BlackRock Earnings Preview: Trillion-Dollar Asset Management Surges Steadily, ETFs Serve as a Robust Growth Engine

$Blackrock(BLK.US$ is scheduled to release its first-quarter earnings report before the market opens on Eastern Time, April 12, 2024. Considering that interest rates on bonds have been sustained at high levels due to rate hikes, coupled with the bullish performance of the US stock market, it is expected that BlackRock's ETF-related products and fixed-income business will demonstrate outstanding performance in the first quarter of 2024 (24Q1). As of April 10th, the company's share price stood at 803.90,with a total market capitalization of 119.588 billion.

BlackRock is a globally renowned comprehensive asset management company, established in 1988, headquartered in New York City, USA. By the end of 2021, BlackRock had grown to become one of the largest asset management companies in the world, distinguished by its exceptional investment management, risk management, and technology services. The firm's core businesses encompass providing investment management and advisory services to institutional and individual investors worldwide across a diverse range of asset classes, including equities, fixed income, alternative investments, cash management, real estate, and private equity, with particular renown for its index funds and ETF offerings. Moving forward, let us delve into how the company's specific operations will evolve in 24Q1 and identify key areas that investors should closely monitor.

Ⅰ Robust Revenue Forecasts and Anticipated Rise in Total Asset Management Scale

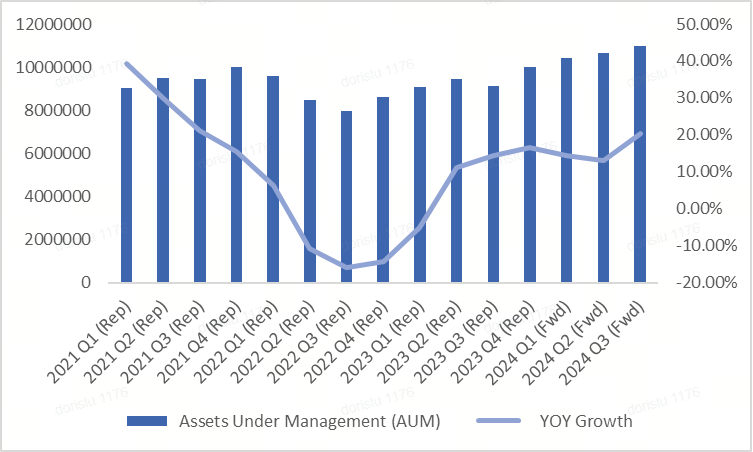

According to Bloomberg's consensus projections, during the first quarter of 2024, BlackRock is expected to achieve total revenues of USD 46.71 billion, representing a year-on-year increase of 10.09%, marking the fourth consecutive quarter of revenue growth. Concurrently, the Total Assets Under Management (AUM) for BlackRock are projected to reach USD 10.41 trillion, reflecting a 14.45% year-on-year rise, surpassing the milestone of USD 10 trillion in managed assets.

The solid AUM figure underscores BlackRock's robust financial footing. Based on Bloomberg's consensus expectations, BlackRock's long-term AUM in Q1 2024 is forecasted to grow by 6.01% YoY to USD 9.62 trillion. Among these, the esteemed iShares product suite is estimated to attain an AUM of USD 3.64 trillion, exhibiting an impressive 18.35% YoY surge. The ascending trend in AUM continuously bolsters BlackRock's steady business performance.

Chart: Total Asset Management Scale of BlackRock (in millions of USD)

II. Fixed Income Business Expected to Drive Growth, with ETF Products as Key Growth Engine

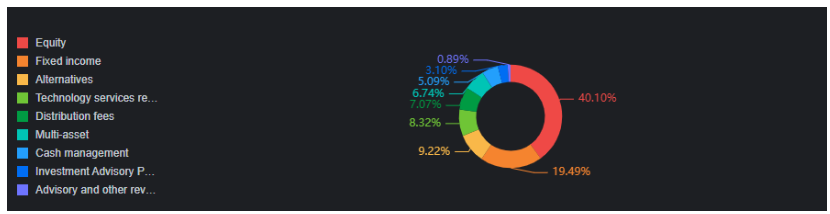

BlackRock's core business is composed of three major segments: Fundamental Investment Advisory Services, Performance-based Investment Advisory Services, and Distribution Fees. The Fundamental Investment Advisory Services segment encompasses various sub-businesses such as equity, fixed income, and cash management revenues, which constitute the largest proportion of the company's revenue and serve as the central driving force behind its revenue growth. It is crucial to pay close attention to the growth status of each mainstay business within this sector.

