After Netflix's continuous surge, what is its current investment value?

Netflix announced its fourth-quarter earnings on Tuesday after the market closed, which greatly exceeded expectations and drove the company's stock price up by more than 10% in pre-market trading.

As the world's largest streaming media company, Netflix's main revenue comes from streaming subscription fees, accounting for as much as 99.54% of its total revenue, with DVD revenue almost negligible.

High-quality content is the fundamental guarantee for the company's growth in the content-driven streaming industry. Under the "Content is King" principle, the growth of subscription users and Average Revenue per Member (ARM) will become the main driving force for the company's performance growth.

In terms of the company's operating level analysis, we focus on the two key indicators of new user subscriptions and ARM for analysis.

Ⅰ. How is Netflix's financial performance?

Conclusion 1: The company's performance has greatly exceeded expectations, mainly driven by the growth in subscription users.

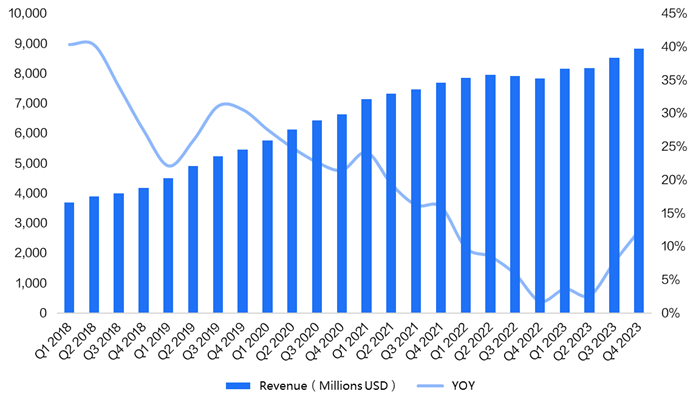

Consistent with our anticipation in the forecast, Netflix's revenue in Q4 2023 increased by 12% year-over-year to $8.83 billion, surpassing the company's guidance of $8.7 billion and the consensus estimate by Bloomberg, mainly driven by an increase in the number of subscription users.

The company's revenue for the entire year of 2023 increased by 23% year-over-year to $70 billion, growing rapidly. Historically, Netflix has managed to achieve continuous growth in most quarters, which is quite impressive. However, it also accumulated a very high valuation premium in earlier stages. During the four quarters of Q1-Q4 2022, which lacked growth, the stock price experienced a significant discount in valuation.

Figure: Company Revenue and Growth Rate from Q1 2018 to Q4 2023 (Million USD; %)

Conclusion 2: Healthy expansion of profit margins.

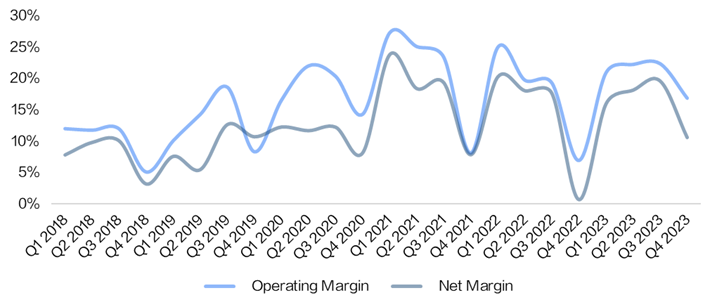

In Q4 2023, Netflix's operating profit reached $1.5 billion, with the operating margin increasing from 7% in the same period last year to 17%, primarily due to revenue growth exceeding expectations, reduced content expenditure, and proper expense optimization. The company's operating margin for the full year 2023 was 21%, higher than the company's forecast of 18%-20%. The EPS for Q4 2023 was $2.11, below the consensus estimate of $2.23, mainly due to a non-cash loss of $239 million resulting from currency fluctuations.

Overall, Netflix's profit margins have shown strong seasonality, with the operating margin increasing from 18.34% in 2020 to 20.62% in 2023, and the net margin quickly rising from 11.05% in 2020 to 16.04%.

