Disney:The stock may have seen its worst yet,here are some suggestions for practical.

Free Cash Flow Woes

1.The quarterly FCF chart is not exactly a model for consistency.

the range between the best quarter (March 2019) and the worst quarter (June 2019) being a staggering $5.25 billion.

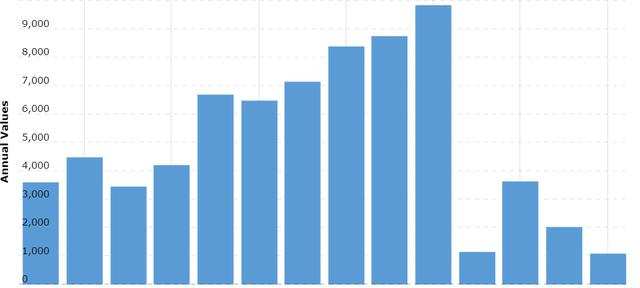

2.The annual FCF chart shows the steep drop in Disney's FCF, with the recent high in 2020 being about 1/3rd of the level in 2018.

The FCF situation is exacerbated when you consider:

3.The company's cost-cutting and price-increasing efforts have not made too much of an impact yet.

4.The company is entertaining thoughts of reinstating its dividend. Consider the following data points:

At 1.80 billion shares and 88 cents semiannually, Disney needs to set aside nearly $1.58 billion semiannually for its dividend payment. That is, about $800 million per quarter, which is nearly 30% higher than the company's average FCF over the last 5 years.

Worrying Debt Situation

Disney incurred $969 million in interest expense in H1 2023, which is 32% higher than the $735 million it had to pay in H1 2022.

Clearly, this is not an enviable position to be in when interest rates are showing no signs of slowing down.

Business Reality

Just as Disney was in the news for all the wrong reasons, Disney+ stopped its upward trajectory and reversed. And at the exact same time, Netflix, Inc. (NFLX) broke out of its flat-lining trajectory to resume its own upward trajectory. With the number of streaming options growing by the day, price increases may not be the right way to reverse this trend.

Many investors feel that Bob Iger’s magic may have worn off.

Conclusion

At some point, Disney's stock will turn around. It is not a question of "if" but "when".

The stock is not ready for a turnaround yet until we start seeing signs that the company has turned around.

Until then, as a Disney long, you can consider sell covered calls at higher strike prices to net some additional returns through premiums.

If you don't have a position in the stock but are interested in making use of this 9-year low, I'd suggest selling puts to be able to acquire the stock at a lower price.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

MonkeyGee : like any storm the sky is the darkest just before the sun shines!

D Blaine : Go ‘woke’, go broke. Desantas is laughing right now.