DraftKings's Options Market Attracts Big Money Bets Ahead of Earnings

A deep-pocketed investor or speculator paid millions of dollars to buy $DraftKings(DKNG.US$ put options that could shield the holder against further declines in the stock that has already slumped about 8% in the past month.

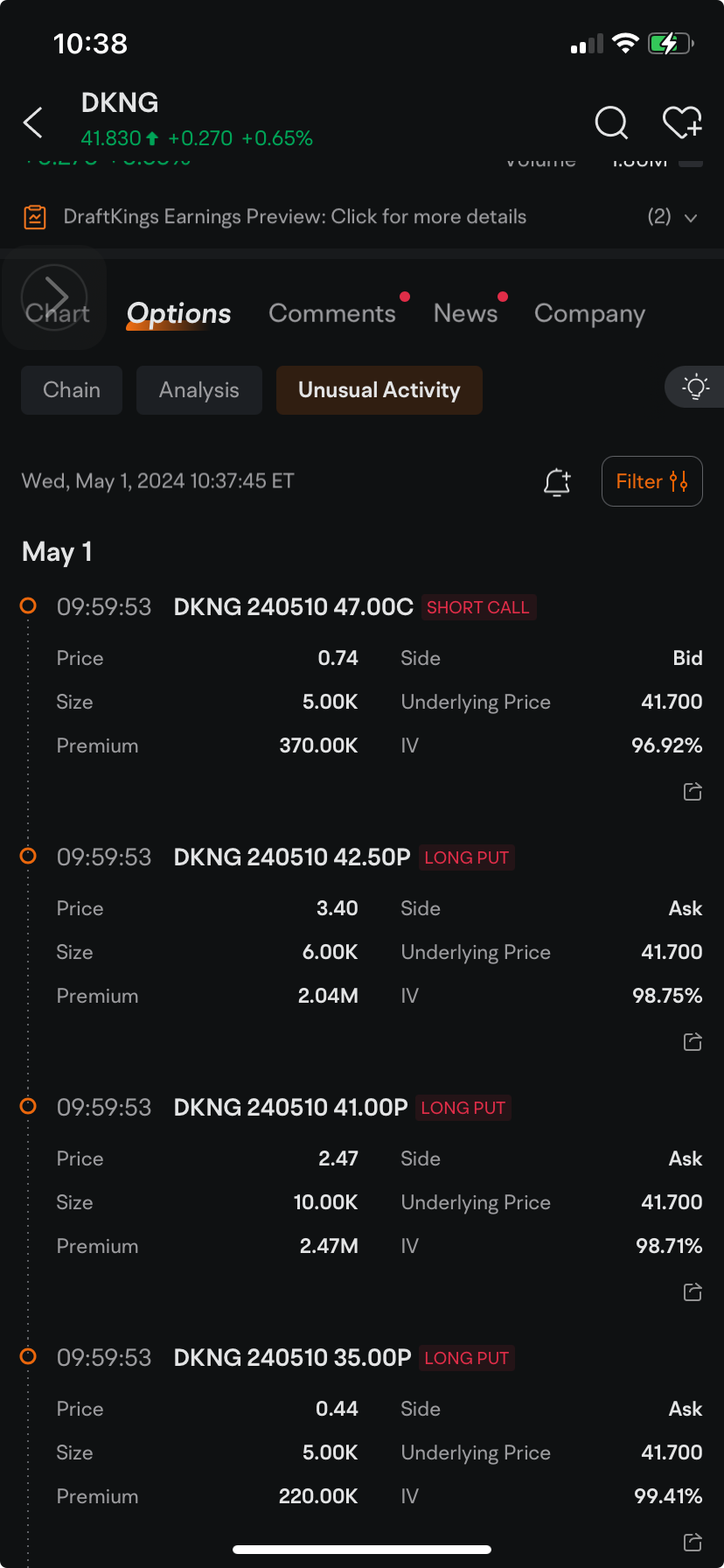

At 9:59:53 a.m. in New York Wednesday, four block trades were posted, including three where the buyer paid a combined $4.73 million in premiums for put options that give the holder the right to sell the stock of the online sports betting provider at a specified price by the end of next week, according to data compiled by moomoo.

At 9:59:53 a.m. in New York Wednesday, four block trades were posted, including three where the buyer paid a combined $4.73 million in premiums for put options that give the holder the right to sell the stock of the online sports betting provider at a specified price by the end of next week, according to data compiled by moomoo.

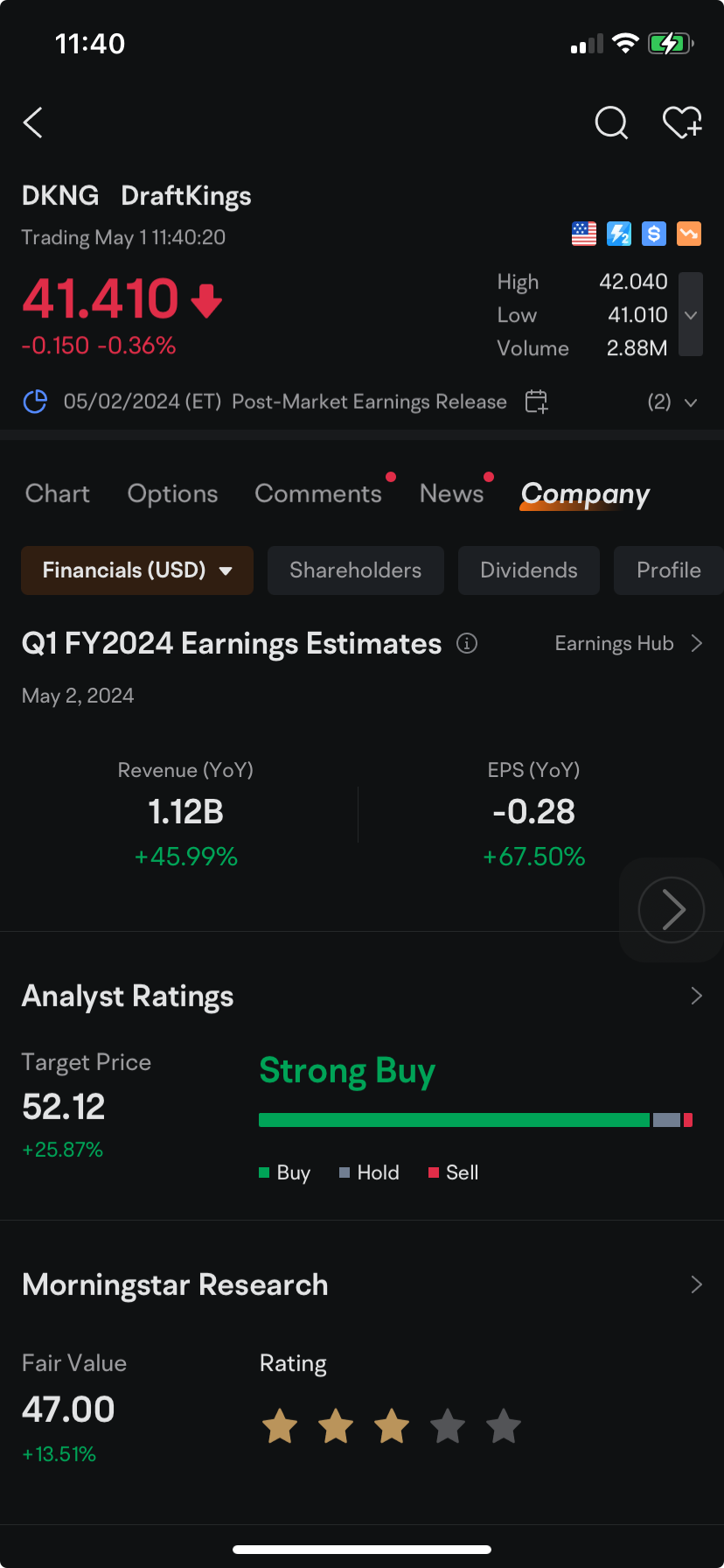

The block trades were recorded just a day before DraftKings is scheduled to report first quarter earnings. The company is expected to report an almost 46% jump in revenue for the $1.12 billion in the three months ended March 31, according to the average of analysts' estimates compiled by moomoo. Net loss is seen narrowing to 28 cents a share, from 87 cents a year earlier.

The biggest of the four block trades cost the buyer a $2.47 million premium for put options that give the holder the right to sell 1 million DraftKings shares at $41 by May 10. The buyer paid $2.47 a share for the puts. Shares traded down 0.4% at $41.38at 11:45 a.m. in New York, amid a wider stock market sell-off.

That trade for 10,000 put options represents almost all of the volume for the contract. Trading surged less than 1,000 contracts a day earlier.

The second biggest block was for a $2.04 million for the right to sell 600,000 DraftKings shares at $42.50 each and the third one was for $220,000 for the right to sell 500,000 shares at $35 each.

At the exact time those three long put options were posted, a block trade was also recorded with the seller who stands to collect a premium of $370,000 for writing call options that give the holder the right to buy 500,000 DraftKings shares at $47 each also by May 10.

At the exact time those three long put options were posted, a block trade was also recorded with the seller who stands to collect a premium of $370,000 for writing call options that give the holder the right to buy 500,000 DraftKings shares at $47 each also by May 10.

The recent weakness in the stock was due "to unfavorable March outcomes, politicians mentioning problem gaming and Q2 likely being the lowest revenue growth quarter on difficult comps with some April hold pressure," MT Newswires reported on April 22, quoting Oppenheimer, which maintained the outperform rating on the stock, with a $60 price target.

Oppenheimer encouraged investors to buy the stock on weakness, noting that structural fundamentals around player engagement, retention, product and advertising efficacy remain intact, helping the company achieve its long-term target for earnings before interest, taxes, depreciation and amortization (EBITDA), according to the report.

Not all the block trades involving DraftKing options were seeking protection against continued price slump. Less than 15 minutes before those four block trades, two smaller trades were also posted.

At 9:45:26, a trade was posted where buyer paid a $100,220 premium for call options that give the holder the right to buy 334,000 shares of DraftKings at $48 each by Friday this week. At that exact time, another block trade was recorded with the seller who stands to collect a premium of about $46,760 for writing call options that give the holder the right to buy the same amount of stock for $49.50 each also by Friday.

Goldman Sachs analysts led by Ben Miller were among those bullish on the stock. They initiated coverage of DraftKings with a Buy rating and a target price of $60, Barrons reported in mid-April. The analysts expect the compound to "compound revenue at 20%+," according to the report.

Disclaimer: Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy. All company analysis information is provided by third parties and not by Moomoo Financial Inc. Any illustrations, scenarios, or specific securities referenced herein are strictly for informational purposes and is not a recommendation. Past investment performance does not guarantee future results. Investing involves risk and the potential to lose principal. This content is also not a research report and is not intended to serve as the basis for any investment decision. The information contained in this article does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Furthermore, there is no guarantee that any statements, estimates, price targets, opinions or forecasts provided herein will prove to be correct.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

74015641 : don't give 2 shits one way or another ill show with my resolve

74015641 : hedging bets on ne btw