Bank's Unrealized Loss, the Closely Watched Indicator After the Silicon Valley Bank Collapse, Spikes Again

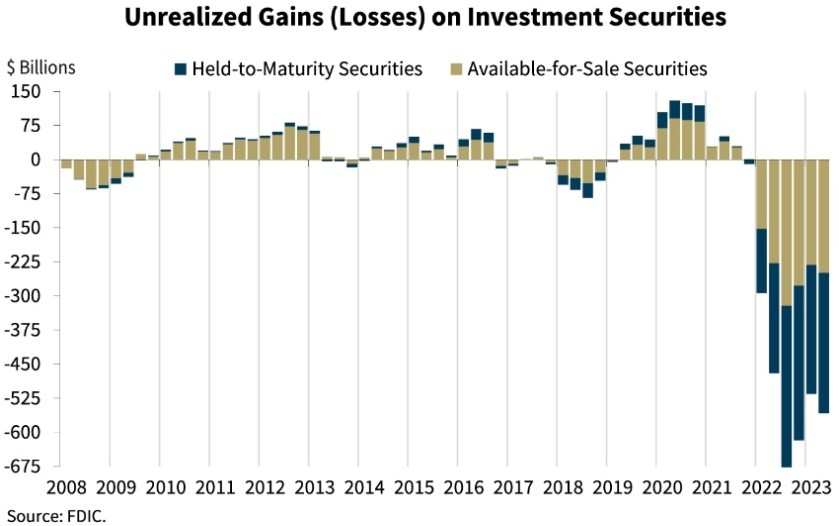

After the Federal Reserve's emergency bailout, the market seems to have forgotten the impact of the collapse of Silicon Valley banks. The banking industry risk indicators for the second quarter released by the FDIC last week did not seem to arouse market vigilance. Data showed banking conditions worsened again amid rising interest rates. The accumulated unrealized losses in the 2nd quarter rose again, reaching $558.4 billion, an increase of 8.3% MoM.

■ What are Unrealized Losses?

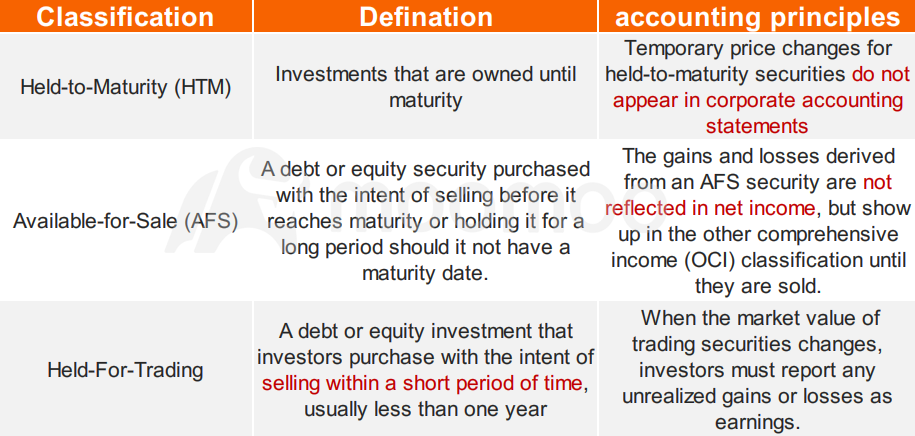

An unrealized loss stems from a decline in value on a transaction that has not yet been completed. The entity or investor would not incur the loss unless they chose to close the deal.

After the value of those bonds plunged when rates went up, the banks plowed more money into bonds using accounting methods called “Available for Sale” and “Hold to Maturity.” For these securities, changes in the value of the bonds would affect their balance sheets but not their income statements.

■ Other indicators also showed the deterioration of banking industry operating conditions.

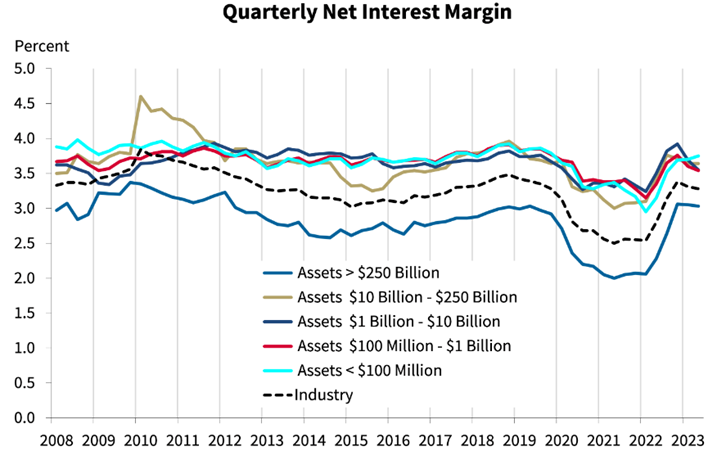

The industry's net interest margin declined for the second consecutive quarter. It declined three basis points from last quarter to 3.28 percent. It reflects that funding costs, particularly the cost of non-deposit liabilities, rose at a faster rate than yields on earning assets over the quarter.

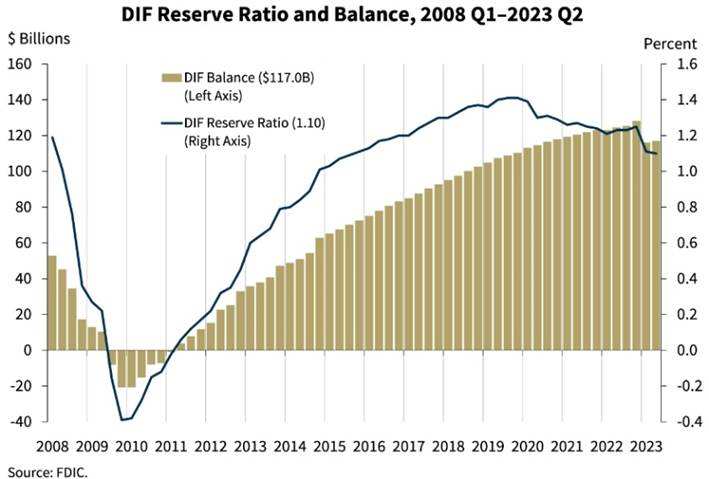

The FDIC's deposit insurance fund, DIF, has been depleted due to massive payouts following the collapse of Silicon Valley Bank and other banks, and the fund has not yet recovered.

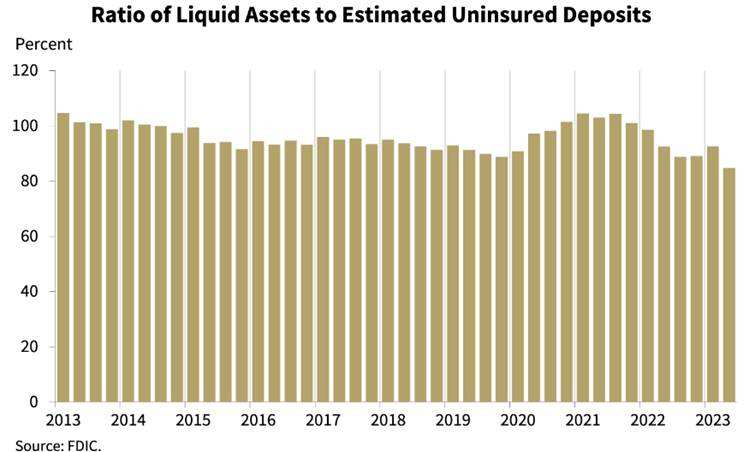

The chart below shows liquid assets as a ratio of estimated uninsured deposits. This ratio increased significantly during the pandemic as bank deposits and liquid assets swelled, but has since declined back to more historical levels. The second quarter liquid-assets-to-uninsured-deposits ratio declined to 84.7 percent, below the pre-pandemic average.

■ What are the implications?

An earlier study by the Kansas Fed shows how unrealized losses affect the banks and the economy.

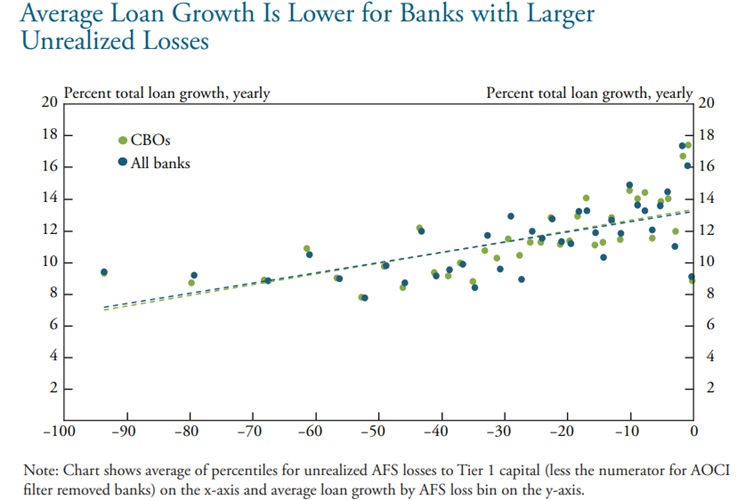

Firstly, across all banks, the share of unrealized losses is correlated with slower loan growth, suggesting that banks with fewer unrealized losses expanded loan growth more than their peers with more unrealized losses.

Besides, unrealized losses reduce a bank's total value and may negatively influence capital and other financial ratios.

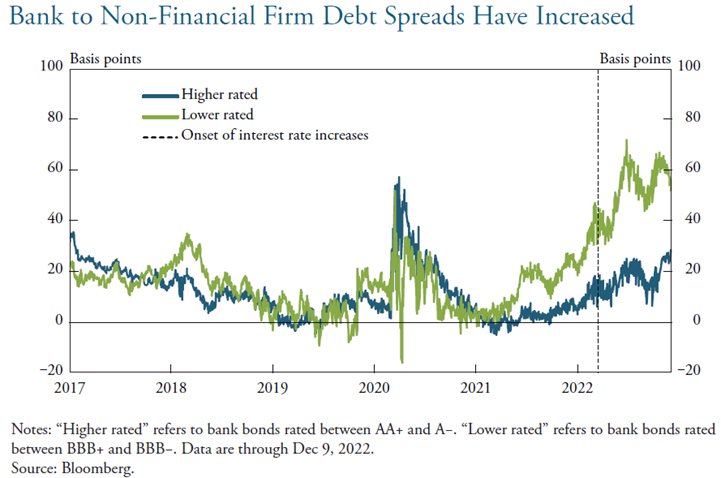

Lower securities valuations provide less collateral at market value for banks to use when raising secured funding, possibly enhancing liquidity strains. Debt investors will require a higher return to offset increased insolvency risk, thereby increasing interest rates on bank debt. The chart below shows both higher-rated (blue line) and lower-rated (green line) investment-grade banks have seen their debt funding costs rise relative to the cost of funding at similarly rated non-financial firms.

At last, as unrealized losses increase, lending constraints can tighten, reducing economic growth—and potentially motivating monetary policymakers to adjust their policy stance. Bank regulators, on the other hand, may face growing concerns about bank risk as interest rates rise.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

D Blaine : Summary: Tight money from banks will probably lead to slowing economy.

一株冲天 : let it burn

Ohshimi :

lost control again

lost control again

102326563 : Such a balance take from moomoo. Unlike racist americunt journalist & YouTuber, it’s forever China collapsing since 1998