Bitcoin Price Hits Record High: What's Next?

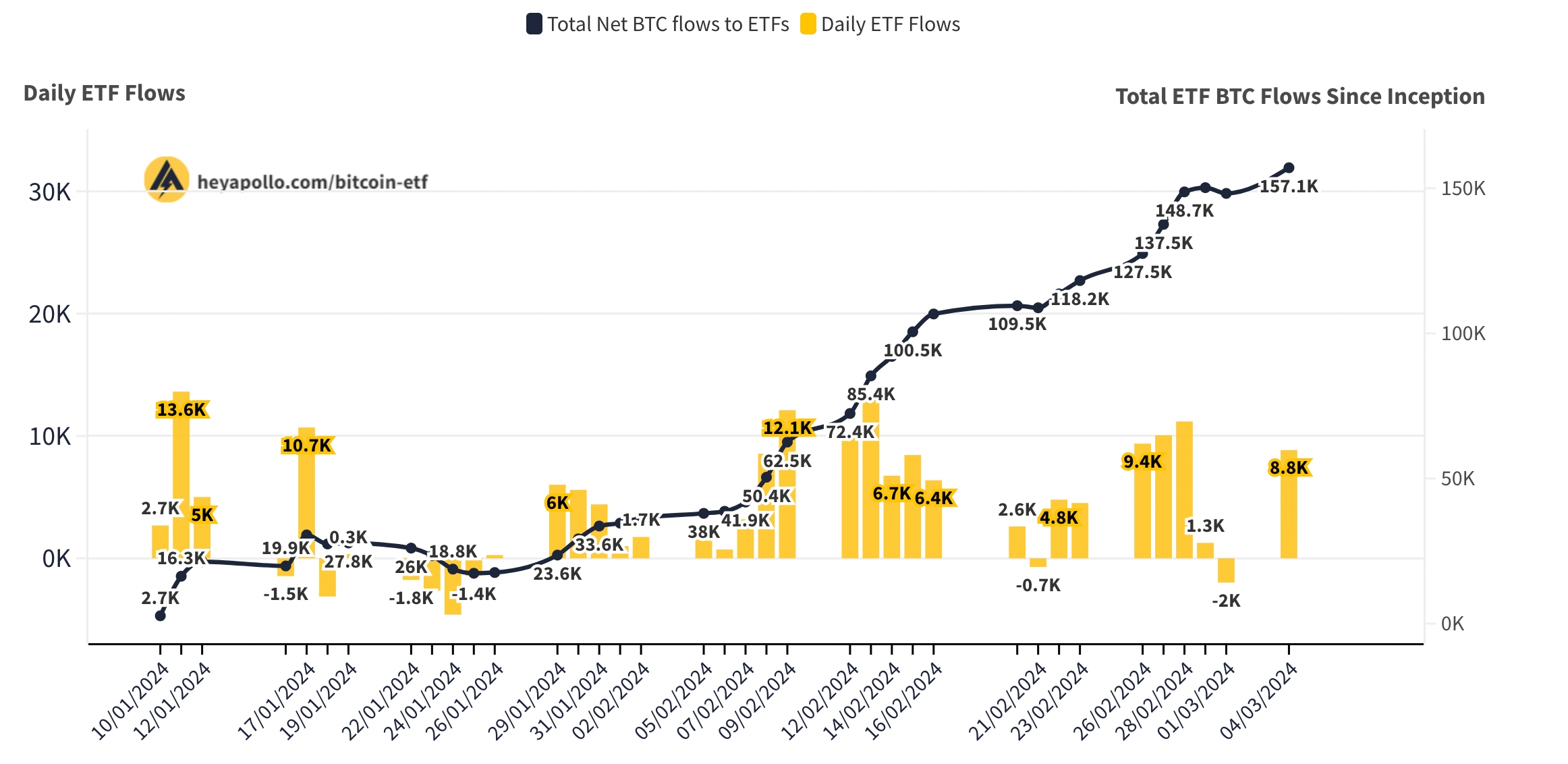

On Tuesday, Bitcoin reached a new all-time high, driven by investment inflows into U.S. spot exchange-traded crypto funds and expectations of a potential decrease in global interest rates. The leading cryptocurrency soared to $69,210, surpassing its previous record set in November 2021, which was $69,000. Investor enthusiasm has surged following the late January approval of 11 spot bitcoin ETFs by the Securities and Exchange Commission. However, it subsequently experienced a reversal, with its value recently declining by approximately 4% to $67,417.

The bitcoin all-time high marks a turning point for crypto," said Nathan McCauley, CEO and co-founder of crypto platform Anchorage Digital. "Traditional institutions were once sitting out; today, they are here in full force as the principal drivers of the crypto bull market."

Why BTC Keeps Surging

• Long-term Money

In recent months, the surge in bitcoin's value has been significantly accelerated by the decision of U.S. regulators to greenlight exchange-traded funds linked to the cryptocurrency. This approval has provided a gateway for more conventional investors to integrate bitcoin into their investment portfolios.

Some experts believe that the recent explosive surge in the cryptocurrency's value could have greater endurance than the rally in 2021. This optimism is based on the belief that an increasing number of institutional investors are allocating long-term funds to the digital token, which may enable it to maintain its elevated prices more effectively this time around.

• Halving Event

Experts indicate that bitcoin's value also saw a boost in anticipation of the upcoming halving event in April, an occurrence that happens every four years and reduces the pace at which new tokens are generated by 50%, as well as the rewards distributed to miners. The total supply of bitcoin is capped at 21 million, and to date, 19 million bitcoins have been mined. As bitcoin approaches scarcity, the value is expected to rise.

• Global Rates Cut

Bitcoin, as well as the broader cryptocurrency market, has gained momentum from the expanded interest among a diverse range of investors. Furthermore, the possibility of the Federal Reserve reducing U.S. interest rates has contributed to this uptrend, as such a move typically encourages investors to shift their funds into assets that offer higher yields or exhibit greater volatility.

One part of BTC's rally has to do with the generally positive sentiment on risk in general," said Alvin Tan, head of Asia FX strategy at RBC Capital Markets. "You can see that in the all-time high in the S&P 500 and Nasdaq."

Will the BTC Rally Continue

• The timing of bitcoin's new record is noteworthy, co-founder of crypto lender Nexo Capital Antoni Trenchev said, because the asset usually hits a new high after the halving. But the ETF bump accelerated the rally.

This could mean we are facing an earlier, sharper and shorter bull cycle — followed by a painful and drawn-out bust," he said.

• "The excitement and hype around the ETFs has ended up being far beyond anyone's expectations," said Jad Comair, founder of digital asset investor Melanion Capital. Spot bitcoin ETFs give investors the ability to gain direct exposure to the cryptocurrency without the risks associated with largely unregulated crypto exchanges.

It's not just a spectacular jump in price, it's also a paradigm shift for bitcoin. Today, investors that allocate for bitcoin will be five or 10 times more confident than they would have been just a couple of years ago."

• JPMorgan analyst Nikolaos Panigirtzoglou said: "The current backdrop looks similar to the exuberant backdrop of 2021 when retail investors were driving both a crypto and equity market rally simultaneously on momentum."

Panigirtzoglou cautioned there was a "high risk of profit-taking" ahead of next month's bitcoin halving event.

• The momentum has to ease at some point, says Neil Wilson, the chief analyst at brokerage firm Finalto. Wilson says "parabolic" market moves – where prices shoot up dramatically – are "never sustainable in themselves".

It will run out of steam. But that doesn't mean it can't go higher, just that some kind of consolidation or correction seems likely in the interim," he says, citing "standard" factors such as investors cashing in their profits and the supply of new buyers drying up.

Source: TheGuardian, Financial Times, CNN Business, REUTERS

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment