Alphabet (GOOGL.O) Q3'23 Review: Double Beat Foiled By Cloud Deceleration

Follow me on Moomoo to stay informed and connected!

Google's overall revenue and profit performance in Q3 was good, mainly driven by better-than-expected advertising revenue under a resilient consumer backdrop. With the traditional holiday season in Q4 and the low base from last year, as well as the impact of NFL Sunday Ticket, it is expected that advertising revenue in Q4 will continue to perform well. However, the slower growth of Google Cloud's business reflects that the company's monetization timetable for AI-related services may be slower than expected. Looking ahead to Q4, Google Cloud services are expected to continue to face the impact of enterprise IT spending cuts.

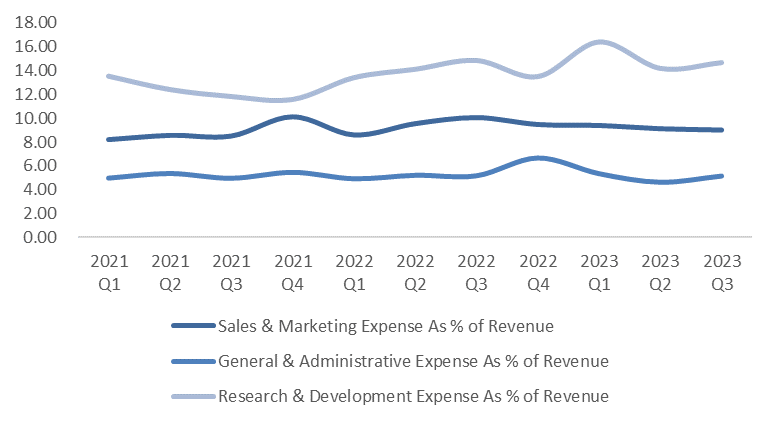

The decline in profit margin this quarter is related to the increase in capital expenditures and expenses related to AI. To achieve the company's guidance on increasing capital expenditures, it means the company will continue to increase capital expenditures and R&D investment in Q4 this year. Marketing expenses will also increase with the holiday season.The focus on Google's future development lies in whether the accelerated growth of advertising revenue can offset the increase in AI-related expenses, while the increase in cost and expenses in Q4 will put pressure on profits.

It remains to be seen whether the incremental revenue brought by AI to Google Cloud can offset the effects of macroeconomic headwinds, and the competitiveness of Google Cloud products still needs to be observed. Attention should also be paid to the commercialization progress of AI-related product features, such as the multimodal large-scale model Gemini and Duet AI toolset.

1. Advertising business beats expectations, YouTube performs well

Google has a wide range of businesses, including software, hardware, network services, and Google Cloud. From the perspective of revenue sources, its main sources of revenue are Google Services and Google Cloud. The revenue from Google Services includes advertising revenue and other revenue, with advertising revenue accounting for more than 80% of Google's total revenue, contributing to the core source of income.

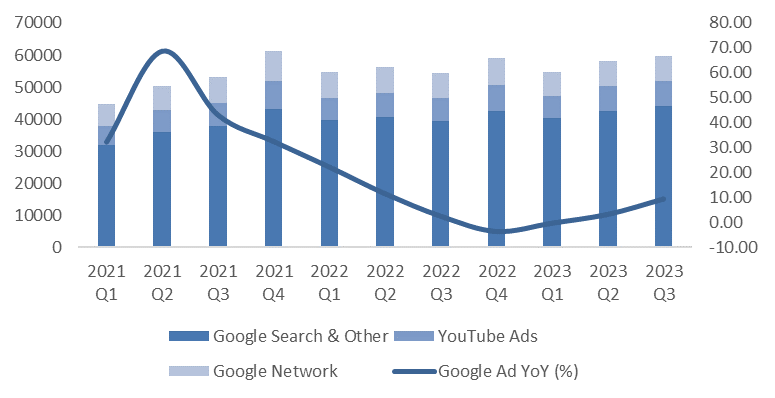

Advertising revenue overall recorded revenue of $59.6 billion, up 3% QoQ and 9.5% YoY, higher than the market's expected 8.1%. Google's advertising revenue can be divided into ads for search and other businesses, Google Network, and YouTube ads, accounting for roughly 60%, 10%, and 10% respectively. Among them, the search business grew steadily, with Google Search and other related business revenue reaching $44 billion, up about 11% YoY.

Following better-than-expected Google advertising revenue in the previous quarter, the market has continuously revised its outlook for the recovery prospects of the advertising business, and raised its expectations for Google's advertising revenue. The actual advertising revenue performance this quarter continued the high prosperity of the second quarter. The high growth of the advertising business is partly due to the low base effect of last year's third quarter, when advertising companies optimized spending in a high-interest, high-inflation environment.

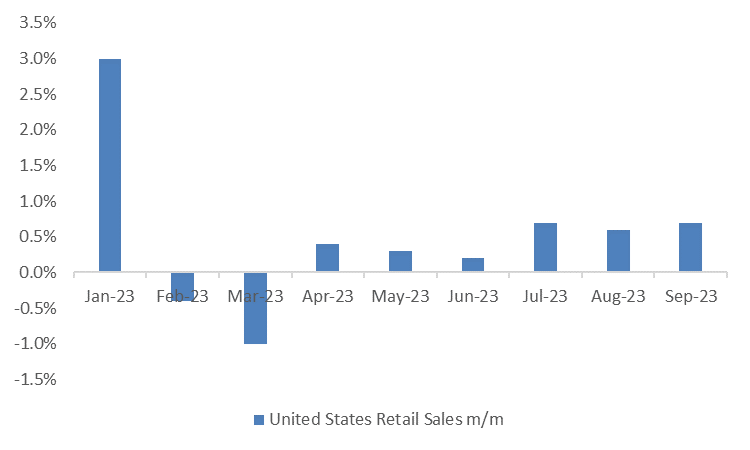

In the third quarter, the overall retail environment improved and consumer resilience remained strong, driving an increase in advertiser spending. The US retail sales monthly rate for July/August/September were 0.7%, 0.6%, and 0.7% respectively, all higher than market expectations (0.4%, 0.2%, 0.3%).

YouTube's advertising revenue performed well, with revenue reaching $7.95 billion, up 12% YoY. According to SensorTower application data, YouTube viewing time in the third quarter increased by 13% YoY, accelerating by 3 percentage points compared to the strong 10% growth in the second quarter. During the reporting period, subscriptions to YouTube Music Premium and YouTube TV also grew. In July, Google raised the subscription prices for YouTube Music and Premium, and the price hike is expected to drive YouTube's revenue growth in future quarters. YouTube Shorts officially began commercialization this year, and currently has over 2 billion monthly active users.

According to WARC's global advertising spend outlook for 2023/24, global advertising spending is expected to reach $963.5 billion by the end of 2023, with a global market growth rate of 4.4%. Advertising spending is expected to accelerate in 2024, with a YoY growth rate of 8.2%. The upcoming US presidential election and the Olympics (scheduled for 2024) will help offset macro uncertainty. The fourth quarter is the traditional holiday season, coupled with the low base effect from last year and the impact of the NFL Sunday Ticket in the fourth quarter, it is expected that advertising revenue will continue to perform well in the fourth quarter.

2. Google Cloud's growth rate is not as expected

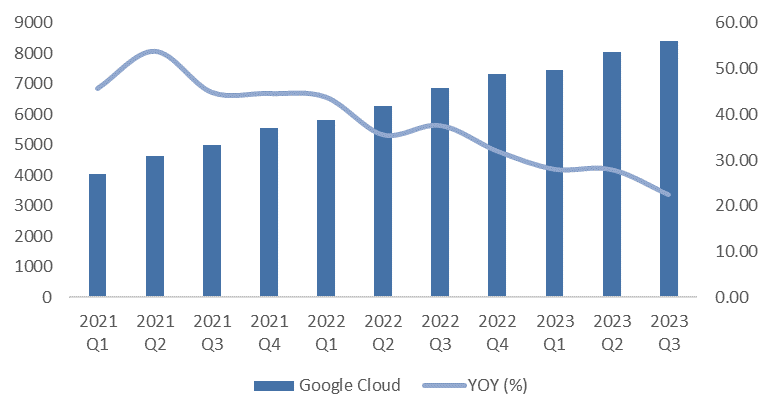

In the third quarter, Google Cloud (including GCP and Google Workspace) had revenue of $8.41 billion, up about 22% YoY, lower than Bloomberg's consensus estimate of 25%, and also lower than Microsoft Azure's 29%, with a significant slowdown QoQ (compared to a YoY growth of 28% in Q2 2023). The operating profit margin of Google Cloud was 3%, down from 5% in the previous quarter.

The macro headwinds continue to persist. From the perspective of the entire industry, the growth of cloud businesses remained sluggish this quarter, and there was no obvious rebound in the trend of some enterprise customers cutting back and optimizing their cloud usage. The moderate growth of Google Cloud this quarter indicates that the company's monetization timetable for AI-related services may be slower than expected, although Google Cloud has an advantage among startups (more than half of generative AI startups that receive financing are Google's customers). Compared with Microsoft, Microsoft's cloud business is driven by AI and has a growth rate of around 3%.

3. The increase in capital expenditure and expenses related to AI led to a decline in profit margin

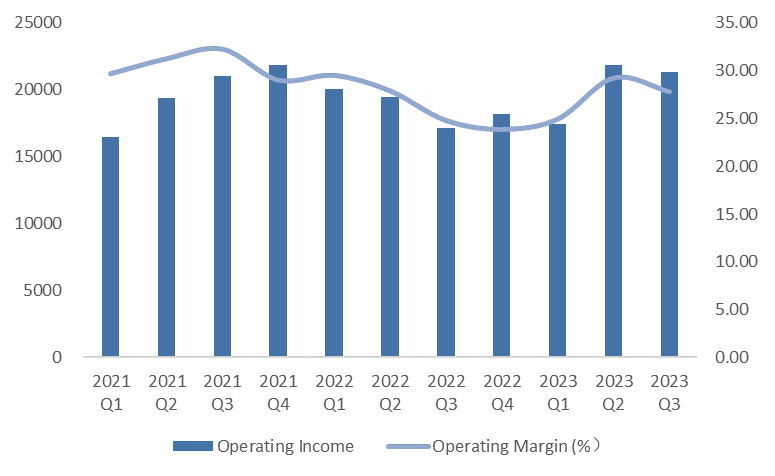

In the third quarter, the operating profit was $21.3 billion, up 25% YoY, and the net profit was $19.7 billion, up 41% YoY.

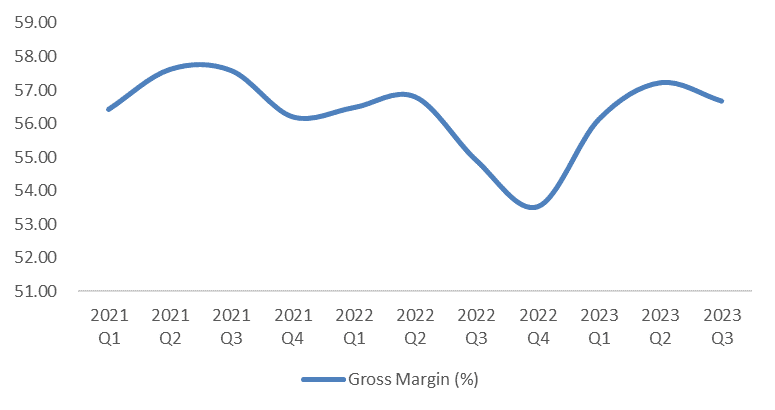

The overall gross margin for the third quarter was 56%, and the operating profit margin was 27.8%, both down QoQ. The increase in the cost of the main business was mainly due to content costs (mainly YouTube subscription services). The increase in server depreciation period optimization (extended from 4 years to 6 years) resulted in a decrease in depreciation expenses due to accounting standard changes, which had a positive impact on net profit in this quarter, approximately $76 million. Sales costs are expected to increase QoQ in the fourth quarter, reflecting the rise in hardware costs after the launch of the Pixel series products and an increase in YouTube's CAC.

The overall operating expenses were $22.1 billion, up 6%, driven by an increase in R&D expenses, mainly due to R&D personnel compensation, and the R&D expense ratio increased slightly QoQ to 14.68%. Management expenses increased by 11% YoY, mainly reflecting the increase in legal-related expenses as Google has recently faced antitrust lawsuits. The sales and marketing expense ratio decreased slightly compared to last year. It is expected that the marketing expenses will increase QoQ in the fourth quarter, mainly reflecting holiday season marketing activities.

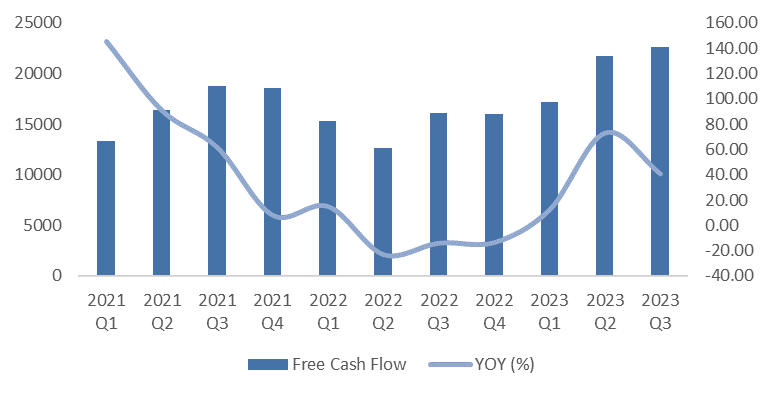

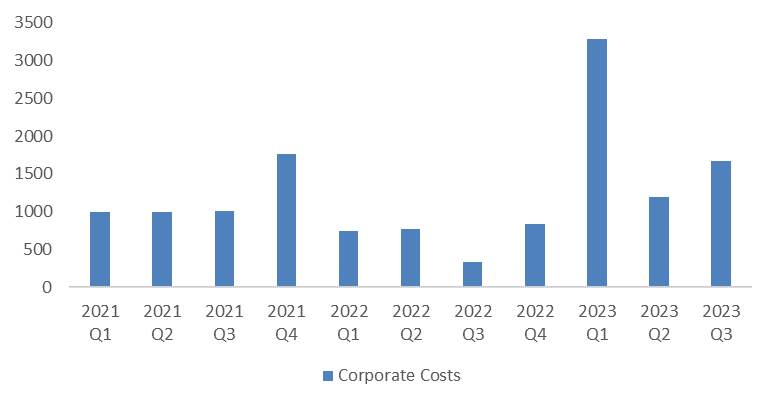

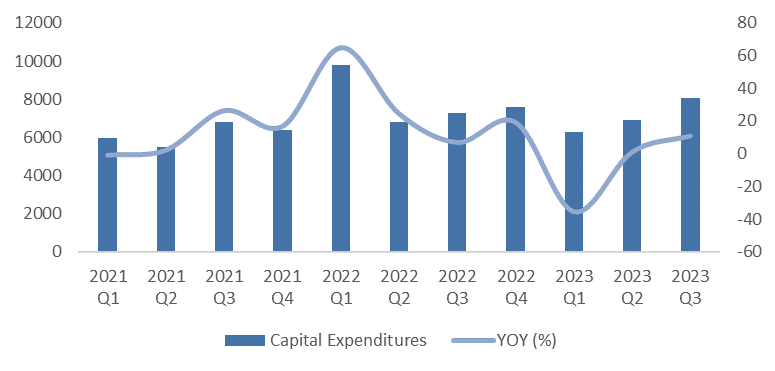

The decline in profit margin reflects the increase in capital expenditure and related expenses in AI in the second half of the year. In the second quarter, the QoQ growth rate of capital expenditures was lower than expected, with total capital expenditures of $6.9 billion, lower than market expectations of $8 billion, mainly due to slower construction of office facilities and delays in some data center construction projects. This portion of capital expenditures will be postponed to the second half of the year. Capital expenditures for the third quarter were $8 billion, mainly driven by investments in technology infrastructure such as servers and data centers, which reflects a significant increase in investment in AI. From the perspective of corporate costs (mainly reflecting company-level expenditures including AI-related R&D expenses and Google Deepmind department expenses), there was a significant QoQ increase in the third quarter.

However, looking at the total capital expenditures from Q1 to Q3, they declined by 11.1% YoY. To achieve the company's guidance of increasing capital expenditures (i.e., higher than in 2022), means that Q4 capital expenditures need to increase by more than 35% YoY. It is expected that the company will continue to increase capital expenditures and R&D investment in Q4 this year and next year.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment