BTC Deep Charts (Part 5 + Imbalance Lesson)

Good morning everyone! I hope you are all well and have been enjoying your week in markets so far. I apologize for the lack of posts since the For Followers Give Back and Moo Contributor announcement. I am finishing up tax work, and have been busy with meetings, ect. I got some free time this morning so let's take a look at the charts.

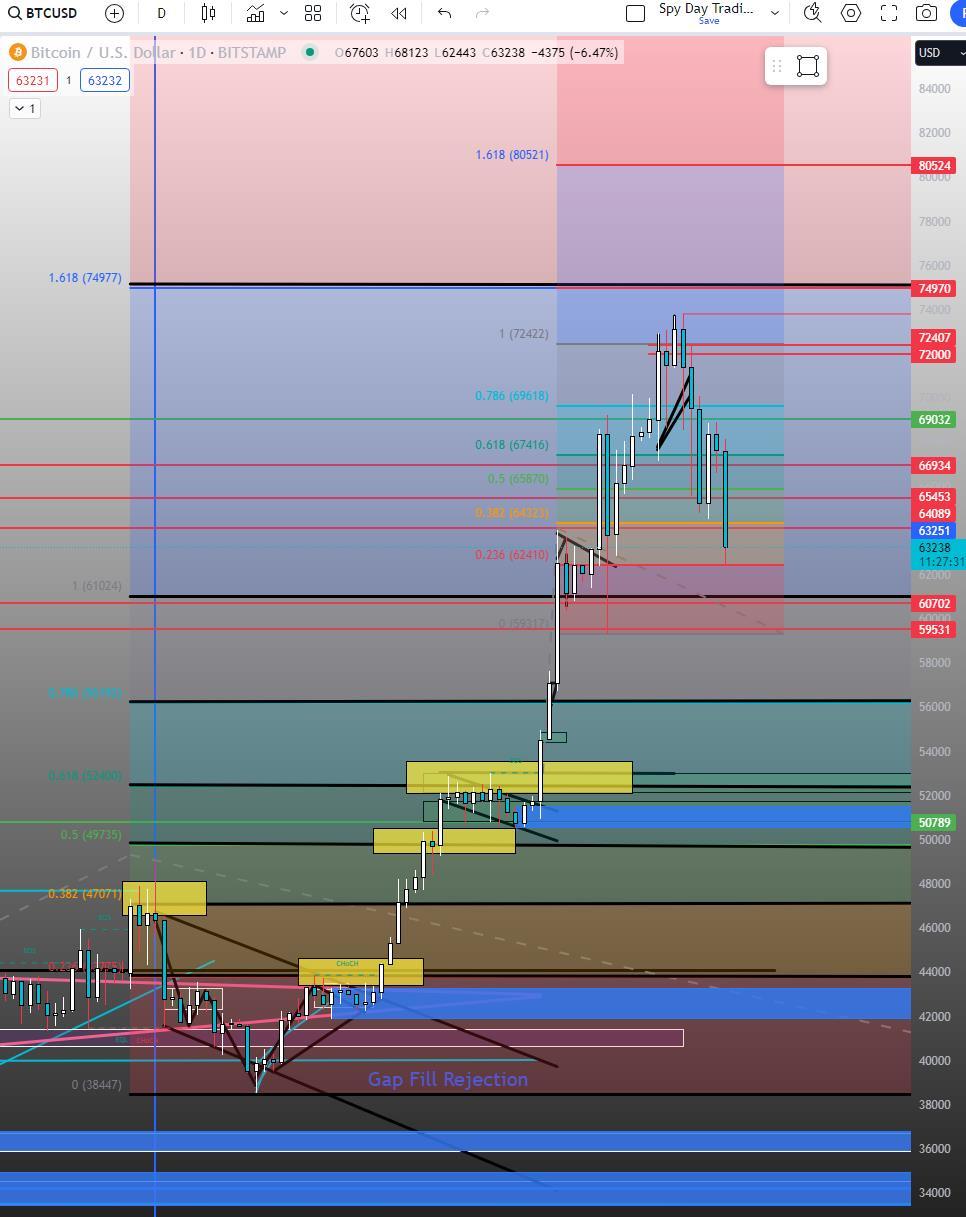

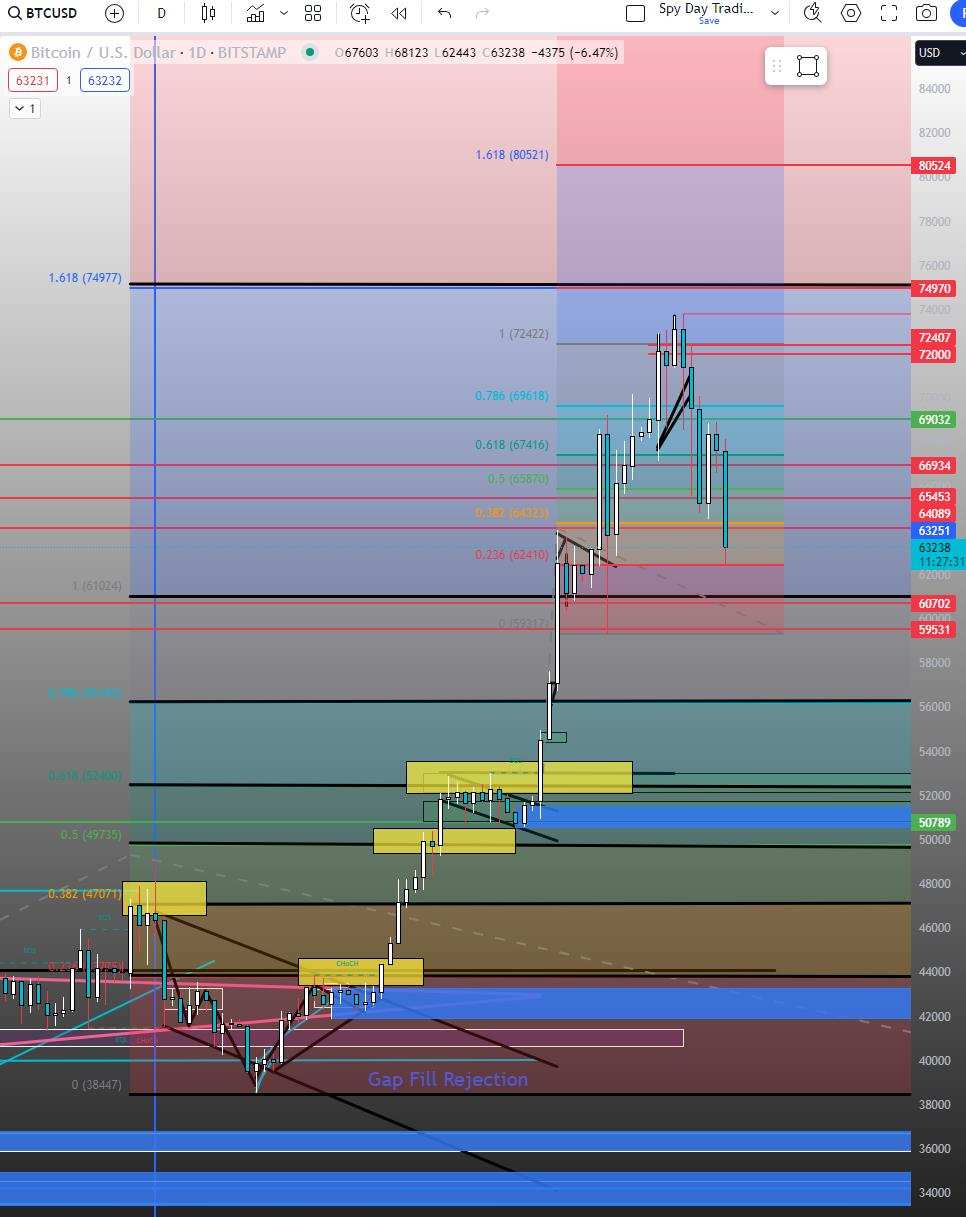

Yeah, we gotta look at the charts for sureeee. We saw the rising wedge a while back, but this is a much larger move. However, it is still in-lign with the Fibonacci levels!

I am going to make two sections of charts today. The levels are really helpful for levels, but not so helpful when looking at the chart. Just look at how messy it is! I'll do a section with the Fibonacci levels and without them in this article.

Bitcoin Weekly (With Fibonacci)

Immediately from the charts I notice a couple of bullish setups, and a couple bearish setups.

Bullish:

1. Possible Bull Flag forming on the weekly

2. Rejection off the Daily Fibonacci level of $62,450 to the upside finding support

3. Have not closed below the previous bullish candle. Showing buyer strength is still there for now

Bearish:

1. Buyers are placing large orders at the lows of the rally

2. And then there is this candle

Although this may look like a Shooting Star (Bearish) candle, I think it's the setup which is more bearish.

3. Three Inside Down

This formation is extremely rare to occur on the weekly, but not one to ignore.

I think if the sellers want to see more downside they must first close below the previous upside candle, then reject off the level to more downside.

Bitcoin Daily (With Fibonacci)

Again, I don't see any buyers here at the level to support the price to the upside. The next Liquidity level on the Daily is around $50,100.

If we close below the area of support I highlighted in purple, then it might get very bearish quickly.

Eventhough we are still above the level, all I see here is a strong probability of a retest from the previous move up. In other words, a possible gap fill to the downside. However, most of you know I love to chart on the 4 hour for imbalances so let's take a look at where we are.

Bitcoin 4 Hour (With Fibonacci)

The 4 Hour tells me a lot more.

I mentioned in my Moo Contributor post that Bitcoin was getting some new sellers, and they came in huge at the $73,500, $69,500, and $68,500 levels.

This obviously means if buyers could not step in, the price would move lower. However, that Liquidity still remains, but Bitcoin would need a strong formation or rejection off of a key level for more upside.

For example, in the puple box I highlighted from the Daily, I showed you an area where Bitcoin would need to close above for more upside, or close below for a lot more downside. My guess was accurate as on the 4 hour there are some buyers at the $62,000 level.

I think if we get to that level there are a few things that may occur.

1. If buyers reject above it with volume, we may see a reversal to sell side Liquidity (low confidence)

2. If buyers cannot support the price and sellers take it below the buy side Liquidity that we see a much lower move down (medium confidence)

3. We move sideways for a a few candles on the 4 hour (high confidence)

The reason I think we will move sideways above all is because of how fragile the lower $60,000 levels are. That's where investors and traders will make up their mind of whether Bitcoin should, could, or maybe move back up or head straight down to $50,000.

My reasoning is supported by the next buying Liquidity zone at the $50,100 level.

If no other buying Liquidity appears, then I think we will move quicker than expected to the downside.

That would setup a buy side liquidity imbalance play for sellers, and a sell side liquidity setup for buyers.

Buy Side Liquidity and Sell Side Liquidity vs Buy Side Liquidity In Imbalances and Sell Side Liquidity In Imbalances Lesson (Advanced)

Now, for newer investors a Buy Side Liquidity setup is complex and not easy to understand. So let me try to break it down.

In summary, an imbalance can be caused by various factors. News, optimism or scepticism, but most of all liquidity and order volume. There are three / four possible buy side imbalances.

Remember how I always say where sell side liquidity and buy side liquidity is? Well inverse those.

-

Scrap what I said about sellers and buyers hitting the tape, as those are overall terms in markets where we see them entering and exiting on the day. In the case of imbalances we are talking about shorts buying and exiting.

-

So when I said there are sellers at $68,500, that is called buying imbalance because short "buyers" entered the market. And where there are buyers, those short "buyers" sell their position by "buying" back into the price. So with imbalances, it's all inverse.

What I mean by this is that at the $68,500 short buy side Liquidity entered, and at $62,000 there is short sell side liquidity.

Confusing I know, but this is how imbalances work.

To explain it all, we have three buying imbalances here

Those are true imbalances due to their immense buying volume and whiping out all of the shorts who exited the markets.

-

However, in the case of a buy side imbalance from the sellers perspective, those levels are where shorts want to target. So if they want to reach that price, (inversely speaking now), shorts would want to "buy" in here to move the price down. It's all about where longs and shorts enter interms of liquidty.

-

Keep in mind, all this is inversly correlated to when I say buyers are entering and sellers are entering.

-

Further break down:

1. Sellers enter the tape from the high or supply as they want to exit lower for profit.

2. Buyers enter the tape from the lows or demand as they want to exit higher for profit.

3. Buy side imbalances occur from the high to the lows where the price originally rallied.

4. Sell side imbalances occur from the lows to the highs where the price originally fell.

-

1. When I say "buyers entered", I am talking about areas of demand liquidity where they pushed the price back up

2. When I say "sellers entered", I am talking about areas of supply liquidity where they pushed the price back down.

-

1. When I say "buy side imbalance" I am talking about shorts buying into the market to push the price lower to demand or short "sell side liquidity" because shorts would want to exit that position in the form of taking profit.