Chart: Breakdown of BlackRock's Core Business Revenue Contribution

In the Bloomberg consensus forecast for Q1 2024, BlackRock's revenue is expected to reach USD 46.71 billion, representing a year-on-year increase of 10.09%. According to Bloomberg's projections, the primary driver of BlackRock's overall performance growth is the robust expansion in its Fundamental Investment Advisory Services segment, particularly the year-on-year growth in both fixed income and equity businesses, which effectively mitigate the pressure on the company's overall results brought about by the anticipated decline in revenue from the Performance-based Investment Advisory Services segment.

Per the Bloomberg consensus estimates, BlackRock's Fundamental Investment Advisory Services revenue for Q1 2024 is anticipated to amount to USD 38.17 billion, reflecting an 8.99% year-on-year increase. Of this, the revenue from the fixed income business is forecasted at USD 9.18 billion, growing 8.11% YoY, while the revenue from the equity business is expected to reach USD 19.05 billion, climbing 8.56% YoY. Meanwhile, the projected revenue for the Performance-based Investment Advisory Services segment is USD 95 million, witnessing a significant year-on-year increase of 71.33% but a sequential decline of 69.64%.

Reasons for the variations in different business units are: (1) In the context of fixed income, amidst widespread interest rate hikes by central banks, including the Federal Reserve, aimed at curbing inflation and leading to soaring bond yields, fixed income funds have become increasingly attractive compared to previous years. BlackRock is committed to deepening its engagement in the fixed income business; thus, it is forecasted that the fixed income segment will experience growth in Q1 2024. Data suggests that due to the persistent rise in bond yields induced by substantial interest rate hikes, bond Exchange-Traded Funds (ETFs) attracted around USD 300 billion in net inflows during 2023, hitting an all-time high. Consequently, BlackRock expects its fixed income ETF revenue within this segment to reach USD 331 million in Q1 2024, indicating a 12.32% year-on-year growth and demonstrating strong profitability.

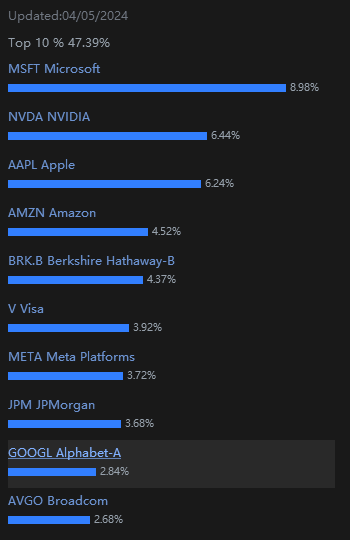

(2) In terms of equity, BlackRock is also using the strategic expansion of its ETF business to drive revenue growth. Bloomberg data highlights that BlackRock's Factor Rotation ETF product (DYNF) has shown remarkable performance in 2024. This product primarily targets technology and financial sector-related firms, and by March 31, 2024, a single ETF's assets under management had ballooned from less than USD 1 billion in the previous year to USD 7.339 billion. Since 2023, the DYNF ETF has consistently outperformed the S&P 500 by more than 12.67% and remains on a positive trajectory.

Table: Top Ten Holdings of BlackRock's Factor Rotation ETF Product (DYNF)

According to Bloomberg's forecast data, the expected revenue from equity business's ETF products is $1.2 billion, reflecting an 8.56% year-on-year increase. Moreover, there has been a 9.11% sequential increase in the revenue from the ETF business, which serves as a pivotal driving force behind the overall growth in the equity business revenue.

