Energy Merger Frenzy Continues: Buffett-Backed Occidental Petroleum Joins the Race for Shale Oil

As consolidation in the energy industry accelerates, mergers and acquisitions have been particularly active this year in the U.S. oil sector, with producers actively seeking high-quality assets in the prolific Permian Basin. On Monday, Buffett-backed $Occidental Petroleum(OXY.US$ announced its acquisition of CrownRock, one of the most popular private shale oil producers in the United States, for $12 billion (including debt). The transaction is expected to be completed in the first quarter of 2024.

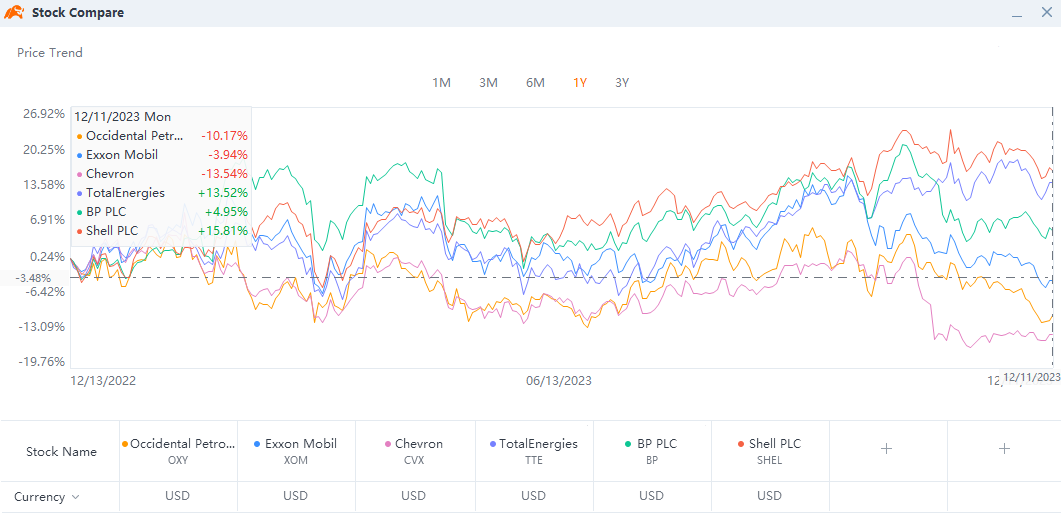

This is the third major merger deal in the oil industry to be announced within the past two months. On October 11th, $Exxon Mobil(XOM.US$, the world's largest oil and gas producer, acquired $Pioneer Natural Resources(PXD.US$ in an all-stock transaction valued at US$60 billion. Less than two weeks later, $Chevron(CVX.US$ also completed a deal to acquire $Hess Corp(HES.US$ in an all-stock transaction worth US$53 billion.

Unlike the previous two acquisitions, $Occidental Petroleum(OXY.US$'s acquisition of CrownRock will be in a cash-and-stock deal, thus making the cost of $Occidental Petroleum(OXY.US$'s upward movement in the "major leagues" of the US shale patch through this transaction a significant factor that cannot be overlooked.

Large energy companies have been particularly active this year in leveraging their ample cash flow and strong balance sheets to acquire rival assets.

Analysts point out that this is due, on one hand, to the large oil companies benefitting from the rise in oil prices following COVID-19 and accumulating sufficient cash flows; and on the other hand, by acquiring developed shale oil fields, they can secure new drilling locations which can be utilized when the market turns and production can increase rapidly to become profitable. Moreover, many medium-sized shale oil and gas companies with the best drilling locations and first-mover advantages have accumulated significant debt due to excessive expansion, resulting in the emergence of some cost-effective M&A targets in the market.

1. Expansion of Resource Reserves and Production: The acquisition is projected to provide $Occidental Petroleum(OXY.US$ with an additional production capacity of 170,000 barrels of oil equivalent per day and access to 1,700 undeveloped sites, out of which 1,250 are ready for development. This will solidify Oxy's position as the second-largest player in the Permian Basin, following the merger of Pioneer and ExxonMobil.

2. Lower Production Costs: The acquisition will enable Occidental Petroleum to secure low-cost oil and gas production. As stated in the press release, the break-even point after the transaction will be below $60/barrel, which is approximately 16% lower than the current $Crude Oil Futures(JUN4)(CLmain.US$ price. Moreover, 750 of these locations have a breakeven point below $40/barrel. This means that as economies of scale increase, the threshold for operators to profit from shale oil extraction will be lowered. The deal is projected to generate $1 billion in free cash flow by 2024 if U.S. benchmark oil prices remain at $70/barrel.

3. Improving Operational Resilience in the Face of Global Geopolitical Risks: Large oil producers can effectively mitigate the impact of geopolitical conflicts on their daily operations and increase future cash flow stability by significantly increasing the deployment of domestic shale oil and gas assets in the United States. By doing so, they can reduce their reliance on foreign sources and enhance their operational resilience amidst global instability.

For investors, the focus on mergers and acquisitions may lead to an expansion of a company's debt scale and potentially impact the stability of stock buybacks and dividend payments. Companies need to make investors believe that the acquisition of high-quality resources will generate new free cash flows and create exceptional value for shareholders.

From the perspective of industry structure, while the oil industry continues to face controversy over "old energy," the increasing occurrence of super-mergers and acquisitions by industry giants may significantly increase industry concentration. As a result, improved operational efficiency and lower operating costs may offset the negative impact of declining demand.

Source: Bloomberg, Financial Times, CNBC, moomoo

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment