Cash Is King Now: Here's What Analysts Are Saying

"As cash yields remain elevated and inflation has cooled significantly from last year's levels, cash yields moved into positive territory on a real, inflation-adjusted basis after a few years of negative real yields," said Veronica Willis, $Wells Fargo & Co(WFC.US$'s global investment strategist.

"This shift to a positive real cash yield environment has prompted investors to question if now is the time to increase cash holdings or hold on to cash to wait for a better opportunity to enter the market," she added.

The Bond Market Has Sounded Recession Alarms

There is growing optimism on Wall Street and in Washington that the Federal Reserve could guide the economy toward a soft landing.

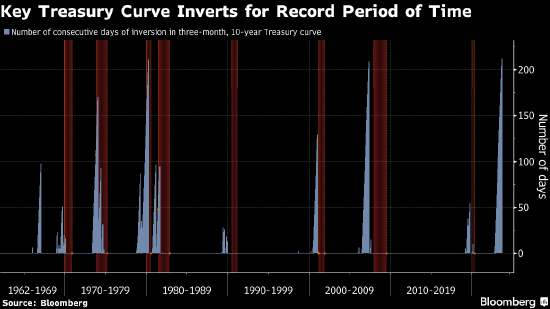

However, for 212 consecutive trading days, the Treasury market has been sending a drastically different signal, indicating that the economy is heading toward a slowdown. This is because the yields on 10-year Treasury bonds have remained lower than those of 3-month bonds.

The conflicting signal between the market's caution and the economy's unexpected resilience demonstrates how much uncertainty has persisted since the Fed started its aggressive rate hikes in March 2022.

Recently, the yield from a portfolio divided 60%-to-40% between stocks and bonds was less than just investing in 3-month Treasury bills, according to data compiled by Bloomberg. "A thriving finance-based economy cannot do well if low-risk investments yield higher than high-risk investments," Said Bill Gross, former chief investment officer of Pacific Investment Management Co.

Ray Dalio, the founder of Bridgewater Associates, has claimed that the world is currently experiencing an acceleration turning point. The U.S. faces a daunting challenge as it deals with a growing deficit that obliges the country to sell bonds to investors worldwide, which requires a delicate balancing act. This act involves maintaining interest rates at an appealing level for creditors while also avoiding overburdening the issuer with excessive rates.

Dalio noted that when investors choose to sell, driving up yields, central banks face a critical decision—whether to print money and buy bonds, a move that can stoke inflation pressures.

He concluded that holding bonds for an extended period may not be a wise investment decision. He's currently steering clear of bonds and favoring cash instead.

Cash to 'outperform' stocks

$Barclays(BCS.US$ anticipates a slowdown in the U.S. gross domestic product growth during the first half of 2024, but it still believes that there will be a prolonged period of high interest rates. As a result, there isn't a compelling reason to hold onto long-term bonds or stocks at this time.

Slowdowns in GDP growth have proven to be a difficult environment for equities and other high-risk investments. Weak economic activity and demand can negatively impact corporate profitability, while rising wages and interest rates further squeeze profit margins. In contrast, commodities tend to outperform other asset classes during these slowdown phases.

Commodities benefit from inflation during slowdowns, unlike expansion periods, when they benefit from robust economic activity. This is because energy and agriculture commodities are factored into the headline CPI rate, and they can drive up consumer prices.

However, at present, investors do not seem to favor commodities. "A stagnant European economy and a weaker-for-longer Chinese economy make pockets of cyclical in FX, equities and commodities look unattractive. So, for a second straight quarter, we prefer the company of cash over stocks and bonds,” Barclays wrote, describing major asset classes as "still unattractive."

The economic weakness in Europe and China means a decrease in demand, particularly from China as it is the largest consumer market for commodities globally. As China and Europe are important consumers of commodities worldwide, their economic slowdown could lead to reduced demand for commodities, which in turn could impact commodity prices. China guzzles almost a fifth of the world's oil, half of its refined copper, nickel and zinc, and more than three-fifths of its iron ore.

David Kostin, $Goldman Sachs(GS.US$' chief equity strategist, has pointed out that nearly $1 trillion has flowed into money market funds this year. This is because of the returns that investors receive from holding cash. It's a "pretty attractive alternative to equities. The relative attractiveness of cash is actually pretty strong in this environment," he said.

Risks of holding cash in the long term

U.K. asset management firm Schroders said in a Sept. 14 note that investors might not fully understand the risks of persistently overweighting short-term investments or cash holdings, and they may underestimate the protective benefits provided by bonds against potential price drops. While it is wise to allocate some funds to cash for flexibility, this firm suggests that it is time to start considering long-term.

"If short-term interest rates fall, short-term investments or cash investors will need to reinvest at a lower rate, reducing future returns. When investors buy longer maturity bonds, they are exposed to less reinvestment risk," Schroders said.

Source: CNBC, Insider, Bloomberg, Schroders Economics Group, The Economist

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

DudeThatsDerpy : I love how just recently there have been so many articles about how we're going to have a soft landing and see new ATHs in the stock market, yet now, almost instantly it seems, cash is king?

70231133 : nicely

Joseph Tyler : nice

maino : Best to believe they will continue to rise five

Dylan Myers : this is what high interest rates do

73677319 : wow

HuberTravis : Hi

73126067 : hello

Ro5900 : Yoo

MerlinKally17 : with other country economy weaker bonds aren't looking as good as cash money

View more comments...