Australian Earnings Season February 2024– Preview

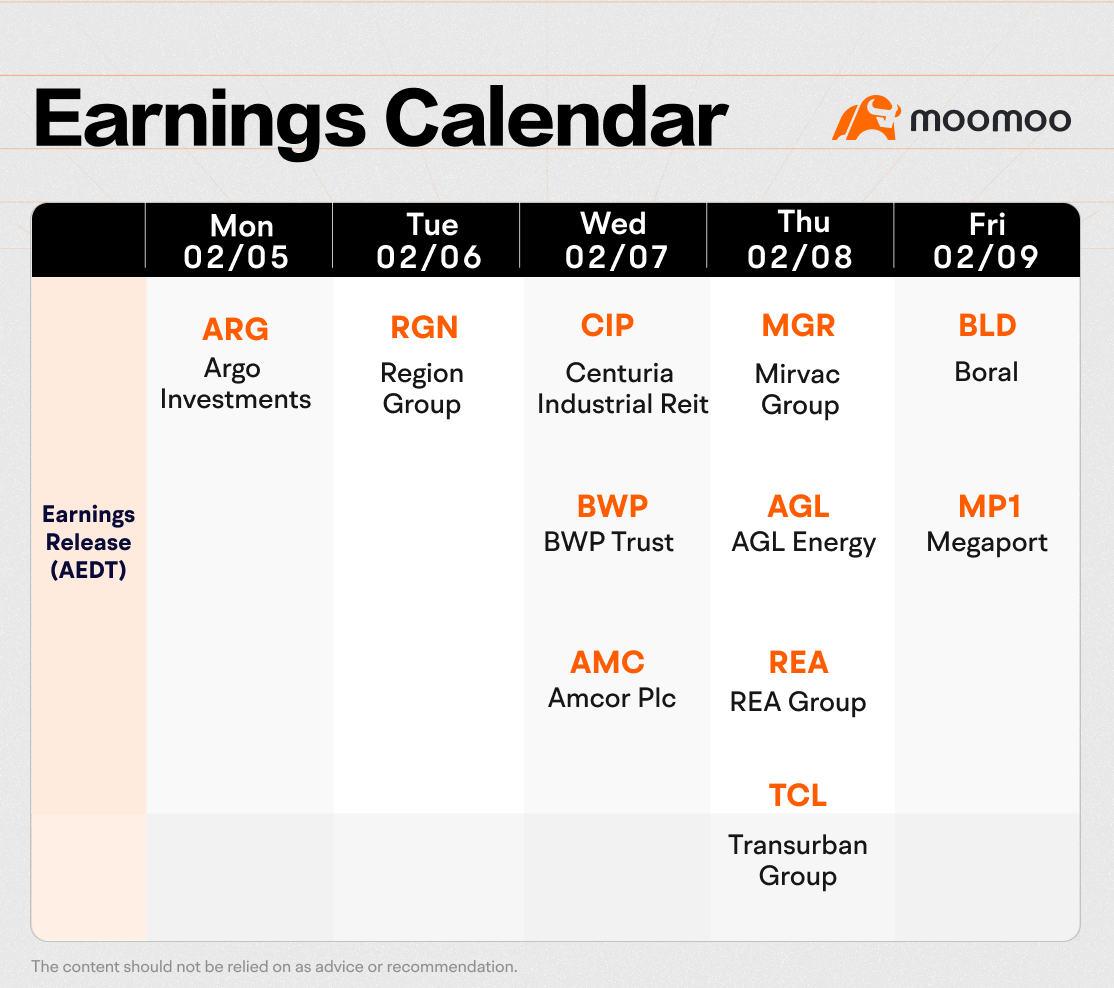

Australian half-year earnings season gets underway in the first week of February 2024.

Share prices have been on a tear in the second half of January but mostly it is has been on the back of positive news out of the US rather than investors getting in ahead of the results season.

From an economic viewpoint the second half of 2023 saw inflation continuing to fall and the unemployment number remain between 3.6% and 3.9% - historically low numbers. With consumers being crushed under the weight of rising mortgage rates and energy prices the burning question has been when will the music stop for consumer spending? We have seen Retail Trade data undergoing a structural shift – consumers are bringing forward their spending to the Black Friday November sales – and the Christmas sales data was essentially flat.

The good news overall is that Australian economy has proven to be very resilient. And Australian companies generally have managed to weather a difficult global environment. Cost structures that had risen sharply during the Covid years were beginning to moderate and these will start to show in results.

Share prices have recently moved to record highs so the question would be: Will earnings rise enough to justify record prices?

At the beginning of 2024 expectations would have been very modest in terms of earnings growth and it is in our view unlikely to jump enough overall to justify these high prices. So, will investors be happy with what analysts call ‘earnings expansion’? That is when investor enthusiasm results in them paying higher prices for each dollar’s worth of earnings.

In the meantime, here are some things to watch out for.

Economic activity in China at the end of 2023 was very subdued and mineral exports reflected that. Lithium prices were savaged in 2023 and investors that have held on will be looking for signs that the electrification theme is not over. Commodity prices have remained high despite many analysts having forecast much weaker iron ore and oil prices. Forecasts of oil below $US65 a barrel and Iron Ore below $US100 a tonne have been wide of the mark with Oil trading at $US77.60 and Iron Ore trading at $US135 a tonne at the end of January 2024.

Key reports will be BHP (20 Feb), Rio Tinto (21 Feb), Bluescope Steel (19 Feb), Fortescue, Pilbara Minerals, Northern Star Resources (22 Feb), Alumina (27 Feb).

Key bond rates have fallen sharply since October and the forecast ‘mortgage stress’ has failed to arrive meaning that bank stocks my see some windfall gains in net margins and reductions in provisions for bad debts. Insurance stocks have been increasing premiums and their results should reflect increased margins. CBA is the only major bank reporting its half year result and it will be scrutinised heavily as the biggest leading indicator for the sector.

Key reports will be CBA (14 Feb), IAG (16 Feb), Suncorp (26 Feb) (ANZ, NAB and Westpac all report in May).

Michael Hill the jeweller has already released an update with a sharp fall in earnings and Domino’s Pizza announced its fourth downgrade in three years. Retail sales data has been largely flat. Kogan announced a strong second half update and Harvey Norman was upgraded by analysts. Just how much has the Aussie consumer been affected by the cost of living crisis?

Key reports will be JB HiFi (12 Feb), Wesfarmers (15 Feb), Domino’s Pizza (21 Feb), Super Retail (22 Feb)

US IT stocks have been booming all through 2023. Australian IT stocks have generally been dragged along in the jetstream.

Key reports will be Megaport (9 Feb), WiseTech, IRESS (21 Feb), Block Inc (22 Feb), Appen (27 Feb)

The work-from-home wave has affected the office rental market and waning consumer spending is a drag on retail occupancy rates. As well valuations have taken a hit from interest rate increases. A difficult half year for the REITs.

Key Reports will be Centuria (7 Feb) Charter Hall, Mirvac (8 Feb), Goodman (15 Feb), GPT, Lendlease (19 Feb) Scentre, Stockland (21 Feb), Growthpoint (22 Feb)

A tough 6 month for industrial stocks that have struggled to emerge from the Covid era with their business models intact.

Key reports will be Transurban (8 Feb), Aurizon (12 Feb), Qantas (22 Feb), Brambles (23 Feb), Worley, Atlas Arteria (29 Feb)

Key reports will be Woolworths (21 Feb) ,Endeavour (26 Feb), Coles (27 Feb)

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment