5 Things to Know Before the Canadian Stock Market Opens Tuesday

Good morning mooers! Here are things you need to know about today's market:

●S&P/TSX 60 Index Standard Futures are trading at 1,317.40 ,down 0.35%.

●BoC is navigating a precarious balance as experts predict a surge in inflation for February

●BOJ joins a rate-hike party that other big central banks have left

●US Crude Oil exports hit new record In 2023, EIA Reports

●Sector to watch: Cannabis stocks

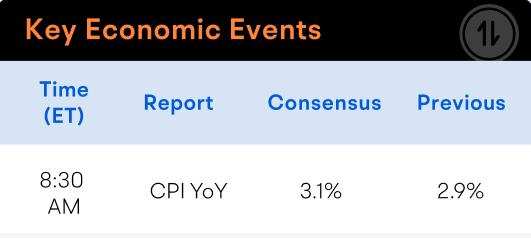

●Earnings Results & Economic Events: Feb CPI

Market Snapshot

Today, the Canadian dollar is trading at 73.70 cents US, a slight decrease from Monday.

The S&P/TSX 60 Index Standard Futures (SXF) are currently trading at 1,317.40, which is down 0.35% from the previous close.

Macro

BoC is Navigating a Precarious Balance as Experts Predict a Surge in Inflation for February

Analysts from Bloomberg anticipate that February's inflation rate will climb to 3.1 percent as revealed by the upcoming consumer price index (CPI) data from Statistics Canada on Tuesday, following a deceleration to 2.9 percent on an annual basis in January. The core-trim and core-median CPI figures, which are closely monitored by the Bank of Canada, are expected to stay consistent with the previous month's readings at 3.3 percent and 3.4 percent, respectively.

When policymakers maintained the interest rates on March 6, they conveyed a clear message that the current breadth and persistence of inflation are too significant to consider initiating rate cuts.

BOJ Joins a Rate-hike Party that Other Big Central Banks Have Left

Interest rates worldwide are experiencing volatility. The Bank of Japan, which remained a notable outlier maintaining low rates while other central banks in developed countries increased lending costs starting in late 2021, has now signaled an end to its period of loose monetary policy on Tuesday.

Commodities

US Crude Oil Exports Hit New Record In 2023, EIA Reports

US crude oil exports reached a record in 2023 at an average of 4.1 million barrels per day, exceeding the record set in 2022 by 13%, the US Energy Information Administration reported Monday.

Except for 2021, US crude exports have risen every year since 2015, when the US ban on most crude exports was lifted, the EIA noted.

Increases in crude exports have been supported by growth in US crude production, the agency said. In 2023, US crude production hit a record 12.9 million b/d, a 9% increase from 2022. Many US refineries are optimized to run heavy, sour crude, but most of the crude produced in the US is light, sweet crude, creating export incentives.

Sector

Wedbush on "The Clock Is Ticking on Cannabis"

With Q4 cannabis earnings wrapped up, Wedbush is "incrementally more positive" on the fundamental setup headed into 2024, as revenues, margins and cash flow metrics for the leading U.S. MSOs showed broad-based improvement and exceeded expectations exiting the year, which are expected to continue. "While this is encouraging, from an interest and sentiment perspective, the far more important potential catalysts on the docket are Florida adult use legalization and DEA rescheduling, both of which have a legitimate chance to pass in our view and both of which would obviously be transformative to the industry," analyst Gerald Pascarelli writes.

Today's Economic Data

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

FARAMARZ AKBARY :