BAC earning preview: Robust Non-Interest Income Expected to Offset Decline in Net Interest Income, Projecting Steady Overall Growth

Introduction

Following last Friday's JPMorgan Chase, Wells Fargo, Citigroup and other large banks have successively announced the first quarter of 2024 financial reports, this Tuesday, that is, before the US stock market on April 16 Eastern time, US Bank (BAC.US) will also release its first quarter financial report.

According to Bloomberg's consensus expectations, it is expected that Bank of America's net interest income will decrease in the first quarter, but the decrease in net interest income will be offset by an increase in other business income. The asset size is expected to be relatively good, and it is expected that in the first quarter:

1. Revenue 25.60 billion USD, down 2.96% YoY, up 15.8% QoQ;

2. Net Profit was $6.60 billion, down 19% YoY and up 110% QoQ;

3. Diluted adjusted earnings per share were $0.77, down 18.4% YoY and up 9.5% QoQ.

Overall, all indicators of US Bank have improved compared to the previous quarter. The following is a specific analysis of each factor.

Outstanding fee income may make up for the decline in net interest income

As mentioned above, Wall Street's overall expectation for Bank of America's revenue is optimistic, and it is expected to increase slightly on the basis of $22.10 billion in the previous quarter. As one of the largest banks and financial holding companies in the US, US Bank mainly engages in banking and other financial services. Its main business is mainly consumer banking, global banking, global wealth and investment management, and global markets.

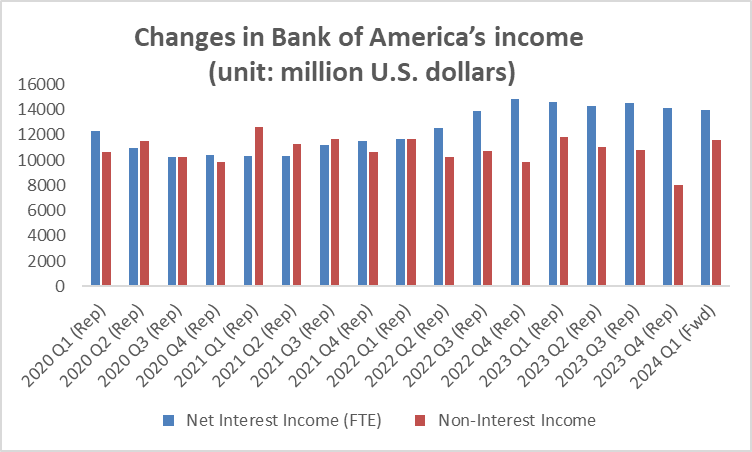

Net interest income (NII) is expected to be approximately $13.80 billion, down 4.33% YoY and 1% QoQ, while non-interest income is expected to be approximately $16.66 billion, up 2.59% YoY and down 6% QoQ. That is, the decrease in net interest income will be offset by an increase in other business income.

Generally speaking, the net interest income of a bank equals total interest income minus total interest expenses, which is one of the main sources of revenue for a bank, including interest from loans, bond investments, etc. The net interest yield can reflect the bank's cost of funds and lending efficiency. In terms of specific business, Bank of America's interest income mainly comes from deposit and loan business, fund market operations, etc.

Its influencing factors include macroeconomic environment, Monetary Policy, and asset-liability structure. In terms of macroeconomics, residents' consumption, investment and other behaviors will affect banks' interest income; Monetary Policy directly affects banks' deposit and loan interest rates; In terms of asset-liability structure, it is mainly necessary to examine the scale of interest-bearing assets (loan and investment assets) and net interest margin of banks. The reasons for the expected decline in net interest income of Bank of America also come from these aspects:

1. Since the beginning of 2024, persistent inflation and high interest rates have put tremendous pressure on consumer spending. The demand for loans in the market remains weak, still below the level before the COVID-19 pandemic. Savers are cautious in choosing high-yield products, resulting in slow growth in total interest income.

2. On the other hand, compared with the past, the financing cost of banks has gradually increased with the rise of the base rate, and the total interest expense has also been increasing; eventually, it will lead to the narrowing of the net interest margin of US banks and the decrease of net interest income.

It is worth mentioning that the dovish interest rate cut strategy of the Federal Reserve in March this year will maintain the current interest rate in the short term, but a rate cut within the year may become inevitable. On the one hand, if the Federal Reserve starts to cut interest rates, the market's mergers and acquisitions and underwriting activities will become more active, which will benefit the corporate and investment banking businesses of large banks. On the other hand, a rate cut may cause a decrease in the net interest income of bank stocks, which is the main income of banks. Therefore, a rate cut by the Federal Reserve is both an opportunity and a risk for bank stocks.

Chart: U.S. Benchmark Interest Rate and Real GDP Growth(black)

According to Bloomberg's consensus expectations, Bank of America's total interest income in the first quarter was about $35.28 billion, a year-on-year increase of 23%, while the total interest expense was about $21.37 billion, a year-on-year increase of 50.4%. This has been reflected in the Q1 financial reports of three other major banks: JPM, Wells Fargo, and Citigroup, whose Q1 NII decreased by 4%, 4%, and 2% respectively.

Compared to net interest income, Wall Street still has expectations for Bank of America's non-interest income. Bank of America's non-interest income mainly includes credit card income, service fees, investment and brokerage fees, total investment banking fees, and transaction income, among which fee income accounts for the vast majority.

It is expected that Bank of America's fee income will increase in the first quarter, with the largest increase in investment banking fees. According to Bloomberg's consensus expectation, it is expected that the total fee income of Bank of America's investment banking in Q1 2024 will be $1.30 billion, an increase of 14% year-on-year. Among them, the debt publishing income is expected to be $750 million, an increase of 17% year-on-year, and the equity stake publishing income is expected to be $200 million, an increase of 45% year-on-year. This is mainly related to the gradual activity of the US market in 2024, the increase in Listed Companies, the increase in investment banking business, and the seasonal increase in trading

Overall, Wall Street expects Bank of America's total revenue to continue to increase.

Seasonal costs are high, and expenses are expected to increase slightly

According to Bloomberg data, Bank of America's expenses are expected to be about $16.65 billion in the first quarter of 2024, an increase of $4-500 million compared to the previous quarter, mainly due to payroll taxes, increased costs of various transactions, and the company's digital transformation initiatives. Companies usually need to pay higher salaries and benefits in the first quarter, and it is expected that the quarterly expenses in 2024 will peak in the first quarter and decrease throughout the year.

Due to the increase in fees, it is expected that the net profit of Bank of America in the first quarter of 2024 will decrease slightly year-on-year, but it is still rising quarter-on-quarter, mainly due to the extremely low base in the previous quarter: Bank of America's 4Q23 net profit fell sharply by 56% to $3.14 billion, mainly due to the special assessment of $2.10 billion from the Federal Deposit Insurance Corporation (FDIC) and the $1.60 billion fee brought by the collective withdrawal of the financial industry from the London Interbank Offered Rate. The impact of this special situation has been basically resolved by the end of 2023.

The asset structure is stable, and small-scale repurchases are planned

For non-performing assets, it is expected that US banks' non-performing assets will be about $5.67 billion in the first quarter of 2024, an increase of 44% year-on-year, slightly higher than the previous quarter 5.48 billion dollars, mainly due to the growth of credit card business and the pressure of commercial real estate. Bloomberg expects its reserve/loan ratio to remain stable at 1.27% in the previous quarter.

According to the changes in the capital rules of BCE (Basel III), the regulatory capital requirement (RWA) of BAC is expected to increase by 20%. This means that Bank of America needs to hold more capital to meet the new regulatory requirements, and its largest increase in capital requirements will occur in operational risks and exposure risks of non-public trading equity stakes.

In terms of shareowner returns, Bloomberg unanimously expects a total return of about $1 billion in the first quarter of 2024, with a dividend per share expected to be $0.24, and Bank of America's target dividend yield is about 30%. At the same time, US Bank plans to continue repurchasing shares in the first quarter, with a repurchase amount similar to the previous quarter, expected to be about $800 million.

In terms of stock market performance, from the beginning of 2024 to the present four months, the stock price of Bank of America has increased by about 4%, lagging behind the 8% increase of the S & P 500 index. As of April 12th, the closing price was $35.79. Given the general performance of the stock prices of the other three major banks after their financial reports were released last week, Wall Street has already believed that the benefits of high interest rates for banks are weakening. The net interest income growth of major banks has not met expectations, and the increase in financing costs caused by high interest rates may exceed the increase in interest income. Banks will face more pressure to pay depositors. Furthermore, some analysts are cautious about the stock price performance of major banks.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment