After the Fed Pivot, What’s Next?

With cooling expectations, investors wonder when and how far U.S. rates will fall in 2024.

Transcript

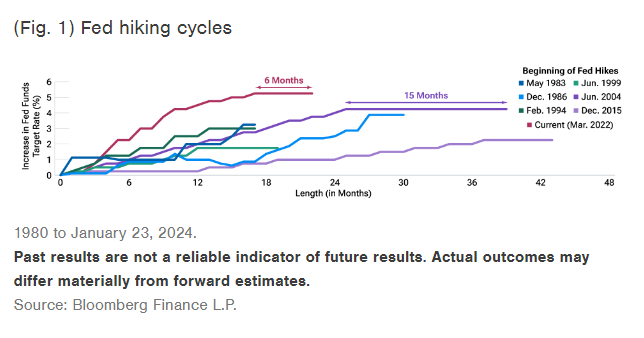

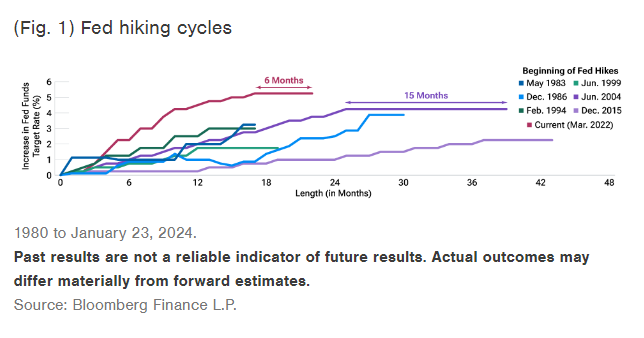

The Federal Open Market Committee delivered a surprisingly dovish signal at its December meeting. Chairman Powell had spent most of 2023 telling us that the Fed would prioritize fighting inflation over supporting the economy for the foreseeable future. But in December they changed their tune. The new message was: Cuts are coming.

In the Fed’s Summary of Economic Projections, they projected three 25-basis-point cuts in 2024. But the fed funds futures market took a more aggressive stance, pricing in seven cuts in 2024. The market also raised the probability of a cut at the March FOMC meeting to above 80% as of the end of December.

The Federal Open Market Committee delivered a surprisingly dovish signal at its December meeting. Chairman Powell had spent most of 2023 telling us that the Fed would prioritize fighting inflation over supporting the economy for the foreseeable future. But in December they changed their tune. The new message was: Cuts are coming.

In the Fed’s Summary of Economic Projections, they projected three 25-basis-point cuts in 2024. But the fed funds futures market took a more aggressive stance, pricing in seven cuts in 2024. The market also raised the probability of a cut at the March FOMC meeting to above 80% as of the end of December.

When will the Fed start cutting rates?

How many Fed cuts in 2024?

A review of the past seven Fed cutting cycles since 1980 shows that the average rate reduction in the first nine months of each cutting cycle was 2.5%, an equivalent of 10 25-bp cuts. However, these reductions varied widely—from 75 bps to 800 bps—reflecting the varying economic environments.

During five of the past seven cutting cycles, the U.S. economy went into recession. The remaining two cycles—those starting in September 1984 and June 1995—were “soft landings,” which provide a better guide in the current economic environment, in our view. In the two soft-landing cycles, rates declined by an average of 23.5% from the peak level. Applied now, the same percentage reduction would lower the federal funds rate target from 5.5% to 4.2%—equaling 5.2 cuts of 25 bps each. Notably, as of January 23, the funds futures market was pricing in a similar outcome, 5.47 cuts in 2024 (Figure 2).

If the U.S. economy remains on track for a soft landing, we expect modest rate cuts in 2024. However, the Fed’s actions will depend heavily on inflation and labor market conditions. If inflation heats up, the pace of rate cuts is likely to slow considerably. But if the labor market shows signs of extreme distress, the Fed could speed up cuts to try to avoid a recession. $S&P 500 Index(.SPX.US$ $Nasdaq Composite Index(.IXIC.US$ $Dow Jones Industrial Average(.DJI.US$ $Invesco QQQ Trust(QQQ.US$ $SPDR S&P 500 ETF(SPY.US$

During five of the past seven cutting cycles, the U.S. economy went into recession. The remaining two cycles—those starting in September 1984 and June 1995—were “soft landings,” which provide a better guide in the current economic environment, in our view. In the two soft-landing cycles, rates declined by an average of 23.5% from the peak level. Applied now, the same percentage reduction would lower the federal funds rate target from 5.5% to 4.2%—equaling 5.2 cuts of 25 bps each. Notably, as of January 23, the funds futures market was pricing in a similar outcome, 5.47 cuts in 2024 (Figure 2).

If the U.S. economy remains on track for a soft landing, we expect modest rate cuts in 2024. However, the Fed’s actions will depend heavily on inflation and labor market conditions. If inflation heats up, the pace of rate cuts is likely to slow considerably. But if the labor market shows signs of extreme distress, the Fed could speed up cuts to try to avoid a recession. $S&P 500 Index(.SPX.US$ $Nasdaq Composite Index(.IXIC.US$ $Dow Jones Industrial Average(.DJI.US$ $Invesco QQQ Trust(QQQ.US$ $SPDR S&P 500 ETF(SPY.US$

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment