Genius and Courage? Bill Gross Placed Bold Bets Against Trump Media

The options market for the media company $Trump Media & Technology(DJT.US$, owned by former President Donald Trump, is drawing in a diverse crowd that includes enthusiasts of meme stocks and seasoned Wall Street experts. The former "Bond King," Bill Gross, has joined the fray.

Bill Gross, an investment veteran, took to social media platform X to broadcast his take on the situation. "A genius can also be an investor with the courage to sell DJT options at a 250 annualized volatility," he posted on last Thursday morning.

Gross is putting his money where his mouth is. The famed bond investor informed Bloomberg that he has sold put and call options on DJT with an April expiration, wagering that the stock will hover between $45 and $95.

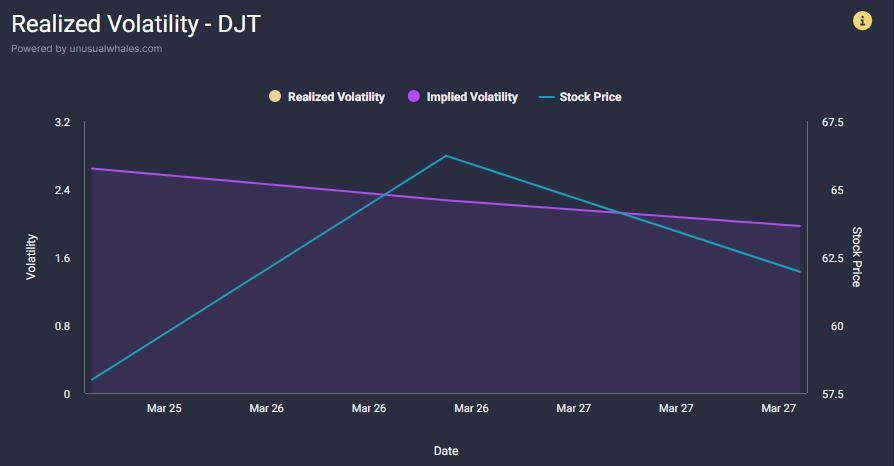

This strategic move comes as the implied volatility for Trump Media's monthly at-the-money options reached a pinnacle of 250 this week—an all-time high—following a 78% surge in the company's share price since the previous Friday. This surge in volatility has inflated the cost of options contracts, enticing sellers with the potential for lucrative premiums, but also exposing them to the risk of substantial losses if the stock deviates significantly from current levels.

The company, which recently went public via a special purpose acquisition company (SPAC), has seen its valuation soar to roughly $9 billion, a stark discrepancy compared to the relatively modest earnings reported by its social platform, Truth Social, in the last year.

Investors, hungry for a piece of the action, are diving into various strategies, from trading call and put options to taking on expensive short positions and speculating on warrants linked to Trump Media.

Those willing to directly short the stock are facing exorbitant borrowing expenses, with annual rates ranging from 400% to 500%, making Trump Media the most costly U.S. company to short among those with over $100 million in short interest, according to data from S3 Partners.

The stock's volatility is further fueled by a limited float and a base of retail investors loyal to the former president. Companies like Trump Media that have emerged from SPAC deals often present a challenge for short sellers, as traditional share-lending sources such as mutual funds and ETFs tend not to hold large positions in SPACs.

As an alternative to the tight shorting market, investors may turn to put options. The options market for Trump Media has been abuzz, with calls expiring at the end of the current week drawing significant attention as traders leverage the stock's rally. Puts with strike prices below $60 or $65 have also been actively traded, offering a hedge if the stock were to decline.

Trump Media's stock price was noted at around $64 in Thursday's morning trading session.

Source: Bloomberg, Unsualwhale

by moomoo news' Jimmy Wang

Disclaimer: Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

All Also Taken : he's just being Gross :)

102782395 : Hi