Can U.S. Stocks Replicate the Past Decade's Bullish Run? Analysts Warn That S&P 500 May Require 50x P/E

In 2023, the three major U.S. stock indexes delivered impressive results, breaking through or approaching record highs. Extending the timeline, U.S. stocks repeatedly regained their footing after sharp declines in 2015, 2018, 2020, and 2022, outpacing all other asset classes during the decade-long bull run.

Looking ahead, Wall Street's outlook for U.S. stocks is mixed, with valid reasons to support both optimism and pessimism. Jordan Brook, Principal at AQR Capital Management, recently reviewed the various factors that drove the outstanding performance of U.S. stocks over the past decade. He pointed out that replicating the stock market prosperity of the past decade would require almost miraculous expansion in both earnings and valuations.

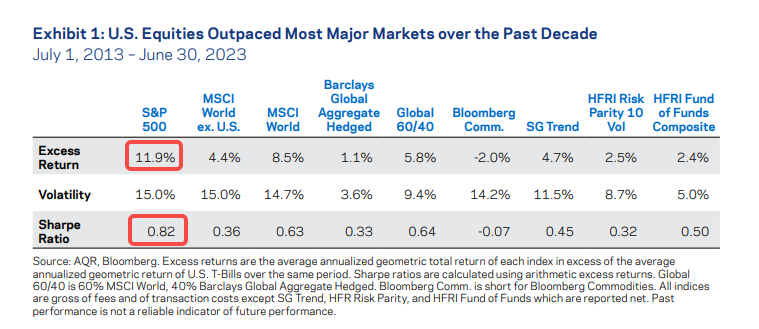

According to Jordan Brook, U.S. equities enjoyed a stellar decade, with the $S&P 500 Index(.SPX.US$ delivering an excess-of-cash return of 11.9% per year from July 1, 2013, to June 30, 2023, surpassing the performance of most major assets. Moreover, when considering risk-adjusted returns, the S&P 500's average Sharpe ratio over the past ten years has been 0.82, which is over twice that of MSCI World ex. U.S. (0.36) and higher than the Global 60/40 strategy's 0.64.

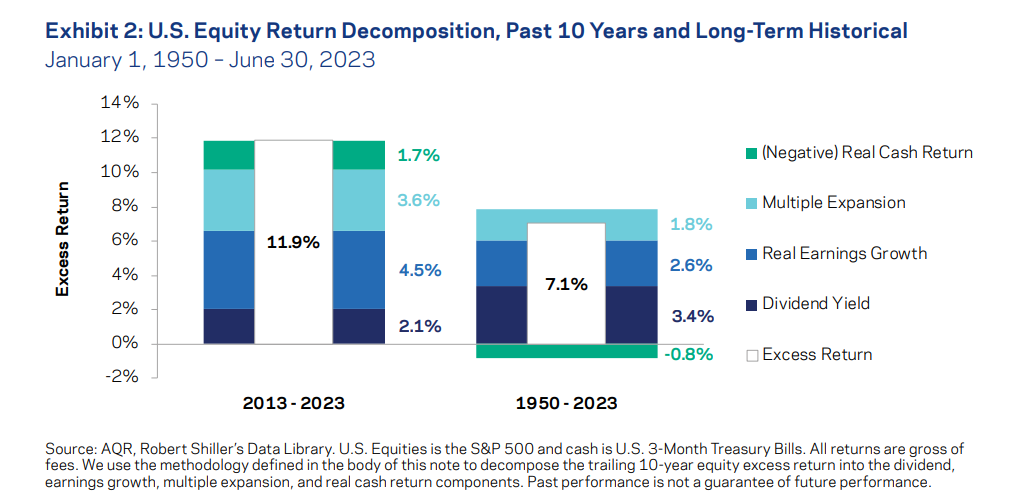

Jordan Brook has proposed a further decomposition of the real stock market return into the following sources:

Excess of cash return = Dividend yield + Real earnings growth + Multiple expansion - Real cash return

The impressive performance of US equity over the last decade is largely attributable to the growth in earnings and valuation. Specifically, 4.5% and 3.6% of the 11.9% excess cash return can be attributed to real earnings growth and multiple expansion, respectively, accounting for nearly 70% of the overall return. Notably, the Federal Reserve's prolonged period of low interest rates before has resulted in negative real cash returns but has also contributed an additional 1.7% return to the equity market.

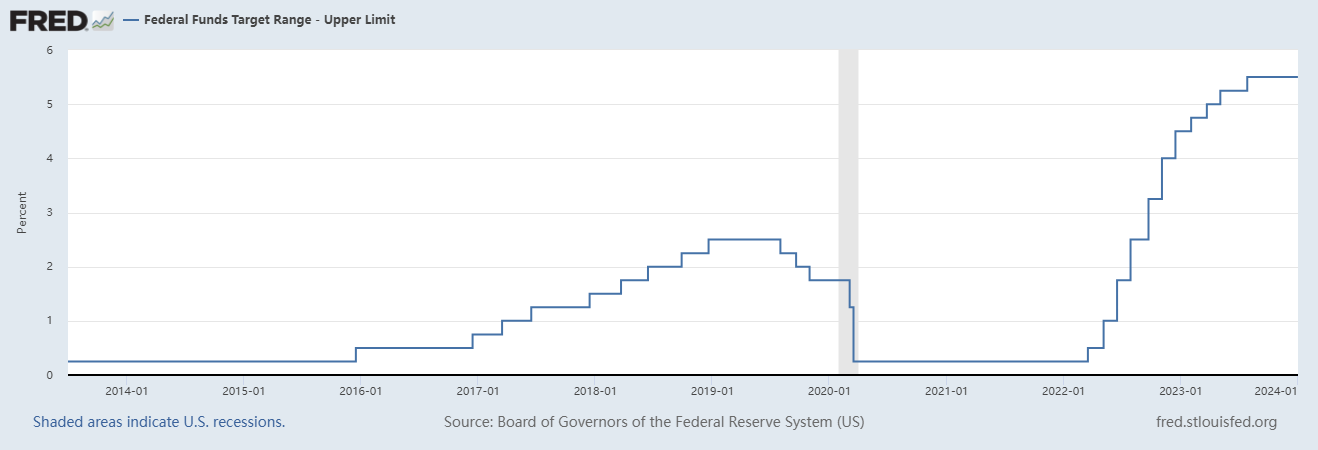

1. Upon analyzing the aforementioned driving factors, the first challenge to replicate is the negative real cash returns

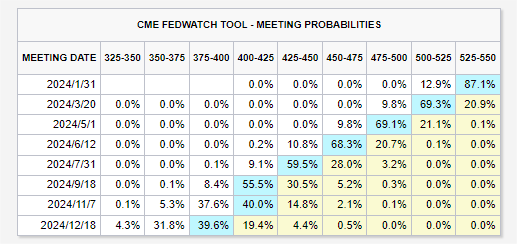

For the past nine years from July 2013 to September 2022, the federal funds rate has remained below 3%, considerably lower than the inflation rate, thereby resulting in negative real cash returns. However, the current policy interest rate level of 5.25%-5.5% and the Federal Reserve's attitude to keep interest rates "higher and longer", correspond to a probable increase in the real cash return in the future. Even if the Fed initiates interest rate cuts in 2024, with a projected drop to an optimistic 3.75% by year-end, it remains improbable for the real cash rate level to become negative again and contribute to the stock market return.

2. To replicate the past decade's success in the US stock market, both profit and valuation growth thresholds are exceptionally high.

Actually, following a rapid ascent in 2023, the S&P 500's valuation has now reached historic heights, thereby rendering rich valuations a key concern for analysts and investors alike.

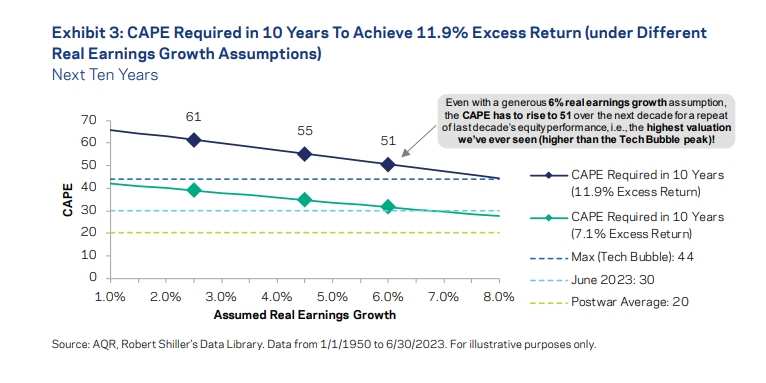

Jordan Brook's calculations reveal that to replicate the excess return of 11.9%, U.S. equities would require astonishingly high valuation levels. Specifically, should the Assumed Real Earnings Growth continue at its average pace of 4.5% over the past decade,a cyclically-adjusted price-earnings ratio (CAPE) of 55 times would correspond. Even if a most optimistic earnings forecast of 6% growth were to be utilized, which represents the 90th percentile, the CAPE would still need to rise to 51x to match the performance of the previous decade, surpassing TechBubble's peak valuation level.

"While this outcome is not impossible, it is an implausible baseline assumption, " wrote Jordan Brook.

It is important to recognize that history does not simply repeat itself. The 2023 rally in U.S. equities has resulted in overly cautious investors missing out on significant gains, while a straightforward buy-and-hold approach has produced substantial rewards.

Looking forward to the market outlook, Wall Street analysts hold varying perspectives on the future trajectory of U.S. stocks. Forecasts for the S&P 500 index by major institutions for the end of 2024 exhibit significant variance. Nonetheless, both pessimistic and optimistic viewpoints seem to be well-founded when examined closely.

Here are Wall Street's predictions for the performance of the S&P 500 in 2024:

In addition to the previously mentioned high valuations, some analysts with a pessimistic view have identified other factors, including inflation pressure, liquidity pressure, and profitability pressure.

1. The downward trend in inflation and its impact on the stock market may be limited: While the anti-inflation effect in 2023 is significant, the Cleveland Fed's inflation forecast warns that December's core CPI month-on-month increase may exceed 0.3%, the highest since May 2023. Moreover, since the current market has already priced in expectations of interest rate cuts in 2024, the positive effect of falling inflation on the stock market may not be as pronounced as before.

2. The supporting role of financial liquidity in U.S. stocks may not be sustainable: Financial liquidity has played a crucial role in driving the increase of U.S. stocks in 2023, and the reduction in reverse repurchases will be pivotal in shaping liquidity in the upcoming stage. As the net issuance of short-term Treasuries slows down in Q2 2024, the release of liquidity from reverse repurchases will likewise slow down, placing pressure on the stock market.

3. Other factors that analysts have cautioned about include macroeconomic uncertainty, geopolitical risks, excessive stock market concentration, and the possibility of lower-than-expected earnings results in 2024.

Despite these concerns, the market remains optimistic. Some analysts are confident that further reductions in inflation will have a positive effect in the next stage. They also believe that upcoming interest rate cuts and the injection of record-high monetary fund assets into the stock market will be beneficial. Additionally, some are optimistic about the potential of artificial intelligence to improve corporate profits.

Source: AQR Capital Management, CME, Fred

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

JP_mykayaplus :

Whispr : nah

Alan DeFlorio : Stranger things have happened. We will likely have another significant rally before the next crash. That will then be the real opportunity.

淡定的惠特莫爾 : Daisies are wobbly! Recommend to do too much and do nothing