2. When I say "sell side imbnalance" I am talking about longs buying into the market to push the price higher to demand or short "buy side liquidity" because longs would want to exit that position in the form of taking profit.

-

1. Buy side demand for "buyers entering the market" is from the lows or buy side liquidity.

2. Sell side demand for "sellers entering the market" is from the highs or sell side liquidity.

-

1. Buy side supply for "sellers entering the market" is from the highs or "short buying liquidity".

2. Sell side supply for "buyers entering the market" is from the lows or "long buying liquidity".

IN THE CASE OF IMBALANCES

1. Buy side demand for "sellers entering into the market" is from the highs to the lows or "short selling" side liquidity. Becuase they are selling the price to go lower.

2. Sell side demand for "sellers exiting into the market" is from the lows to the highs or "short buying" side liquidity. Because they are exiting their posititions as the price goes higher.

-

1. Buy side supply for "buyers (or longs) buying into the market" is from the lows to the highs or "long sell" side liquidity. Because longs are exiting their position as the price goes higher.

2. Sell side supply for "buyers (or longs) exiting the market" is from the highs to the lows or "long buy" side luqidity. Because longs are buying as the price moves lower.

VERY CONFUSING I KNOW LOL.

However, it all aligns in with the constant rule of Price -> Liquidity. Liquidity acts as a magnet, so if if there is a large demand at the lows, then sellers would want to buy back into markets to take profit at the liqudity, and buyers would want to enter new positions as the sellers exit their positions at the demand zone or on the way down.

Inversly, if there is a large demand at the lows, longs would want to exit their positions as the markets move down and sellers would want to buy from the long sellers into the market as the price moves lower.

Same goes for supply. If there is large supply liquidity to the upside, sellers would want to enter buy into a position as longs sell their position at the supply zone and sellers would want to enter new positions or exit their positions on the way up,

Inversly, if there is a large supply zone at the highs, sellers would want to sell their positions as the price moves up and buyers would want to buy from the sellers into the market as the price moves higher.

Fundementally, thats how the market works!

Whats my point?

To show you a possible 4 Hour imbalance play that might be in the works. From the buying imbalance where we went to the upside from $52,000 to $59,000, sellers might want to fill that "gap" in effeciency back to the downside known as a sellers buy side imbalance back to the lows.

Bitcoin 1 Hour

There is a possible bear flag forming on the one hour chart. No heavy sellers entering the market, all are riding their positions to the downside towards the sell side demand (where sellers exit / take profit and buyers try to re-enter). If we close below the liquidity to the downside, we may move much further to the downside.

Lots of heavy 5 minute sellers entered on the way down and at the levels which are now acting as resistance. Such as the $65,453 level and the $64,089 level where the price rejected from the upside back to the downside.

I will talk about the Weak Low indicator in a For Followers post as it is key for understanding where the price may be headed.

As I mentioned, I will post the charts without the Fibonacci levels.

Bitcoin Weekly

Bitcoin Daily

Bitcoin 4 Hour

Bitcoin 1 Hour

Bitcoin 5 Minute

Conclusion

It looks bearish here for now, with a bunch of sellers holding their positions and not a lot of buyers trying to enter. If we close below the previous candle upwards on the Weekly / Daily I expect much further downside, but I also anticipate some sideways action as investors make up their mind of where the price should be. Buyers will need to enter soon for more upside, but for now there is no clear reversal structure on Bitcoin that would signal a move to back to the higher highs.

I hope you all enjoy your week in the markets, and this is my first post as a Moo Contributor! I hope I was able to explain the differences in terminology when taking about inverse correlations to my terminology and the imbalance terminology used when trading liquidity imbalances. I apologize if I was not able to explain it in better detail, maybe that will be my next larger For Followers post.

Even if Bitcoin is looking bearish, I am very bullish on our 1000 followers goal! I appreciate you all and thank you for the support.

At the time of writing, Bitcoin is at $62,730

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

10baggerbamm : well that's terrific so at the end of the day it's like everything else it's a coin flip and all the charts due is try to justify when you're wrong.

Cui Nyonya Kueh :

AkLiOP 10baggerbamm: Bitcoin is especially difficult to chart, actually crypto itself is hard since the price is heavily controlled by sentiment. With no earnings report and no forecast, charting Bitcoin can say one thing one week and another the next week. So you're right, it is a coin flip haha