Can US Stocks and Investment-Grade Corporate Bonds Continue to Defy Investor Concerns Amid Treasury Market Volatility?

Last week, the unexpected surge in retail sales data shows remarkable resilience from US consumers despite concerns over rising interest rates and a weak economy. The data reinforces market expectations for the Fed to maintain "higher-for-longer" approach to interest rates, resulting in an increase of more than 10 basis points in US Treasury yields across various maturities, with the benchmark $U.S. 10-Year Treasury Notes Yield(US10Y.BD$ even briefly breaching 5%. The sharp increase in Treasury yields has raised further concerns among investors about investments in risk assets.

According to Bank of America strategist Yuri Seliger, amid Treasury market volatility, the recent movements in US stocks and investment-grade corporate bonds have remained relatively steady over the past few trading days. Seliger pointed out that corporate bonds and equities are moving independently from the fluctuations in the Treasury market, which is a relatively bullish signal indicating that economic growth is feeding risk appetite, even as historic swings continue to impact the world's most important bond market.

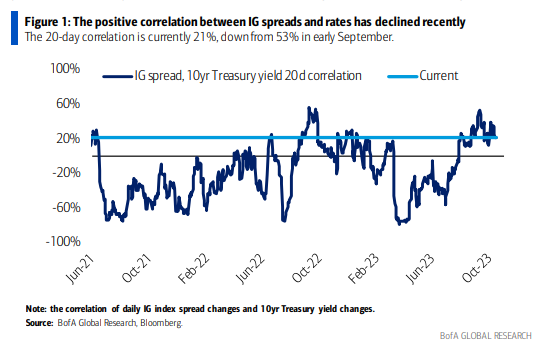

BofA analysis shows that the correlation between rates and stocks has decreased from 85% in early August to 24% in October, while the 20-day positive correlation between US investment-grade spreads and the 10-year Treasury yield has dropped from 53% in early September to 21% in October.

"It's a balancing act," Seliger said in a phone interview. "And it looks like the balance has shifted slightly towards a less negative correlation." He noted that the decreased correlation between stocks and treasuries suggests that risk assets are gradually withstanding the pressure from bond market sell-offs.

Data from Morgan Stanley Asset Management shows that even with money market funds currently yielding above 5%, a 60/40 portfolio will significantly outperform cash and achieve an annualized return rate of more than 4.1% over the next decade. Specifically, $100 of cash in a 60/40 model portfolio will grow to $197 over the span, while the same amount of cash will only be worth $133 after 10 years.

However, it is still too early to tell if the trend identified by Bank of America will continue.The broader turmoil in the US Treasury market may further trigger a simultaneous sell-off of stocks and bonds, prompting investors to seek safer assets.

"The recent easing of the stock market's reaction to the sell-off of US Treasuries is a good sign, but if the sell-off of US Treasuries accelerates, the situation could change and there is still a lot of uncertainty regarding the direction of Treasury yields."

Source: Bank of America, Bloomberg

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment