Can Surging AI Chip Stocks Stay Red-Hot This Year?

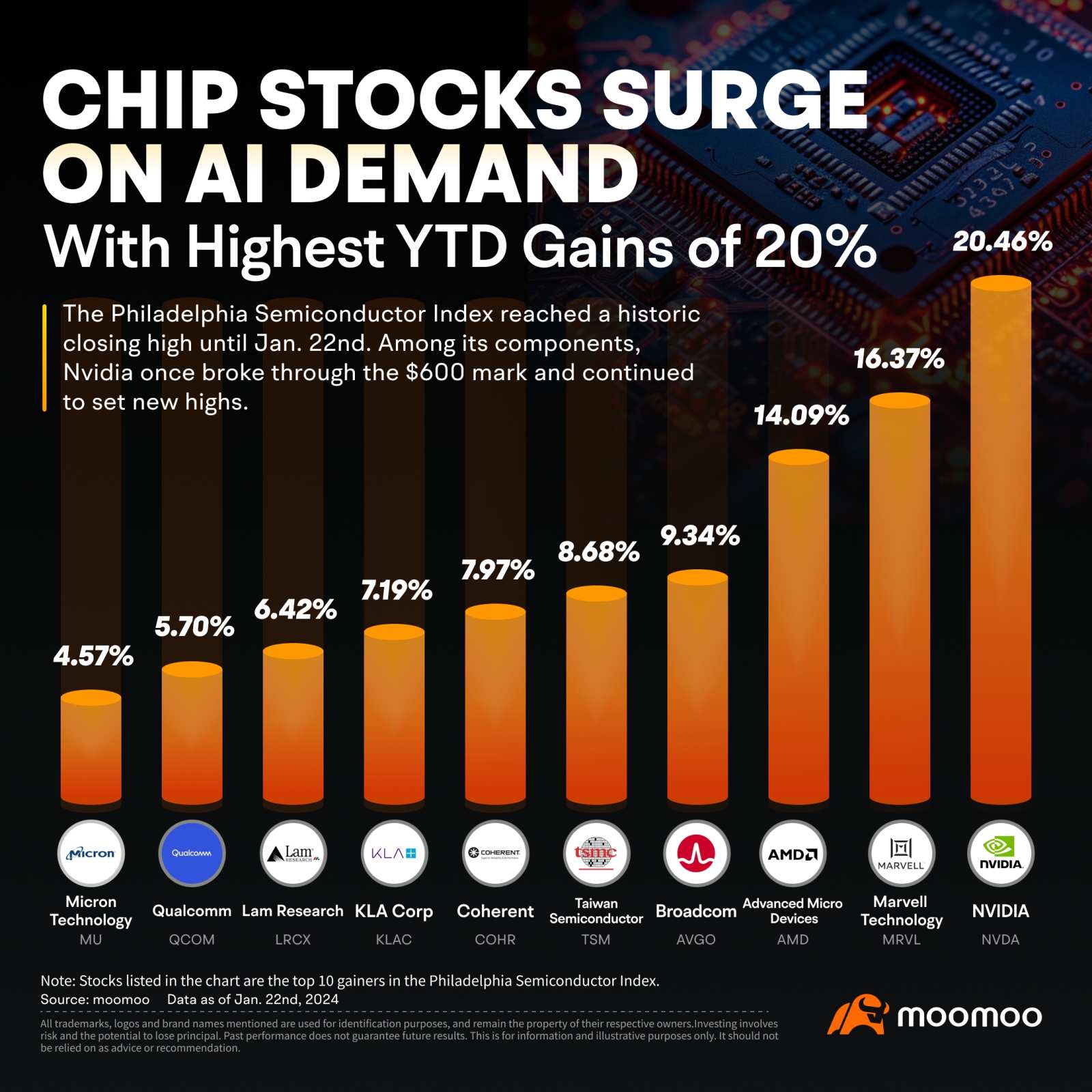

U.S. chip stocks rose sharply in 2024, with the $S&P 500 Index(.SPX.US$ approaching record highs as AI optimism drove gains in $NVIDIA(NVDA.US$ and other chipmakers. Semiconductor stocks rose following the first major earnings report of the season from $Taiwan Semiconductor(TSM.US$. The industry is closely monitoring chip demand, and TSMC forecasts a 20% increase in revenue for the year. Heavyweight chipmaker Nvidia has continued to set new highs since 2024, and has become the top gainer among chipmaker stocks.

Throughout 2023, the demand for next-generation GPUs and CPUs skyrocketed as companies sought to power their new AI applications, making AI chip stocks among the best ways to invest in the emerging AI megatrend.

AI has caused this industry to have a 'rip your face off' rally, and I don't think it's stopping anytime soon," said Jake Dollarhide, CEO of Longbow Asset Management.

Recently, Market.us provided a positive outlook on the semiconductor industry for the next 10 years, stating that the global semiconductor market is expected to experience significant growth. They believe that the year 2024, which marks the beginning of the industry's recovery, will see a market size of $673.1 billion.

What is more, the global Artificial Intelligence Chip market is expected to grow at a CAGR of 38.16% through 2032, with the market size increasing from USD 14.68 billion to USD 372.01 billion in 10 years. The growth is driven by the increasing demand for AI applications, particularly in the healthcare and retail sectors, and the emergent need for quantum computing to handle extensive datasets related to operational failures for enhancing operational efficiency.

However, in a client note, Northland Capital Markets analyst Gus Richard downgraded $Advanced Micro Devices(AMD.US$ stock from outperform or buy to market perform, or neutral. He noted that investors were overestimating AMD's AI chip sales. According to Richard's analysis, if AMD's sales of AI chips were to reach $16 billion in 2027, doubling every year from $2 billion in 2024, the company would achieve a 13% market share. To stay competitive with Nvidia, AMD would need to continue investing heavily in research and development. Richard predicts that AMD's total revenue in 2027 would be $45 billion, a figure that is already accounted for in the current stock price.

The stock market is experiencing "irrational exuberance" over AI," Richard said.

Source: The Motley Fool, Investor's Business Daily, The Brainy Insights, CNBC

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment