Assessing the Impact of Soaring U.S. Treasury Yields: Who Will Be Most Affected?

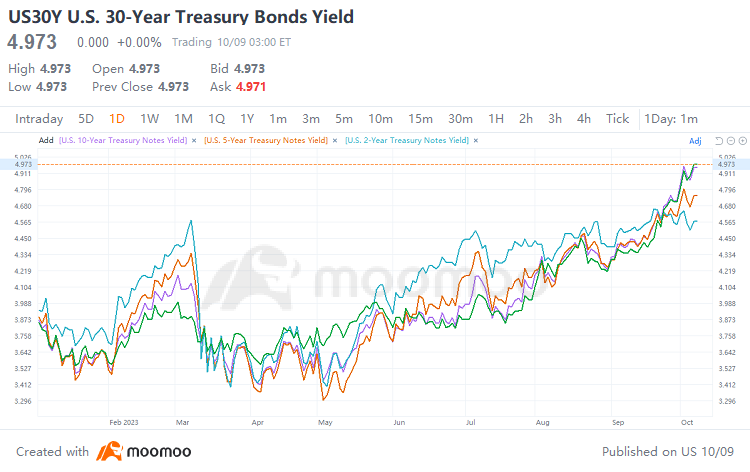

Heading into October, surging U.S. Treasury yields are once again causing turbulence in global financial markets and raising investor concerns. Last week saw the $U.S. 30-Year Treasury Bonds Yield(US30Y.BD$ surge above 5%, a level not seen in 16 years. After the $U.S. 10-Year Treasury Notes Yield(US10Y.BD$ climbed to 4.85%, market experts predict that the benchmark yield will reach5% for the first time since 2007.

The sell-off in the U.S. Treasury market has pushed borrowing costs to levels not seen in over a decade, directly impacting major buyers such as the Federal Reserve, U.S. banks,pension funds, insurance companies, and overseas investors. Furthermore, this trend indirectly threatens various parts of the financial system and influences global financial markets, potentially affecting even overseas central bank decisions.

As of the end of 2022, the total U.S. national debt had reached almost $31.4 trillion, with publicly held debt accounting for about $24.5 trillion. About two-thirds of debt held by the public (DHBP) is owned by domestic holders, with the Federal Reserve being the largest buyer among them. Meanwhile, in terms of foreign holders, investors in Japan and China hold the largest shares of U.S. public debt.

1. Federal Reserve:

Recently, the Federal Reserve reported its first annual net operating loss in a century, with a net interest loss of $57.38 billion and this loss could continue through 2023. The interest rate mismatch between the Fed's assets and liabilities is a significant contributor to the Fed's loss.

As the Fed had held a sizable portion of U.S. Treasuries, many of which were acquired during a period of lower interest rates, the sharp decline in asset prices of these Treasuries under the surge in Treasury yields has caused substantial book losses for the Fed. Additionally, the Fed now faces a significant rise in the cost of interest payments as financial institutions follow the Fed's rate hikes. Although the Federal Reserve has stated that net operating losses and unrealized losses will not have an impact on the Fed's monetary policy, the net profit that the Fed remits to the US Treasury will be directly affected.

2. U.S. Banks:

The surge in Treasury yields has also led to unrealized losses in U.S. bank bond portfolios, contributing to the overall risk and challenges faced by banks. According to Deutsche Bank's analysis of data from the FDIC, unrealized losses in the U.S. banking sector likely exceeded $700 billion in the Q3 of this year, surpassing the previous peak of $689.9 billion in the same quarter of 2022.

Although most banks, especially larger ones, do not realize these losses unless there is an unusual run or other risky event requiring them to sell these bonds, lower valuations of securities could impact banks' capital adequacy ratios. Moreover, regional banking crisis that erupted in March have refocused regulators' and investors' attention on the risks lurking in banks' bond portfolios. Additionally, higher interest rates can prompt depositors to move their money to more profitable areas, making it more expensive for banks to mobilize deposits - another factor hurting their profits.

3. Pension Funds:

The experience of the UK pensions crisis suggests that significant fluctuations in Treasury yields may force pension schemes to sell their most liquid assets - gilts. Many UK pension schemes use a "liability-driven investment" strategy to hedge against fluctuations in UK government bond yields by matching the duration of assets and liabilities. However, after the UK government's "mini" budget a year ago, there was a sudden sell-off in UK Treasuries and a spike in bond yields, causing the hedging strategy to require more collateral. This forced pension schemes to sell their most liquid assets in exchange for cash.

4. Insurance Companies:

While insurers typically hold bonds until maturity to avoid realizing losses on fluctuating asset values, a rapid rise in interest rates could prompt customers to cash in long-term products, resulting in insurers being forced to sell bonds and other matching assets at a loss.

The recent frenzied sell-off in U.S. Treasuries has hit global markets with a magnitude comparable to that of the COVID-19 pandemic. The correlation between Bloomberg's index tracking major global bonds (excluding those from the U.S.) and the U.S. Treasury index reached its highest level since March 2020.

As U.S. Treasury yields surged last Wednesday, other government bond yields also rose significantly. $German 10-Year Treasury Notes Yield(DE10Y.BD$ rose to 3%, their highest level since 2011, while $Italy 10-Year Treasury Notes Yield(IT10Y.BD$ climbed nearly 5% to reach their highest level since November 2012. Additionally, the U.K.'s 30-year bond yield touched a 25-year high of over 5%. The rapid decline in bond prices also led to an increase in demand for the safe-haven dollar, resulting in weaker performance for other currencies such as the yen.

Low-risk government bonds offering higher returns are likely to attract funds away from equity markets and other high-risk asset classes like corporate bonds. If Treasury yields continue to rise quickly and consistently, this could lead to a reevaluation of risk and decrease market risk appetite, leading to a significant sell-off in risky assets.

Over the past 12 months, the volume of private equity deals relying on leveraged buyouts has decreased due to rising borrowing costs. This slowdown in the deal cycle has made it more challenging for companies to sell assets and return funds to investors. The increasing cost of debt has significantly reduced interest coverage ratios among private equity firms, making it more difficult for companies to service their debt through operating profits.

According to Haakon Blakstad, chief commercial officer at Validus Risk Management: “Private equity has for a long time been synonymous with ‘leveraged buyout’, so it goes without saying that the ‘leverage’ part becomes more expensive for current or prospective portfolio companies.”

1. Companies:

The significant increase in borrowing costs, combined with ongoing economic uncertainty, has created headwinds for businesses. As a result, the number of bankruptcies among U.S. companies may reach its highest level since 2010 this year. According to data from Guggenheim Investments, as of the end of August 2022, more than 450 U.S. companies had filed for bankruptcy protection. This number has already surpassed the total number of bankruptcies in the past two years combined.

2. Real Estate Markets:

The real estate market has been severely impacted by the increase in mortgage rates. On October 6th, the U.S. 30-year fixed mortgage rate rose by 12 basis points from 7.69% to 7.81%, reaching a new high not seen since September 2000, according to data from Mortgage News Daily.

3. Government:

The already substantial burden faced by the Federal government in terms of debt and financial obligations will be further compounded by the increased cost of refinancing. If interest rates continue to remain high, it will be necessary for the government to pay more to finance its borrowing needs.

One of the leading causes behind the doubling of the federal budget deficit over the last year, as projected by the Congressional Budget Office, is higher interest rates. This is compounded by surprisingly weak tax collections, further exacerbating the situation.

Source: Financial Times, Peter G. Peterson Foundation, Federal Reserve

By Moomoo News Irene

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

GhostPhantom : very interesting information

SpyderCall : Very good info in here. This stuff is at the core of the US financial system, which systemically affects other financial systems around the globe.

This stuff is at the core of the US financial system, which systemically affects other financial systems around the globe.

Donald Joseph heslin : $ProShares UltraPro QQQ ETF (TQQQ.US)$