Block (SQ2) to Report Q4 Earnings: What Should Investors Know?

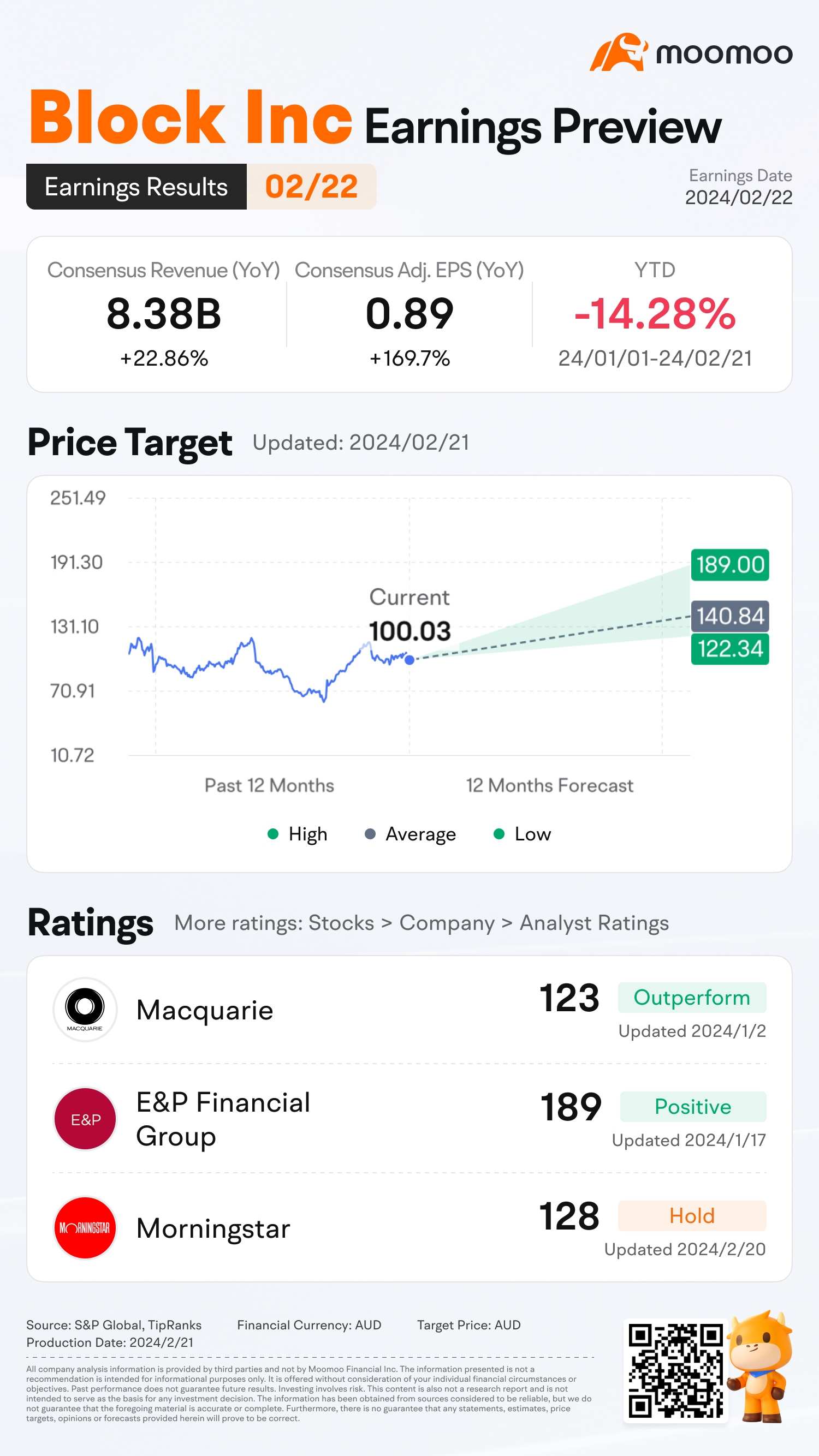

$Block(SQ.US$/ $Block Inc(SQ2.AU$ is set to report earnings for its fourth quarter on Feb. 22 after the US market close. Analysts on Wall Street project that Block will announce quarterly earnings of AU$0.89 per share in its forthcoming report, representing an increase of 170% year over year. Revenues are projected to reach AU$8.38 billion, increasing 23% from the same quarter last year.

For digital payment processor Block, the growth trajectory of Square's consumer Cash App is one issue. There's also cryptocurrency Bitcoin and the Afterpay acquisition. Also, Square faces growing competition on many fronts.

Here are key expectations to watch:

Key Things to Watch

• In the upcoming quarterly report, the company's expansive commerce ecosystem is believed to have attracted more sellers and helped retain existing ones, potentially boosting the seller base.

• Block's diverse product offerings are anticipated to have fueled revenue growth during the fourth quarter. The seamless integration of the company's product lines, aimed at improving user experience, is also expected to have supported the expansion of the seller base. Block's omnichannel solutions, designed to provide sellers with unique customer experiences by streamlining order management across sales channels, are likely to have strengthened the seller community further.

• Increased user engagement with the Cash App within the Square ecosystem is projected to have positively impacted revenue. These factors, along with strong gross payment volume—a critical indicator of growth for the company — are expected to have accelerated in the reviewed quarter.

Furthermore, SQ's growing footprint in the "buy now, pay later" sector, driven by the robust performance of Afterpay solutions, is also expected to have made a significant contribution.

• Block has been focused on developing an infrastructure that facilitates bitcoin transactions on its merchant platform. Moreover, Square has established a new division dedicated to assisting developers in creating Bitcoin-centric financial services products.

In January, Square announced that its Bitcoin digital wallet had become accessible to Cash App users across 95 countries.

Risk & Uncertainty

• Rising expenses in advertising, product development, and staffing are expected to have put pressure on the company's profit margins during the fourth quarter.

• A downturn in consumer spending within the food and beverage sector, as well as in discretionary retail categories, is likely to have posed further challenges.

• In the event a U.S. recession eventually hits, one question is how resistant Square will be to a business downturn. The relatively low income levels of Square's customer base is one factor for investors to consider if the U.S. economy weakens, analysts say.

• With multiple products, SQ stock faces stiff competition in both consumer financial apps and the small business market. Rivals include $PayPal(PYPL.US$, First Data's (FDC) Clover unit, $Shopify(SHOP.US$, merchant acquirers, and well-funded startup Stripe.

Source: The Motley Fool, Nasdaq, TipRanks, Investor's Business Daily

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment