Dell's 28% Stock Surge Spur Block Trades in Options Market

Options traders won't be left out of the $Dell Technologies(DELL.US$'s party.

The soiree that sent Dell stock soaring 29% Friday also attracted investors in the options market, after the technology company said it's boosting its dividend by 20% as earnings and revenue beat estimates.

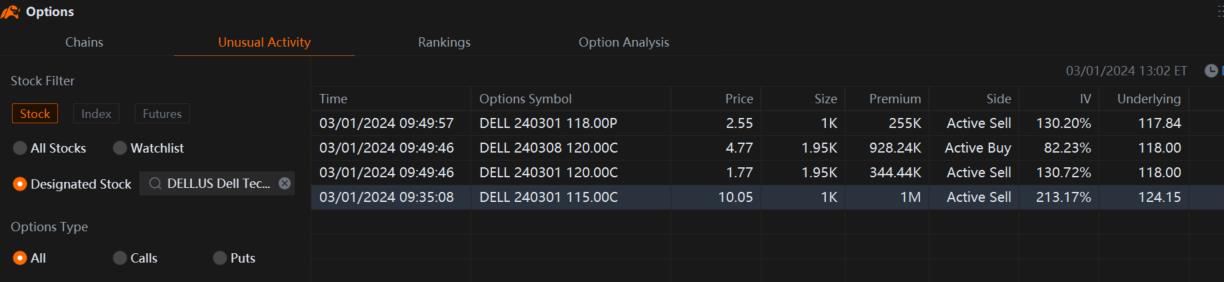

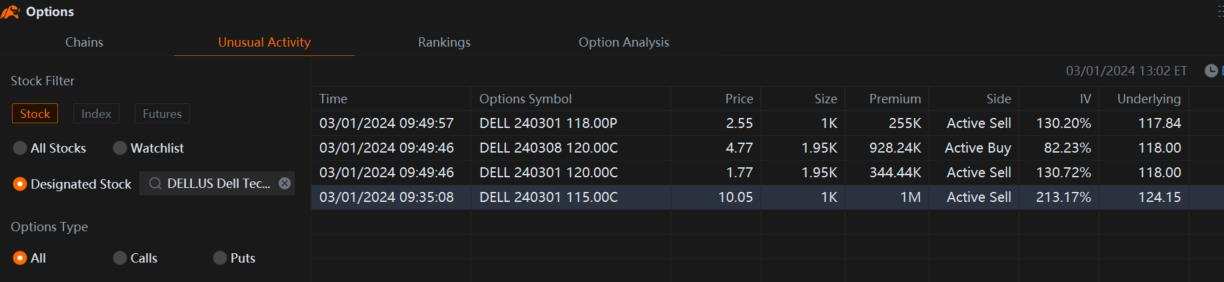

Data compiled by Moomoo on unusual trading activities in the options market showed four block trades, including one where the seller was paid a premium of $1 million for calls that give the holder the right to buy Dell shares at $115. The block trade, which covers contracts expiring today, was posted at 9:35:08 a.m. New York, when the underlying stock was still trading at $124.15.

Dell joined the list of the 20 most active options a day after the company reported a 22% surge in adjusted earnings to $2.20 a share in the three months ended Feb. 2 from a year earlier. The company generated strong cash flow as orders for its AI-optimized servers climbed 40% and its backlog almost doubled.

At 9:49:46 a.m. New York time Friday, another block trade of Dell options was posted when the stock was still at $118. The buyer paid a $928,240 premium on 1,950 calls that give the holder the option to buy Dell shares at $120 each by March 8. The calls were sold at $4.77 a share.

At that exact time, a block trade of the same size and the same strike price of $120 was sold, this time involving calls expiring today. The seller was paid a premium of $344,440 or $1.77 a share.

Less than 10 minutes later, a block trade of 1,000 put options expiring today, which give the holder the right to sell Dell shares at $118 changed hands. The seller was paid a premium of $255,000, or $2.55 a share when the underlying stock was still at $117.84.

The frenzy over Dell happened as analysts raised their price target on the stock. They include Wells Fargo, which boosted the price target to $140, from $85, signaling more upside potential.

"Our strong AI-optimized server momentum continues, with orders increasing nearly 40% sequentially, and backlog nearly doubling, exiting our year at $2.9 billion," Chief Operating Officer Jeff Clarke said in the company's earnings release Thursday. "We just started to touch the AI opportunities ahead of us and we believe Dell is uniquely positioned with our broad portfolio to help customers GenAI solutions."

The company announced that it's boosting its annual cash dividend to $1.78 per share, with 44.50 cents per share payable on May 3 to holders as of April 23, according to its press release on Thursday.

Disclaimer: Options trading entails significant risk and is not appropriate for all investors. Certain complex option strategy carry additional risk. Before trading options, please read Characteristics and Risks of Standardized Option. This article is for information and illustrative purposes only, and is not a promotion of option trading or a recommendation of any of the specific option mentioned above.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Froy : expiration day is 3/12. Should I sell or wait for next week

73764990 : how to add this in morning?

104073473 : အောကား

BelleWeather Froy: Price? ITM?

MAXIMAS82 Froy: there are no options expiring on the 12th LMFAO

Siew How Woo :