How Vinfast Became the World's Third-most Valuable Automaker? Here's What You Need to Know

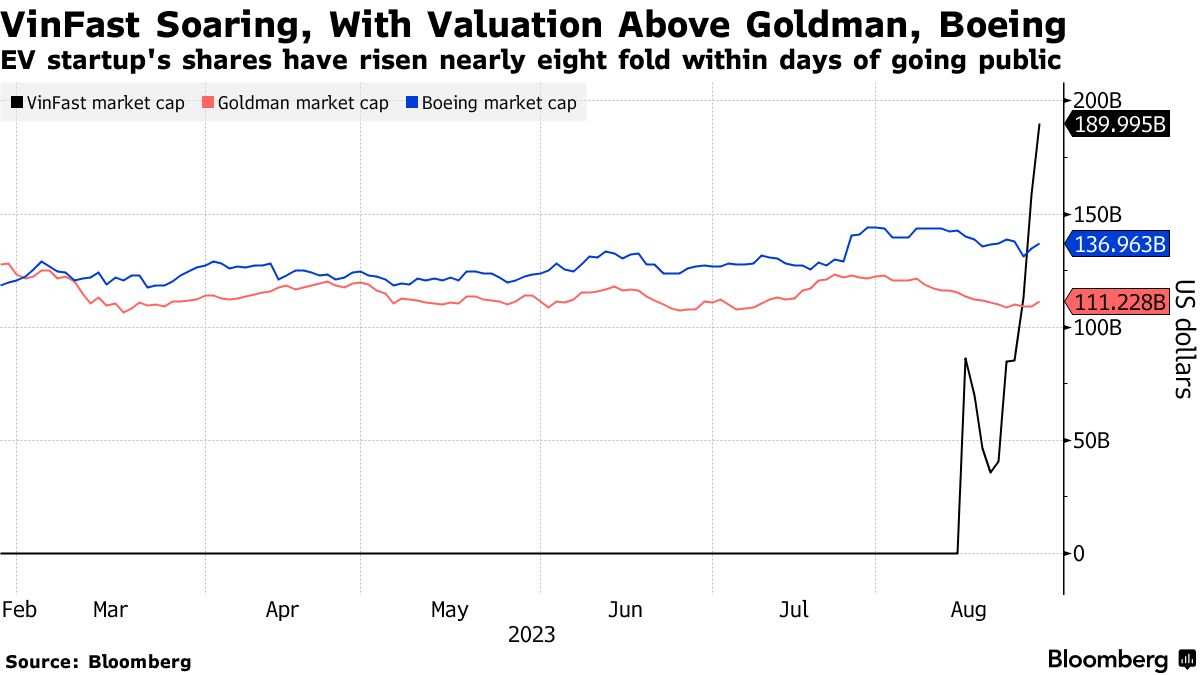

Unprofitable Vietnamese electric-vehicle maker $VinFast Auto(VFS.US$'s shares closed up 20% at $82.35 on Monday, with a current worth of approximately $190 billion since its market debut in August. This valuation surpasses that of companies such as $Goldman Sachs(GS.US$ and $Boeing(BA.US$, and is about 10 times larger than $Walgreens Boots Alliance(WBA.US$. Despite the broader US equity market cooling, VinFast has caught the attention of retail traders due to its association with EV makers and its small number of outstanding shares, which amplifies movements. On Monday, options trading for the stock began, providing traders with opportunities for leveraged bets on the rally.

But Vinfast's small amount of publicly available shares has made the stock prone to volatility, with shares jumping or slumping more than 14% in 11 of the past 12 sessions. Barron's reports the company only has a float of about 16 million shares that can be publicly traded. According to MarketWatch the average daily trading volume is over 8 million shares. That means half of the entire share float is being traded each day on average.

The stock is soaring not because of how successful the company is, but because of its low share count combined with investor excitement. The SPAC merger left 99% of the Vietnamese electric vehicle (EV) company in the hands of founder Pham Nhat Vuong. Investors should be careful about trying to get in on the massive move higher. There is no business-related company news driving the move. Just the hype behind its recent public listing.

This advance shows that there's still plenty of froth in the marketplace," said Matthew Maley, chief market strategist at Miller Tabak + Co. Maley added that the $S&P 500 Index(.SPX.US$'s "only" 4% decline from its summer highs has not incited a lot of fear among investors. "It will take something more like a full-blown correction of 10% or so to push some real fear back into the marketplace."

The company made a blowout debut on Wall Street this month and has quickly grown in valuation to become the third-most valuable automaker - only behind $Tesla(TSLA.US$ and $Toyota Motor(7203.JP$.

Despite the market enthusiasm, Vinfast faces a long road before it can start competing meaningfully with Tesla and legacy automakers that are pouring billions of dollars to grab a share of the EV market. Only 137 Vinfast EVs were registered in the United States through June, according to S&P Global Mobility. Vinfast expects to sell as many as 50,000 electric vehicles this year, compared to the 1.8 million projected by Tesla and Toyota's target of 1.5 million EVs per year by 2026.

VinFast's trading volume is significantly lower than its competitors and of companies with similar valuation. Meanwhile, VinFast options started trading Monday, with $100 calls — allowing the buyer to purchase shares if they rise above that level by Sept. 15 — the most actively traded.

VinFast also reported a loss of more than $2 billion last year. Investors trying to jump into the frenzy should be aware of the company's fundamentals. They should also realize that the extremely low float means that the stock could plummet as fast as it has recently soared. With such a small float, a low number of investors can move the shares. Thus far, those moves have been higher. But if those investors decide to take profits, the reverse would occur.

Source: Bloomberg, REUTERS, Forbes, The Motley Fool

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

102326563 : Yeah just like Wework

Jonitye : Advice is well taken!!!

SpyderCall : Low float runners move big. They hardly ever run up in price based on good company fundamentals or good financial reports.

They are just like meme stocks. Eventually, these sky-high valuations in these stocks like this will come back to reality. Sometimes, they can run for several weeks though

SpyderCall : These companies that run up like this will eventually take advantage of the sky-high stock price by issuing more shares at a much higher price than they would have normally without an already sky-high share price.

watch out for the share issuance in the SEC filings

Ishah : This is terrible... Healthy competition is good for consumers...and profitable for a greater number of companies... This deserves our attention... Some companies need to be known as legends and start-up EV companies can bring valuable alternatives to the masses.

Money365D : Just another share for trade not value stock yet. Lure everyone in then kill. Trap