Gold Hits New Milestone: Decoding the Surge and Spotlighting Key Investments

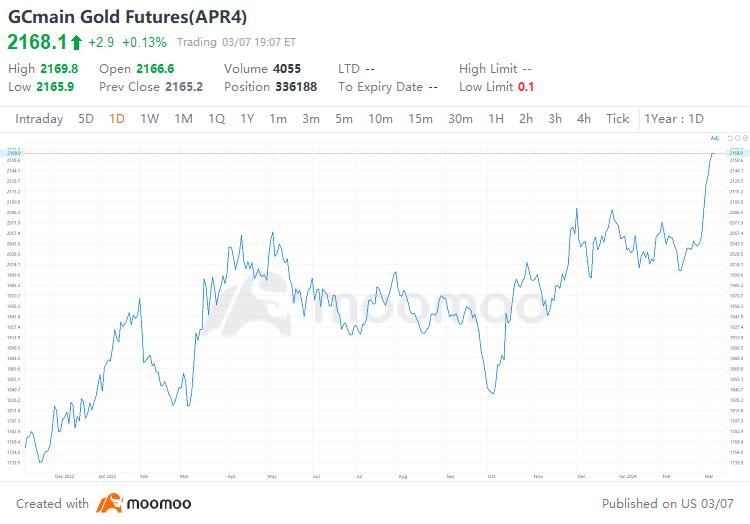

In 2023,$Gold Futures(APR4)(GCmain.US)$ shone brightly among global asset classes, with international prices climbing by 13%. This year, the precious metal's value achieved a breakthrough, with spot gold momentarily surpassing the $2,160 per ounce mark on Thursday, setting a new historic record.

What's Fueling the Surge in Gold Prices?

1. Expectations for Monetary Easing:Recent weakening in U.S. economic data has reignited expectations for a Federal Reserve interest rate cut. Last Friday, the U.S. ISM Manufacturing PMI for February unexpectedly accelerated its contraction to 47.8, falling short of the forecasted 49.5. Key sub-indexes, including new orders and employment, all slipped into contraction territory. This Tuesday, the U.S. ISM Non-Manufacturing PMI for February was revealed to be 52.6, falling below the anticipated 53.According to the CME FedWatch Tool, the current probability of cutting interest rates by 25 basis points in June is 58.15%, up from 52.81% a week ago.

2. Trading Credit Depreciation:As global public debt continues to climb, market concerns over sovereign debt crises intensify.Taking the United States as an example, its debt has been ballooning at a snowballing pace, increasing about $1 trillion nearly every 100 days in recent months.In 2023, the debt held by the public was equivalent to 97% of the GDP and is forecasted to keep increasing and could reach 116% of GDP by 2034, and eventually climb up to 172% by 2054, according to CBO.

Bank of America investment strategist Michael Hartnett believes the 100-day pattern will remain intact with the move from $34 trillion to $35 trillion. He wrote in a note commenting on the record height of gold and bitcoin,Little wonder 'debt debasement' trades closing in on all-time highs.

3. Continued Gold Purchase by Global Central Banks:Central banks are increasing their gold holdings not only as a strategy for diversifying reserve assets but also as an indication of their concerns over the stability of the current monetary system. According to The World Gold Council's (WGC) report, gold demand in 2023 soared to record levels and one of the primary driving factor was continuous central bank purchases.

4. Geopolitical Risks:Heightened international political frictions and frequent security incidents have exacerbated uncertainty in global markets.From the Israeli-Palestinian conflict to the volatile situation in the Red Sea, the Middle East continues to simmer with geopolitical risks.

5. Risk of Stock Market Correction:The market has continued to rise since the start of 2024, primarily driven by technology stocks.Recently, a number of analysts have raised alarms about the potential for a bubble and a pullback in U.S. stocks, casting a shadow of concern over the market.Savita Subramanian of BofA warns of potential short-term market retreat due to rising optimism on Wall Street, as their Sell Side Indicator nears a 'sell' alert.Strategists at Citigroup Inc. warn that bullish positioning in U.S. technology stocks has reached its highest level in three years and that other global markets are also showing signs of being overextended, which increases the risk of a pullback.

Key Factors Should Be Monitored Closely

Factors such as the pace of global economic recovery, fluctuations in inflation rates, the direction of monetary policy from the Federal Reserve and other central banks, U.S. election, as well as shifts in the geopolitical landscape,will influence the trajectory of gold prices. Citi views gold as a hedge against recession in developed markets and believes that there are growing tailwinds due to the uncertainty surrounding the upcoming U.S. election in November. According to a report released on Monday, Citi analysts consider themselves to be "medium-term bullion bulls." They have assigned a 25% likelihood of gold achieving an average of $2,300 per ounce.Ewa Manthey, a commodities strategist from ING, is also bullish on the gold price. She wrote on the latest report,We expect gold prices to trade higher this year as safe-haven demand continues to be supportive amid geopolitical uncertainty with ongoing wars and the upcoming US election.

What Investment Opportunities Should Be On Your Radar?The chart below organizes various methods for holding gold positions in Canada:

Source: MT Newswires, Financial Times, CNBC

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

73814556 : $Bitcoin (BTC.CC)$

73814556 :

FARAMARZ AKBARY :