Figure: Company Operating Margin and Net Margin from Q1 2018 to Q4 2023

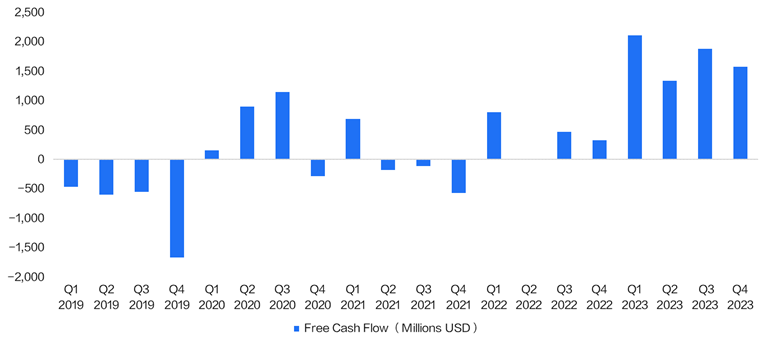

Conclusion 3: Significant growth in free cash flow supports the healthy growth of company operations and shareholder returns.

In Q4 2023, Netflix's free cash flow was $1.6 billion, and for the full year of 2023, the total free cash flow amounted to $6.9 billion, which includes approximately $1 billion in delayed expenditures due to the Hollywood strike. With the company's free cash flow reaching a new high, it indicates that the company's operations have entered a positive trajectory. This is expected to support spending on high-quality content in 2024. As the company has more cash on hand, and based on Netflix's historical performance of returning cash to shareholders, an increase in cash flow is also likely to enhance shareholder returns.

Figure: Company Free Cash Flow from Q1 2019 to Q4 2023 (Million USD; %)

From an overall performance perspective, the crackdown on shared accounts had an immediate positive impact on revenue and profit. However, let's take a closer look at two key operating metrics—net subscriber additions and ARPU (Average Revenue Per User)—to extrapolate future trends.

Ⅱ. Exceedingly high growth in new subscriber additions is the main driver of the company's performance.

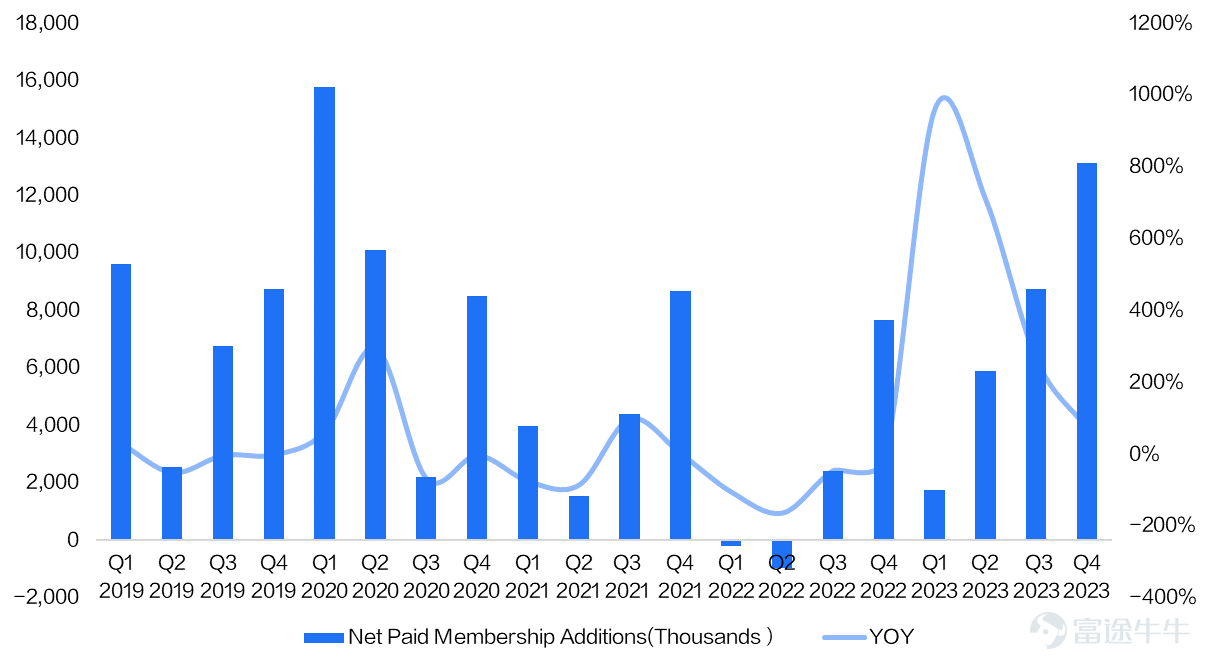

The market was significantly surprised by the fact that in Q4 2023, Netflix added 13.12 million new subscribers, setting a record high for subscriber growth in the fourth quarter, far exceeding the consensus estimate of 8.91 million, bringing the total number of subscribers to 260 million. Looking at it regionally, all regions exceeded expectations for new subscriber additions. In the United States and Canada (UCAN), streaming paid users increased by 2.81 million, far exceeding expectations. In Q4, APAC streaming paid users increased by 2.91 million, surpassing analyst expectations by 2.08 million. In Europe, the Middle East, and Africa, Netflix added more than 5 million users.

Why such rapid growth? We can further dissect this at the content level.

Figure: Net Subscriber Additions from Q1 2019 to Q4 2023

Netflix's subscriber growth exceeding expectations is attributed to several key factors:

(1) High-quality content in the fourth quarter. The streaming industry is primarily content-driven, and high-quality film and television content is the fundamental guarantee for the company's growth. The fourth-quarter series were of high quality, being a traditional peak season for content, including the final seasons of "Sex Education" and "The Crown," the movie "The Killer," the reality show "Squid Game: The Challenge," and the original new series "All the Light We Cannot See," among others. Although the company's content production was somewhat delayed due to the strike, the rich reserve of high-quality content significantly attracted new users and retained existing ones. According to data from Antenna Research, Netflix has the lowest monthly churn rate among streaming platforms, with only 2% of users leaving in December.

(2) Continued crackdown on account sharing. The data shows that few users have unsubscribed due to the crackdown on shared accounts, with some shared accounts directly converting into full-paying users, reflecting excellent user stickiness and a high retention rate. According to data disclosed by the company at the beginning of 2023, there are up to 100 million shared accounts worldwide, with an estimated 50% of these expected to become paid sharing users or full-paying users. It is anticipated that some users will gradually convert to full-paying or additional-paying users over the next few quarters.

(3) Low-priced ad-supported plans attracting new subscribers. According to the latest data disclosed by the company, the number of active monthly users for the ad-supported membership exceeded 23 million at the beginning of 2024, growing by 8 million in less than three months (15 million in November 2023 and 5 million in May 2023), with an accelerating growth rate. Starting in the second and third quarters of 2023, the company gradually phased out the basic ad-free plan in some regions and increased the prices of the old basic and premium plans, indirectly enhancing the attractiveness of the ad-supported plan to new users.

Therefore, Netflix has achieved good results in "content creation + cracking down on account sharing + promotional customer acquisition," which has led to the growth of new users. So, what about ARM?

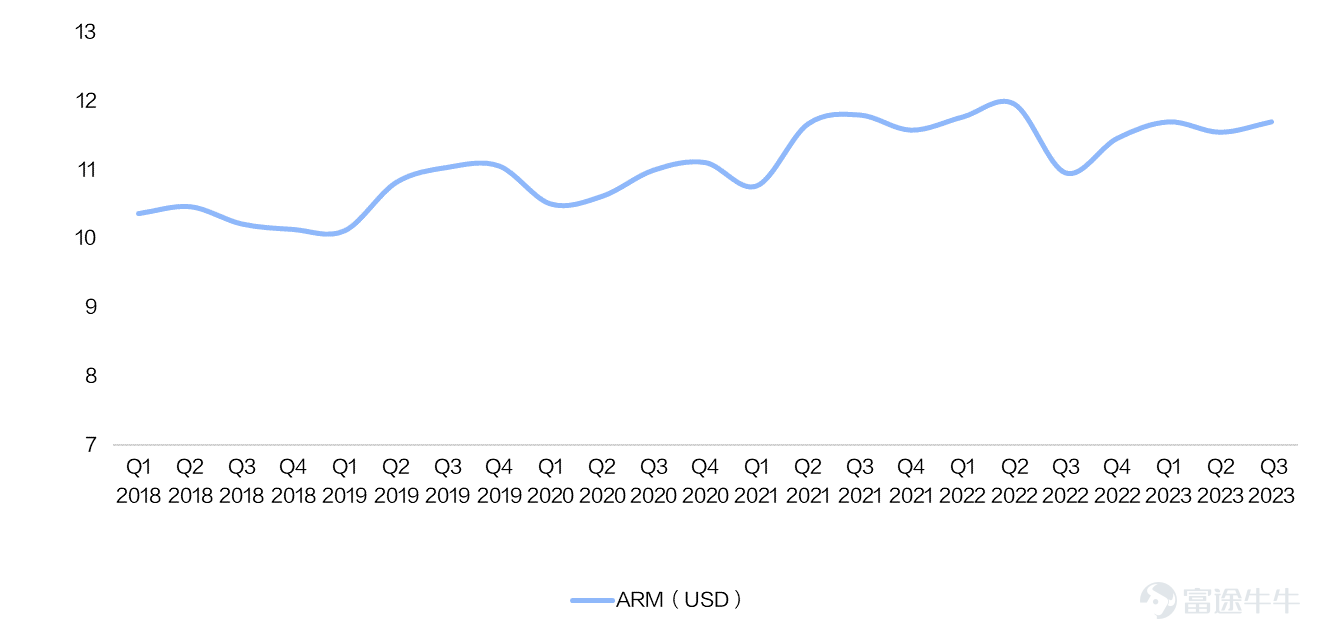

Ⅲ. ARM (Average Revenue Per User) saw limited growth in the fourth quarter, but is expected to improve in the 2024 fiscal year.

The company's ARM remained roughly flat year-over-year, with a limited impact from price increases in Q4. In Q4 2023, the company's ARM grew by 1% year-over-year (with constant exchange rates), which was in line with the company's expectations, mainly due to the low-priced ad-supported plans reducing ARM, while there have been limited price increases for memberships over the past 18 months, resulting in little change in ARM. Although the company announced price increases of about 10%-20% for basic and premium memberships in some regions of the United States, the United Kingdom, and France in the third quarter, this alleviated the downward pressure on ARM. However, considering the relatively small coverage of the price increases and the timing of the announcement in mid to late October 2023, the impact on ARM in the fourth quarter was limited.

Figure: Netflix ARM (Average Revenue Per User) from 2018 to present.

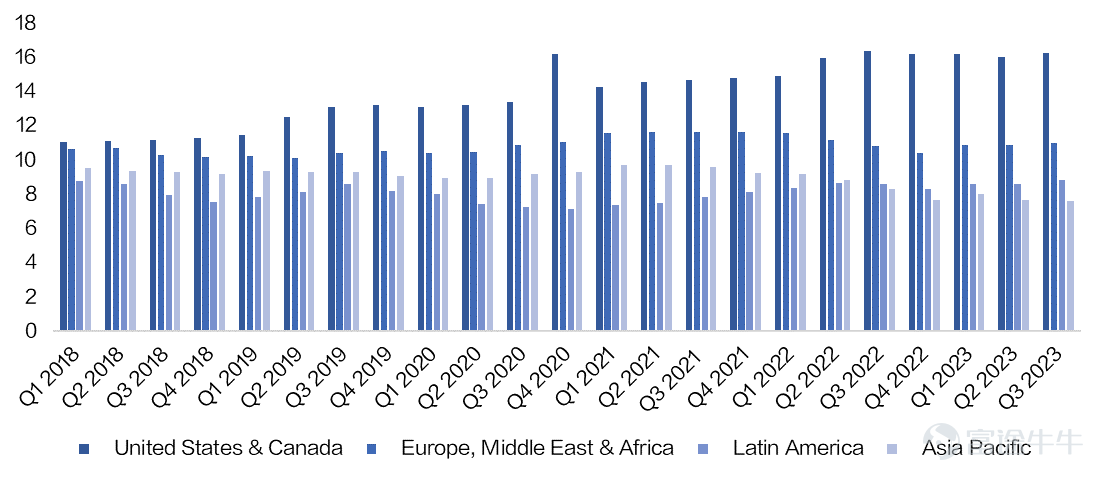

Regionally, ARM growth was faster in the UCAN region while there was a slight decline in the APAC region. The UCAN region's ARM increased to $16.64, showing a clear increase both year-over-year and sequentially, mainly due to the positive impact of price increases. In the EMEA region, ARM increased year-over-year to $10.75, with a slight decline sequentially. In the LATAM region, ARM increased year-over-year to $8.6, with a slight decline sequentially. In the APAC region, ARM was $7.31, showing declines both year-over-year and sequentially, mainly due to a strategy of attracting users with lower prices and the addition of a larger number of low-priced ad-supported plans.

Figure: Netflix ARM (Average Revenue Per User) by Region.

Looking to the future, the growth in the number of ad-supported subscribers is expected to increase viewership of advertisements, thereby raising the CPM (Cost Per Mille) and increasing advertising revenue. Based on comparable rates (on a per-hour basis) from fubo TV, The Roku Channel, and Hulu, it is estimated that ad-supported packages could generate $10 per user per month in advertising revenue. Therefore, the ARM for ad-supported package users is expected to align with the standard packages. As advertising revenue grows, it is expected to drive an overall increase in ARM.

Ⅳ. As for the company's earnings per share, they are expected to maintain high growth, with a shareholder return rate of about 4% in 2024.

The company's performance this quarter was outstanding, with user growth setting a new record for a single quarter, driving revenue beyond expectations, mainly due to the supply of high-quality content, effective measures against account sharing, and the increased attractiveness of low-priced advertising packages. To calculate Netflix's future investment returns, let's break it down:

(1) Earnings Per Share (EPS):

- User numbers: The company expects an increase in new paid subscribers in Q1 2024 compared to the same quarter last year, but the growth rate will slow down due to it being a traditionally slow content period. With strong content development, continued crackdown on shared accounts, low-priced ad-supported packages, and the ongoing substitution of streaming services for traditional TV, it is expected that the company's new subscriber additions will maintain healthy growth, although not at the current strong rate.

- ARM: Driven by price increases and growth in advertising revenue, ARM is expected to improve in fiscal 2024. It is projected that the company's revenue will achieve high double-digit growth for the full year, with global ARM expected to grow on a constant currency basis. The company's revenue is estimated to grow by 13% in Q1 2024, considering a 3% foreign exchange headwind.

- Profit margins and free cash flow: The company has raised its full-year 2024 operating margin forecast from 22%-23% to 24%, indicating a steady increase in profitability and entering a positive development trend. Given the significant increase in content spending in 2024, free cash flow is expected to fall to $6 billion.

In summary, EPS is still expected to achieve at least double-digit growth in 2024.

(2) Shareholder Return:

- In Q4, Netflix used $2.5 billion to repurchase 5.5 million shares, with $8.4 billion remaining in the current repurchase program. Assuming the entire repurchase amount of $8.4 billion is used in 2024, the shareholder return rate would be around 4%.

- Assuming a quarterly repurchase of $2.5 billion, totaling $10 billion for the year, the shareholder return rate would be around 5%.

- However, looking at the balance sheet, it is apparent that Netflix's cash and cash equivalents have declined from $8.577 billion to $7.138 billion in the past six months, part of which may have been used for stock repurchases, resulting in repurchase amounts exceeding free cash flow. Therefore, it is more likely that Netflix's shareholder return is around 4%.

(3) Valuation:

- Assuming the company's growth logic remains intact, it is forecasted that in 2024 and 2025, the company's revenue will be $38.836 billion and $43.655 billion, respectively, with net profits of $7.767 billion and $9.037 billion. Supported by high-speed earnings growth, a valuation multiple of 30-35 times for 2024 is reasonable, implying a potential target price range for Netflix between $532 and $620.

- If the company's growth logic breaks down, with intensified competition in streaming, high content spending eroding profits and free cash flow, and content quality falling short of expectations leading to user churn, the company would be priced based on the "risk-free interest rate plus equity operation risk." Optimistically assuming that if income and profit remain unchanged, but the competition intensifies and the 4% shareholder return falls to an added 5% risk return, there could be a 25% decrease in valuation. Therefore, in a fiercely competitive market, there is a potential for a 25% decline in the stock price.

In conclusion, the investment value of Netflix can be judged as follows:

- Scenario 1: If the company's EPS is likely to achieve double-digit growth, with a shareholder return of about 4% and the return rate remains unchanged, then the target price for 2024 is expected to be in the range of $532 to $620.

- Scenario 2: Under the background of Scenario 1, if the competitive landscape deteriorates but does not affect profits, then the overall stock price is expected to fluctuate around the current position.

- Scenario 3: If the competitive landscape becomes exceptionally intense, there

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment