A tax-free way to save and invest?What you need to know about TFSA

If you're looking for a tax-free way to save and invest, a Tax-Free Savings Account (TFSA) could be the solution for you, a flexible, registered savings vehicle allowing Canadians to earn tax-free investment income.

Investing gets you far higher returns in the long run, and the icing on the cake? You’ll get the benefit of not paying a single dollar of tax on any of your earnings.![]()

![]()

Whether you're a novice investor looking to quickly dive into investing in major market indexes such as $TSX(BK4001.CA$ $S&P 500 Index(.SPX.US$ or $Nasdaq Composite Index(.IXIC.US$

or a conservative investor looking to earn passive income through dividends from high-yield stocks

or someone keen on tracking the latest hot sectors that are buzzing among investors, like the AI industry and the well-known “Magnificent 7” $Microsoft(MSFT.US$ $Apple(AAPL.US$ $NVIDIA(NVDA.US$ $Alphabet-A(GOOGL.US$ $Amazon(AMZN.US$ $Meta Platforms(META.US$ and $Tesla(TSLA.US$

or an investor looking to make profits from commodities like gold or cryptocurrencies such as Bitcoin

The TFSA is a versatile account that may cater to your diverse investment needs!

How much can I contribute to my TFSA?

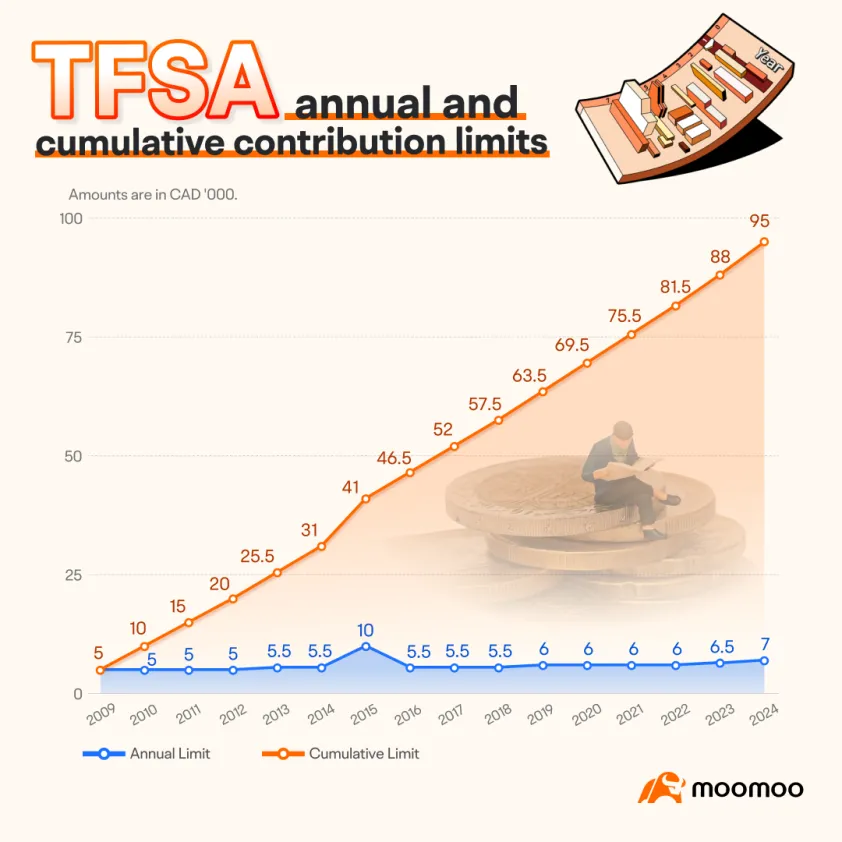

The contribution room for a Tax-Free Savings Account (TFSA) builds up annually, even if you haven't opened a TFSA.

If you are a Canadian resident, your contribution room begins accumulating from 2009 or the year you turned 18. This means if you open a new TFSA in 2024 and have never contributed to a TFSA elsewhere, you would have a total available contribution room of $95,000 if you were 18 or older in 2009.

Note that investment income earned in your TFSA and changes in the value of your investments do not affect your TFSA contribution room for current or future years.

TFSAs vs. RRSPs

While TFSAs and RRSPs both offer valuable saving opportunities, they also accommodate a range of investments beyond just cash holdings. That being said, there are still a few notable differences between these two accounts. To cut to the chase, here are some of the keywords you might be looking for:

If you are still unsure about which method to choose after reviewing the table above, you can refer to the following flowchart for further determination.

Wanna learn more?

1. Who is Suitable for a TFSA?

2. What are the Benefits of a TFSA?

3. What you need to know about TFSA Withdrawals

Ready for rewards?

Click to open your tax-saving account and get up to a $2,400 welcome bonus!

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment