to understand the basics of options. Thanks a ton

102758610 : thanks for clear explanation