Finally Friday, Finally May. Higher Unemployment? Investors say 'Buy Now' | Market Moovers

Morning mooers! It is Friday, May 3rd, and the market green after a jam-packed Q1 earnings week.

This time around, FOMC nonaction and low jobs numbers helped push equities in the green, or it migh just be because April is finally over. My name is Kevin Travers, here are stories moving the market:

MOOVERS

$Amgen (AMGN.US)$'s stock soared 12% toward biggest gain in 15 years, adding more than 220 points to the Dow's price and leading the S&P and Nasdaq 100 after the drug manufacturer posted adjusted earnings above expectations and executives said they are "very encouraged" by preliminary data from a trial of an injectable weight-loss drug 'MariTide.'

$苹果 (AAPL.US)$rose by 7% after the company reported a decline in revenue but still exceeded analysts' projections and announced a $110 billion stock buyback program.

$Cloudflare (NET.US)$ dropped by 17% after positive results, with an unchanged 2024 outlook that disappointed most investors.

$Expedia (EXPE.US)$ slipped 11% after the company issued lower-than-expected guidance for its fiscal second quarter, with executives pointing to its Vrbo segment as a drag on its results.

SECTORS

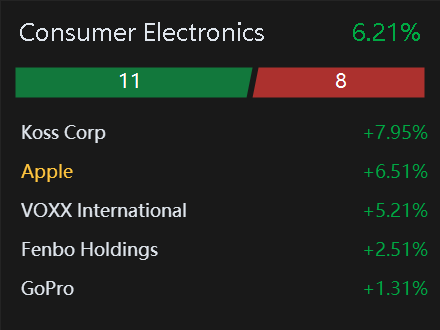

When it comes to sectors, Consumer Electronics were flying, up 6% compared to the moomoo sector trackers usual sector changes of +-2%. Leading the pack was Koss Corp, +7% and Apple with its dividend boosting earnings report.

Crude oil futures continued their decline.

Gold and silver futures were falling.. Bitcoin climbed 4%, pulling back from its nosedive that helped pull crypto stocks out of the dust.

RECAP

The market was green Friday.

Just past noon EST, the $S&P 500 Index (.SPX.US)$ grew 1.17%. The $Dow Jones Industrial Average (.DJI.US)$ climbed 1.17%, and the $Nasdaq Composite Index (.IXIC.US)$ climbed 1.95%

MACRO

Friday saw the release of more macro data.

Non-farm payrolls rose 175,000 in April, down from 303,000 previously and below a consensus that had looked for a 238,000 increase, while the unemployment rate rose to 3.9% from 3.8% previously. Consensus was for an unchanged jobless rate.

The $USD (USDindex.FX)$ fell heavily against all major trade partner currencies in early North American trade on Friday after the non-farm payrolls, hourly earnings and unemployment figures all missed expectations for April.

Wednesday, the Federal Open Market Committee left the target Federal Funds Rate unchanged at 5.25%-5.50%. In a statement released just at 2 PM, the committee said inflation has eased, but it can only expect to reduce the target range when they have more confidence inflation has lowered for good.

Federal Reserve Chairman Jerome Powell said it's unlikely that policymakers will increase interest rates, even though he acknowledged that bringing inflation down to their 2% target remains uncertain.

"I think it's unlikely that the next policy rate move will be a hike," Powell said in the press conference following the announcement. "We need persuasive evidence that our policy stance is not sufficiently restrictive to bring inflation down to 2%. That's not what I think we're seeing, as we mentioned."

$U.S. 2-Year Treasury Notes Yield (US2Y.BD)$ fell to 4.82, the $U.S. 10-Year Treasury Notes Yield (US10Y.BD)$ fell to 4.52

Mooers, what are you watching today? Comment below and I may feature your comment tomorrow!

Disclaimer: This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Indexes are unmanaged and cannot be directly invested in. Past performance is no indication of future results. Investing involves risk and the potential to lose principal. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information regarding your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal. Moomoo makes no representation or warranty regarding its adequacy, completeness, accuracy, or timeliness for any purpose of the above content. See thislinkfor more information.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment