Copper Pullback from Record High: Is the Bull Run Over?

On this Monday, the London Metal Exchange witnessed a significant surge in benchmark copper prices, reaching an unprecedented nominal peak above the $11,000/t mark. This milestone eclipsed the previous high of $10,850, recorded in 2022.

However, the market saw a dramatic reversal on Wednesday, with prices plummeting 4.3% to $10,396/t—marking the steepest single-day drop since July 2022. Despite this midweek slump, copper prices have maintained a robust upward trend, boasting a 21% increase this year to date.

What factors caused the sharp pullback?

1. Diminished Fed rate cut expectations

The release of the Federal Reserve's FOMC Minutes on Wednesday conveyed a hawkish tone, highlighting concerns over a loose monetary environment and policy uncertainty. Participants expressed a willingness to tighten monetary policy further if necessary, triggering a collective retreat in the closely-watched prices of commodities such as $Gold Futures(DEC4) (GCmain.US)$, $Silver Futures(DEC4) (SImain.US)$, and $Copper Futures(DEC4) (HGmain.US)$.

2. High prices dampen China's demand

According to a survey by Mysteel Global, which covered 28 copper rod plants representing nearly a third of the country's fabrication capacity, over 60% of producers have reduced or ceased production due to slowing sales. This is primarily because fabricators are not accepting higher prices at the moment, leading to a spike in copper inventories to new highs for the year. Additionally, the impending off-season for the industry further heightens market concerns regarding demand.

Hai Jianxun, a sales executive at Henan Yuxing Copper Co., a smaller company in central China specializing in copper pipes, has stated that "Orders might rebound in June or July if copper can fall below 80,000 yuan a ton." This price refers to the Shanghai Futures Exchange prices, which closed at 84,260 yuan per ton on Wednesday, or more than $11,600/t. (Chinese prices are higher due to taxes being included.)

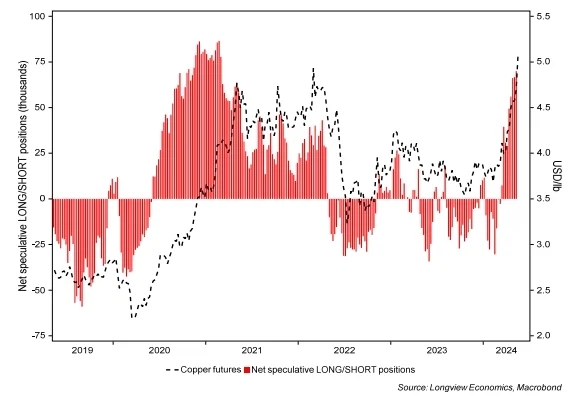

3. Long position profit-taking

Following a robust 7% surge in copper prices last week, heightened media attention to the rally led to inevitable profit-taking on Wednesday, amidst China's stagnant demand and a hawkish toneof the Fed.

What's next for copper?

- The demand landscape

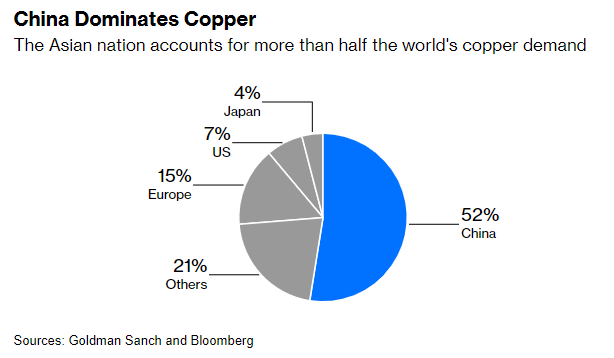

China is responsible for over half of the global copper demand. Recently, China has introduced a series of positive policies in the real estate sector aimed at promoting recovery. Additionally, policies related to the "old-for-new" scheme in the automotive and home appliance sectors are expected to boost copper consumption. Furthermore, since March, China's Manufacturing PMI has remained within the expansion territory.

Major banks such as Goldman Sachs and Morgan Stanley have raised China's growth outlook for 2024 lately. In a note, Goldman's economists wrote that "Recent China macro data have been solid," and that the manufacturing data "suggests the Chinese economy found a local bottom in late 2023 and is on the way up."

Outside of China, the latest Economic Outlook from the OECD indicates that the global economy is sustaining growth at a modest pace. The OECD has upgraded its economic growth forecasts for the next two years, projecting a global GDP growth rate of 3.1% for 2024, up from its previous estimate of 2.9%. For 2025, the growth rate is expected to rise to 3.2%, compared to the earlier projection of 3%.

The global manufacturing sector is also maintaining a recovery trajectory. The latest Markit Manufacturing PMI index from the United States remains robust, while the rise of emerging economies, exemplified by Southeast Asia and Mexico, along with the ongoing restructuring of supply chains, continues to drive the upward trend of the global Manufacturing PMI.

Besides, the ongoing global energy transition, which involves shifting to renewable energy sources and electrification of transportation, among other initiatives, is expected to continue driving demand for copper. And the global infrastructure investment and the worldwide boom in artificial intelligence are seen as potential drivers for increased copper demand.

- Supply pressure

Constrained copper supply is a widely held belief in the market. The easiest copper deposits have already been exploited, and additional production will come from miners with lower ore grades, located in more difficult geographies, and with ore bodies buried deeper.

The mining industry is focusing on mergers and acquisitions centered on copper, such as $BHP Group Ltd (BHP.US)$'s attempt to acquire $ANGLO AMERICAN (AAUKF.US)$. However, M&A activity does not create new supply and may not fully address the supply constraints in the copper market.

As a result, many institutions remain optimistic about copper prices in the long run. Citi forecasts that in the long term, copper prices are expected to continue their upward trend, potentially hitting $12,000 per ton within the next 12 to 18 months, with a chance of climbing as high as $15,000 per ton. However, for the coming three to six months, copper prices are likely to consolidate as China's economy is still in the process of recovery and the recent sharp increase in copper prices is expected to bring the market back into equilibrium.

Indeed, the year-to-date rally marks the beginning of copper's second secular bull market this century, with copper miners set to print massive margins for the next two to three years at least.

$Freeport-McMoRan (FCX.US)$, the copper giant, expressed optimism about the future prospects at the latest conference call in April, suggesting that we are now entering "the early stage of a new era for copper."

Source: Bloomberg, S&P Global, Freeport-McMoRan

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Guardian87 : shot shot shot

ces short : always $BHP Group Ltd (BHP.US)$ in my basket

71545516 : it's because I bought the stock. happens every time