(3) Concerning the Performance-based Investment Advisory Services segment, the data reveals that the expected revenue is 9.5 million, experiencing a substantial year−on−year increase of 71.33%, declining by 73.69% on a quarter-to-quarter basis. Given that this part of the business contributes only 4% to the overall revenue mix, its impact on the company's overall performance is considered limited.

III. Expectations of Decreased Expenses and Improved Profitability

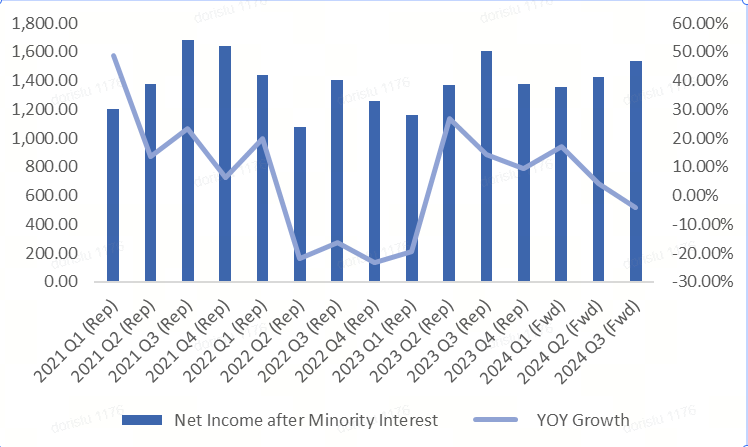

In terms of profitability, according to Bloomberg's consensus forecast, for Q1 of 2024, BlackRock's net income attributable to non-minority interests is expected to reach $1.354 billion, representing a year-on-year increase of 16.98%. Despite a slight decline in net profit margin from 29.69% in Q4 2023 to 28.85%, the overall profit situation appears quite favorable.

Table: Changes in BlackRock's Net Income (in millions of USD)

In terms of expenses, the company is persistently implementing cost optimization measures, including layoffs, which are expected to result in a decrease in BlackRock's operating expense ratio from 65.77% in the prior quarter to 64.26% in Q1 of 2024. When examining the expense ratios by business segment, due to the reduction in personnel costs from the layoffs, the employee compensation and benefits expense ratio for Q1 2024 is anticipated to decrease modestly from 32% to around 31%. Additionally, the management fee ratio is expected to decline from 13% to 11%. However, against this backdrop, the direct fund fees ratio, driven by higher expenses associated with fund investment activities, is projected to rise from 6% in Q4 2023 to 7%.

Overall, we expect that BlackRock's profitability will be in a phase of steady growth during the Q1 2024 period. Nonetheless, it's important to note for investors that despite the notable year-on-year increase in net profits, there is a marginal quarter-on-quarter dip in the net profit margin, mainly attributed to a forecasted decline in non-operating income. It is anticipated that the net profit margin will recover subsequently, not causing any persistent impact on the company's profitability.

IV. With the upcoming release of the company's financial results, what investment strategies can we adopt?

BlackRock, being an outstanding asset management company, has adeptly adjusted its product structure amidst high interest rates and a bullish US stock market, thereby seizing investment opportunities and achieving steady growth in its asset management scale. We anticipate a continuous positive development trend in the company's performance, along with steady growth in profits under effective cost control. We project double-digit growth in the company's EPS for 24Q1. Hence, we hold an optimistic view regarding the latest financial results, which may exceed market expectations.

Given the anticipated bullish trend in the stock price, how should options trading be approached?

Given our expectation that BlackRock's share price will likely rise after the release of the first quarter earnings report, exceeding Bloomberg's consensus estimates, we suggest investors consider purchasing call options related to BlackRock's stocks. If BlackRock's share price indeed rises post-earnings announcement as anticipated, the value of these call options will also increase correspondingly. Investors could then close their positions at a higher price to profit from the price difference.

For investors who already own BlackRock shares, adopting a covered call strategy might be suitable. This way, they can enjoy the gains from the stock's appreciation if the share price rises. However, if the stock price does not exceed the strike price before the option's expiration date, the sold call option would expire worthless. In such a scenario, investors not only retain the premium received from selling the option but also avoid potential losses from having to sell their shares.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment