Crude oil future supply are thinning out

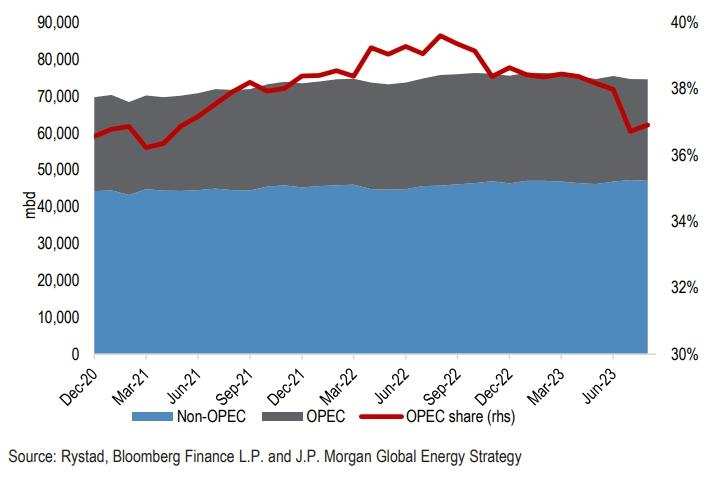

1.As to OPEC,it's share in the world’s crude oil production has decreased by about 300bps in last12 months from its recent peak of c. 40% in Aug-22 to c. 37% in Aug-23. the barrels from “core members” were mainly replaced by rising production from “sanctioned members” (Iran, Libya and Venezuela – not subject to OPEC quotas).

In the meantime,Iran(3), Venezuela() and Libya(8)are nearing their maximumproduction capacity.Sustainable production increases from hereshall only come with additional capex, and it will take years for additional investmentdollars to translate into marginal barrels.

All three countries’ total capacity utilizationaveraged near 92% in 2017-18 before President Trump reimposed sanctions on Iran inNov-2018. A 92% utilization of the current production capacities implies additional c.300kbd production from them collectively – significant, but not a material figure tofundamentally change the global supply picture.

2,SPR and commercial crude oil held by US firms are below historical averages.

US SPR and commercial inventories account for c. 90% of traceable OECD crude inventories (US, Europe andJapan) and the share has been relatively stable over the years

(1)Commercial crude inventories are below historical averages. US commercial crudereserves stood at 418mn barrels as of 15 September, this is already below the mostrecent 5 year average and 2015-19 average (OPEC’s preferred metric), and just 6%above the historical lows for this time of the year. We note that US SPR and commercialinventories account for c. 90% of traceable OECD crude inventories (US, Europe andJapan) and the share has been relatively stable over the years.

(2)US SPRs are at a level not seen since 1983 and c. 40% below the long term averagelevel of 600mn (latest reading 351mn barrels as of 15 September). While we don’texpect material additional supply from the SPR as the reserves remain low, we shouldn’trule out the possibility of further releases if oil prices move markedly higher;

(3)Besides,The lower productivity,higher cost of debt and equity to be a major impediment to the continued highelasticity of US supply growth during periods of elevated oil prices.

overall cost of debt still doubled from c. 3% in 2021 toc. 6% today.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment