5 Aspects to Watch: A Guide to Betting on the 2024 US Election

Goldman Sachs recently released a research report: Trading the 2024 US Election. This report focuses on five aspects: fiscal stance, taxes and regulations, trade policy and tariffs, monetary policy, and geopolitics. The analyst Dominic Wilson noted that the election will only drive markets clearly much later in the year since candidates have not been definitively determined, polling is unreliable, and the key policy differences have not been confirmed. Still, it may be helpful to understand the asset shifts that could arise in case the market allows early exposure to those themes.

■ What aspects can we focus on in the election?

1) Fiscal stance

As the two parties reached an agreement in 2023 to reduce fiscal spending and deficits since the epidemic, the shift in fiscal stance in 2024 is likely to be much smaller than in 2020.

Nevertheless, significant shifts in the fiscal stance are still possible if a unified government is formed. Goldman Sach's cross-asset models suggest that fiscal expansion that leads to a 100bp increase in GDP growth over the next year under unified government would boost US equities by about 7% and US 10-year yields by around 30bp.

Given the heightened attention on fiscal sustainability, any additional fiscal expansion might raise concerns about the necessary premium for longer-term rates, potentially encouraging a steeper yield curve.

2) Tax and regulatory policy

Corporate tax changes from 2017 were mostly permanent, and neither side has outlined major plans at this stage, although it partly contributed to the increase in fiscal deficit.

Should the Republicans secure a sweeping victory, it's expected that there would be renewed momentum for deregulation and a more favorable attitude towards fossil fuel production, but support for renewable energy initiatives would be diminished. This could lead to challenges against the Inflation Reduction Act, potentially dampening the anticipated demand growth for "green" metals.

In contrast, Dominic Wilson said expectations might eventually resurface that Democrats will raise the effective corporate tax rate if they have unified control.

3) Trade policy:

Both political parties have shown a commitment to a more assertive U.S. industrial policy. However, a second term for Trump may result in more significant alterations to trade policy. Trump has suggested imposing a blanket 10% tariff on imports, though the implications of such a measure on the US-Canada-Mexico agreement and the existing tariffs on China remain unclear.

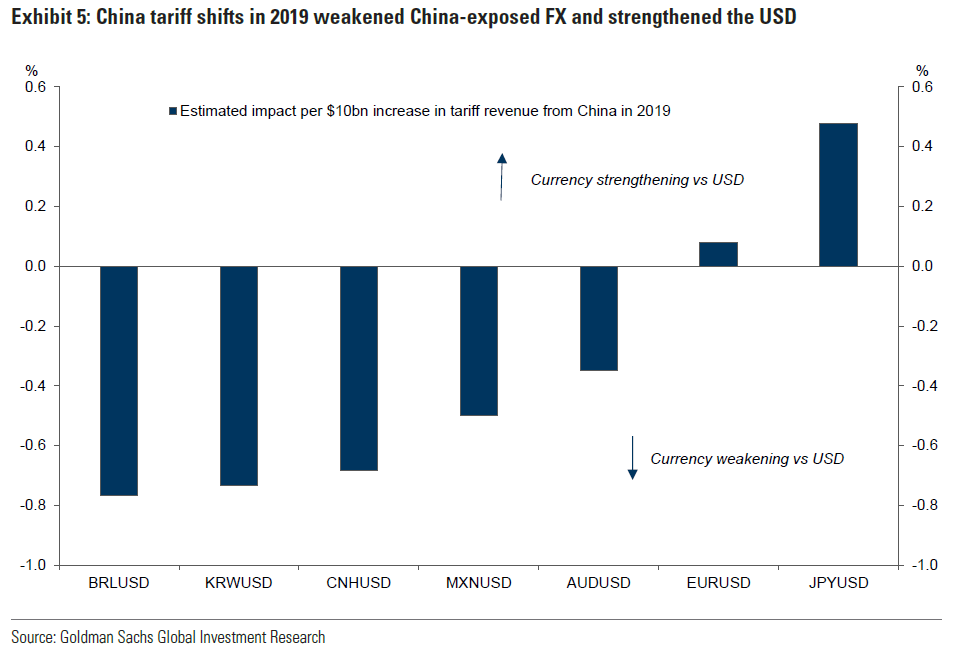

The possibility of increased tariffs is likely to support the U.S. dollar, albeit the outcome may hinge on the geographic distribution of the tariffs. In 2016, the Mexican peso was notably impacted by the proposed renegotiation of NAFTA, reflecting the focus on potential changes in trade policy. In contrast, the 2020 elections centered around the possibility of a less stringent tariff regime on China under Biden. However, the Biden administration has largely continued the trade policies of its predecessor towards China, including the maintenance of tariffs and the implementation of additional non-tariff barriers.

4) Monetary Policy

Theoretically, the Federal Reserve operates independently of the presidential office, and its monetary policy decisions are expected to remain unaffected by election results. The primary point of interest is the end of Chair Jerome Powell's term in May 2026. Former President Trump has indicated he would not reappoint Chair Powell if given the opportunity. The Trump Administration previously expressed more overt opinions about the Federal Reserve's actions than past administrations, which could elevate market concerns about the central bank's autonomy in the event of a Trump re-election.

While these apprehensions emerged during Trump's previous term, it is important to remember that any Federal Reserve appointments must still clear the Senate, a factor that has historically ensured more mainstream choices. Additionally, the possibility of tighter immigration controls under a Republican government may stoke worries about a reduced labor force, potentially exacerbating inflationary pressures at the edges.

5) Geopolitics

A Republican Administration and Congress are likely to look less favorably on ongoing support for Ukraine in its war with Russia (the House has already blocked an extension of aid so far). Given this, the market would likely anticipate that outcomes more favorable to Russia and less favorable to Ukraine would become more likely, though the true impact may be more unpredictable.

A Republican Administration seems more likely to increase restrictions on Iran, and so, in some respects, the upside tail from oil supply disruptions could increase. Markets may also anticipate higher tensions with European allies, given the likelihood of more conflicting stances on Ukraine, trade policy, and NATO.

■ What does history tell us?

Historical data indicates that during years when a president campaigns for re-election, as President Biden is doing this year, the performance of U.S. stocks has typically been above average. According to Sam Stovall, chief investment strategist at CFRA, the S&P 500 has recorded gains in all 14 instances since World War II when a sitting president ran for another term, generating an average total return of 15.5%.

However, seasonal trends within election years suggest that stock market performance is not consistently positive throughout the year. Keith Lerner, co-chief investment officer at Truist Advisory Services, analyzed data going back to 1950 and found that the initial months of an election year often experience a mixed stock market, with the S&P 500 typically showing little overall movement. The period leading up to Election Day in early November is also characterized by volatility.

Investment strategists at U.S. Bancorp have meticulously examined market data dating back to 1948. By determining the average three-month returns subsequent to various election results and contrasting those figures with the average three-month return across the entire period under review, the strategists assessed the statistical relevance of the connection between political control and market performance.

The analysis revealed three instances of a divided government that demonstrated a statistically meaningful correlation with market behavior.

Among these, two cases were associated with positive absolute returns that surpassed the long-term average returns:

♦Democratic control of the White House and full Republican control of Congress.

♦Democratic control of the White House and split control of the Senate and House.

One situation was identified where positive absolute returns were slightly less than the long-term average:

♦Republican control of the White House and full Democratic control of Congress.

■ What are the risks and opportunities for asset prices in the election year?

With the potential for marked disparities between policies, a key outcome could be elevated volatility and a broader spectrum of possible results, particularly concerning interest rates and the U.S. dollar, as the election draws near and until its conclusion.

The prerequisites for policy shifts vary across domains. Changes in trade, geopolitical dynamics, and significant regulatory aspects mostly hinge on who occupies the White House. Meanwhile, alterations in fiscal policy, including tax legislation—and thus a wider array of modifications—are more probable with a single party controlling both the executive and legislative branches.

Generally, a Republican triumph, and notably a clean sweep, appears to increase the likelihood of a fortified U.S. dollar, higher yields, and a steeper yield curve. It might also widen the range of outcomes for energy prices in both directions. This mix of risks—comprising potential volatility in commodity prices, increased yields, and a robust U.S. dollar—could also signal a tendency for emerging market assets to underperform in such a scenario.

Wilson warned that trading on these potential outcomes with a high degree of certainty is challenging at this stage, well before the election takes place. One reason for this is that policy platforms are still evolving, and the dynamics of the race are subject to change.

Consequently, options with longer maturities are expected to be priced higher, given the uncertain landscape at this time frame. Considering these uncertainties, there's a relative increase in the attractiveness of more stable assets—such as the VIX index, volatility indices broadly, and credit default swaps (CDX)—compared to assets like equity indices, bond yields, or the U.S. dollar, which are more susceptible to directional trends.

Source: Goldman Sachs, US Bancorp, Reuters

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

srinath nalluri : 0p88