Conflicting Data Leaves Europe in a Dilemma Over Whether to Raise Rates, And What It Means for The US

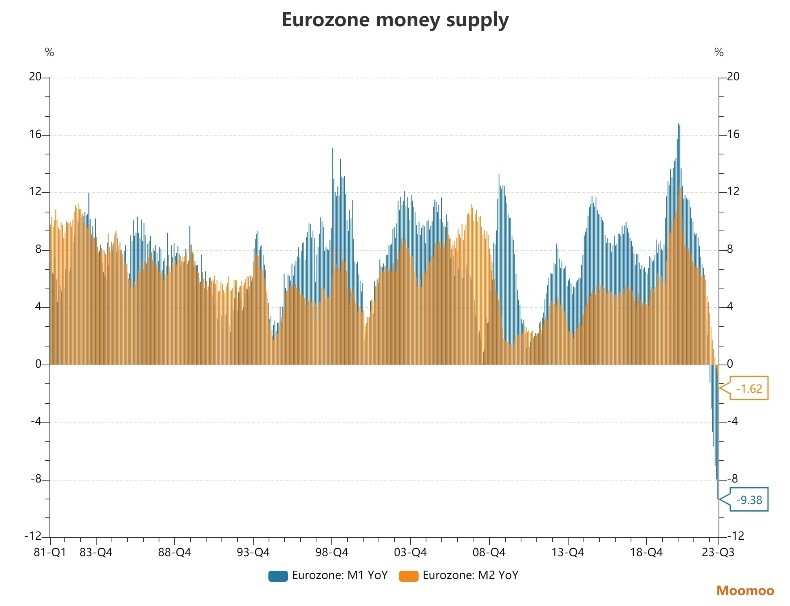

As lending dried up and short-term deposits decreased, Eurozone money supply shrunk further. M1 dropped by 9.38% and M2 decreased by 1.62% in July.

The money supply is one of the main metrics monitored by the European Central Bank to check the impact of recent monetary policy tightening. The latest data will feed into the debate at the ECB's governing council over whether it should pause interest rate rises for the first time since July 2022 at its next meeting on September 14.

■ European PMIs for August show steep downturn

The shrinking money supply isn't the only bad news. European business activity contracted once again during August, to its lowest level since November 2020. The euro zone's flash composite PMI fell to 47.0 for August from 48.6 in July. This missed economists' expectations for a figure of 48.8. The service sector of the euro zone is showing signs of turning down to match the poor performance of manufacturing.

■ European economic engine German economic momentum slowed down significantly

The outlook for economic growth in Europe is not optimistic, especially in Germany, which contributes more than 24% of the euro zone's GDP. IMF expects Germany to be the only advanced economy to shrink this year — with a forecast contraction of 0.3% compared with an average rise of 0.9% for the 20 countries.

Falling private and public spending were the main drivers of the recession. A higher cost of borrowing has hit Germany's residential building sector hard: More than 40% of construction companies responding to a survey by the ifo Institute last month reported a lack of orders, up from 10.8% a year earlier. The broader industrial sector, which includes Germany's famed manufacturers such as Volkswagen and Siemens, has also taken a knock. Industrial output contracted 1.7% year-over-year in June.

Some problems are temporary, while others, like a rapidly aging population and a high corporate tax rate, are structural. Besides, German exports to China are sluggish this year. China has become a competitor and simply doesn't need as many German-produced goods as it did in the past.

■ Europe lags behind in fighting inflation

Although Europe's economy faces downside risks, the decline in inflation was slower than the US. On Monday, European Central Bank Governing Council member Holzmann said that the ECB has not yet beaten inflation. The Austrian central bank chief said in an interview that a tight labor market means unions are likely to boost wages significantly.

He added that the ECB was still "somewhat behind" in fighting inflation. Asked if that meant rate hikes could continue beyond September, he said "once we get to 4% we'll talk again".He said the stop-and-go path of interest rates is harder for the market digestion.

■ ECB struggles in debate over whether to raise rates

At the Jackson Hole meeting, ECB President Lagarde shied away from sending a clear signal of her policy intentions. Her presentation focused on longer-term structural changes, including changes in the labor market, the energy transition and geopolitics, meaning it has become more challenging to read the economy. "There is no ready-made playbook for the situation we face today. Our task is to draft a new agreement," she said.

Economists at Berenberg, led by Holger Schmieding, changed their forecast on Friday ahead of Lagarde's speech, raising the probability of the ECB pausing rate hikes to 60% from 40%. Analysts polled by Refinitiv suggest that the central bank will most likely leave rates unchanged next month with its main rate currently at 3.75%.

However, for ECB hawkish officials, a September rate hike is necessary. Holzman isn't the only hawkish policymaker. Both Bundesbank President Nagel and Latvian Central Bank Governor Kazaks said in television interviews last week in Jackson Hole, Wyoming, that they were also leaning toward another rate hike.

■ What does it mean for the US?

Europe is the third largest export market for the United States, and its share may be even higher, considering that a considerable portion of trade with Asia is processing trade. If the European Central Bank suspends raising interest rates in September, it means that the economies of various countries have approached the critical point of tolerance under high interest rates this year.

The impact of the European economy on the United States can be referred to when the European debt crisis broke out in 2011, when former President Obama said, “If Europe is weak, if Europe is not growing, as our largest trading partner, that's going to have an impact on our businesses and our ability to create jobs here in the United States.”

After a decade, the US should be more cautious in raising interest rates now because the US debt/GDP ratio is even higher than that of Europe. A rate hike means the Treasury will pay more interest in the future.

Besides, the US dollar index was still above 100, higher than most periods of past decades. A strong dollar generated by U.S. rate hikes puts pressure on non-U.S. economies, which in turn limits the room for U.S. rate hikes.

■ The central bank's balance sheet reduction is more urgent than raising interest rates

Nomura Securities economist Richard Koo pointed out in a recent report that in addition to interest rate increases, we should pay more attention to QT. He believes that if the Fed's balance sheet cannot be reduced quickly, the United States will need to raise interest rates even more.

He suggested that the reason monetary policy isn't working may be the policy itself becoming less effective, rather than what Powell calls "long and variable lag", and the overuse of loose policies has resulted in a vicious cycle. He noted, “The prolonged application of QE has left the US with excess reserves of some $3trn, or 1,600 times the amount that existed prior to Lehman Brothers' failure.”

The Chicago Fed's National Financial Conditions Index stood at -0.39 in the week through 11 August, the negative sign indicating that conditions remain more accommodative than they have been on average for the past 50 years—in spite of all the Fed's rate hikes.

Although the Fed is implementing QT twice as fast as it did the last time, starting in October 2017, considering the starting point of this round of QT is higher, it will take until 2025 for the Fed to return to the level before the epidemic at the current speed. Therefore, the speed of QT will become the focus of market attention in the future.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

71175628 : Also inflation is here to stay!!! Raising the rates creates more chaos!