Bracing for a Repeat of the March 2020 Treasury Market Turmoil: Could This Time Be Worse?

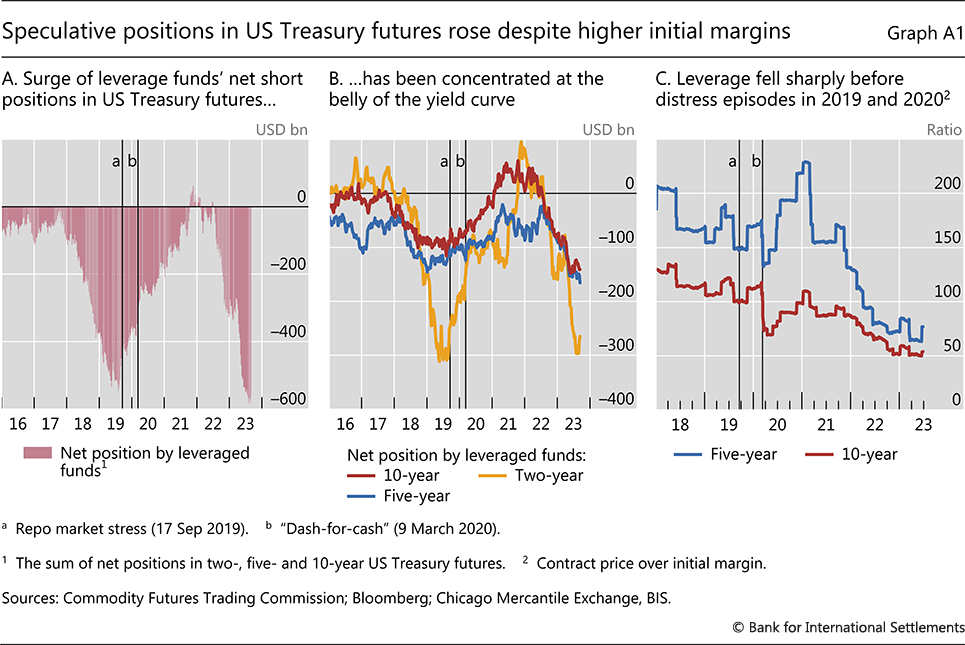

Recent research by the Bank for International Settlements (BIS) has prompted that “Speculative positions by leveraged investors in US Treasuries are back”. The study further warned that the current accumulation of leveraged short positions in US Treasury futures could pose a significant financial vulnerability due to its potential to trigger margin spirals, which in turn could cause "dislocation" in US Treasury market trading.

The trades that BIS is referring to are basis trades. This type of trading has been gaining increased attention from financial regulators, including the Federal Reserve and the Financial Stability Board. In fact, both institutions issued successive warnings in August and September about the growing trend of basis trading.

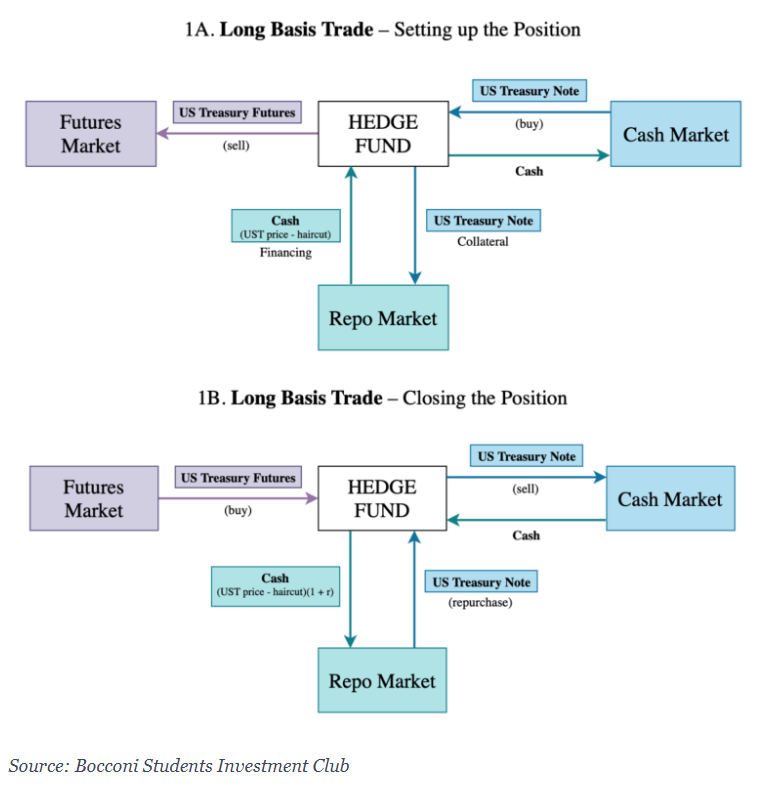

According to the FEDS Notes, cash-futures basis trade is an arbitrage strategy that involves:

1) a short Treasury futures position;

2) a long Treasury cash position;

3) borrowing via the repo market to finance trades and provide leverage.

This trade profits from pricing differences between futures and their underlying cash bonds (the futures and cash prices will ultimately converge as the futures contract nears expiration), and is typically associated with high leverage.

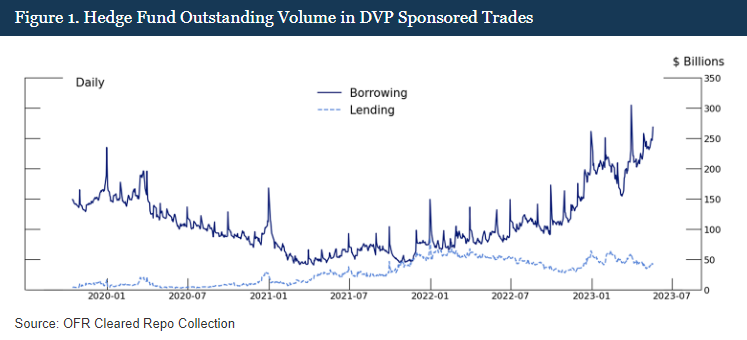

1. Sponsored repo borrowing by hedge funds, the important funding source for basis trading, has significantly increased, indicating potential growth in basis trading activities.

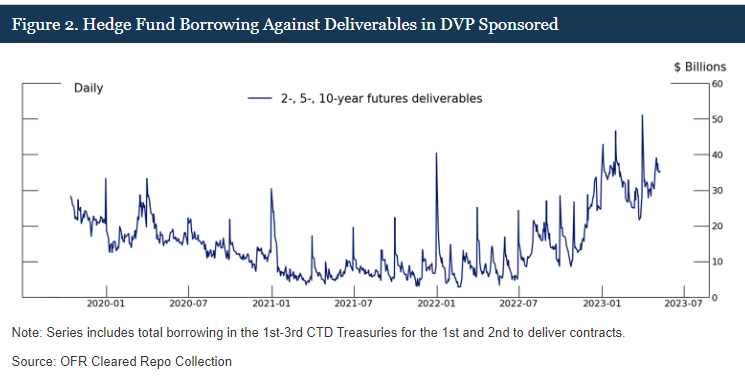

2. Since borrowing for basis trades typically focuses on Treasuries that are deliverable into Treasury futures,the recent uptick in sponsored repo borrowing against such deliverables - including 2-year, 5-year, and 10-year Treasury futures - implies a likely connection to short positions in futures and potential involvement in basis trading.

3. Substantial short positions have been taken in U.S. Treasury futures contracts and Hedge funds' futures and repo positions align with the upsurge in cash-futures basis trading. According to the BIS, leveraged funds have been accumulating net short positions in US Treasury futures, amounting to nearly $600 billion over recent months. More than 40% of these net shorts are concentrated in two-year contracts, putting the overall position close to its previous 2019 high.

The Federal Reserve warned in late August that the Basis Trade is "probably" back.

In March 2020, the global COVID-19 pandemic caused market panic and stress in the market for Treasury securities. A panicked rush for cash by companies, foreign central banks, and investment funds resulted in selling the most liquid assets available, which are typically Treasury securities. As of March 11, 2020, the Treasury markets experienced unprecedented disruptions, with bid-ask spreads widening, repo rates skyrocketing, and arbitrage spreads diverging.

As Treasury markets are essential to the global financial system, the Fed had to step in and expand their purchases of Treasury securities from dealers and offer unlimited repo facilities on Treasury collateral. On March 15, 2020, the Fed announced a significant cut in interest rates, reducing the target range for the federal funds rate to an unprecedentedly low level of 0-0.25 percent. Simultaneously, the Fed launched a new round of QE worth $700 billion. Research by the National Bureau of Economic Research indicates that in 2020Q1, the Fed purchased over $1 trillion worth of Treasuries.

Some economists believe that the prevalence of basis trading exacerbated the liquidity crisis in the Treasury market during March 2020. The rapid unwinding of basis trades by hedge funds may have further intensified the disruption in the Treasury market at the time.

1) Funds participating in basis trading suffered considerable losses due to volatility in the market, which led to widened cash-futures basis spreads;

2) Price volatility in the repo market affected refinancing and increased borrowing costs.

3) Margin requirements for Treasury futures were increased to an unprecedented level and this put more pressure on short futures positions held by hedge funds;

As a result, some hedge funds quickly closed out their basis trading positions and sold Treasuries in cash market, ultimately exacerbating the turmoil in the Treasury market at that time.

Given 1) the current downward trend in the size of U.S. debt held by major overseas buyers like Japan, 2) the Fed's reduction of its balance sheet through quantitative tightening (QT), and 3) the heightened monetary policy and macroeconomic uncertainty, liquidity conditions in the U.S. Treasury market are likely even worse than the 2020 liquidity crisis.

As a result, the rapid leveraging and accumulation of large short positions by hedge funds further increased the vulnerability of the U.S. Treasury market. Rising repo financing costs and market volatility could disrupt trading, leading to margin calls and forced sell-offs. This would increase volatility in the Treasury market while amplifying disruptions in the Treasury, futures, and repo markets.

Source: BSIC, BIS, NBER, Office of Financial Research, Federal Reserve, Financial Times

By Moomoo News Irene

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

73404496 : y