Netflix Earnings Review: Adjusted Pricing Strategy Accelerates Monetization

Netflix (NFLX.O) is expected to release its second-quarter earnings report on July 19, Eastern Time. Since November 2021, Netflix's stock price has experienced large fluctuations, which has aroused widespread concern in the market. I will conduct a forward-looking analysis of Netflix's financial report for the second quarter of 2023 , and discuss its future development trends and possible risk factors.

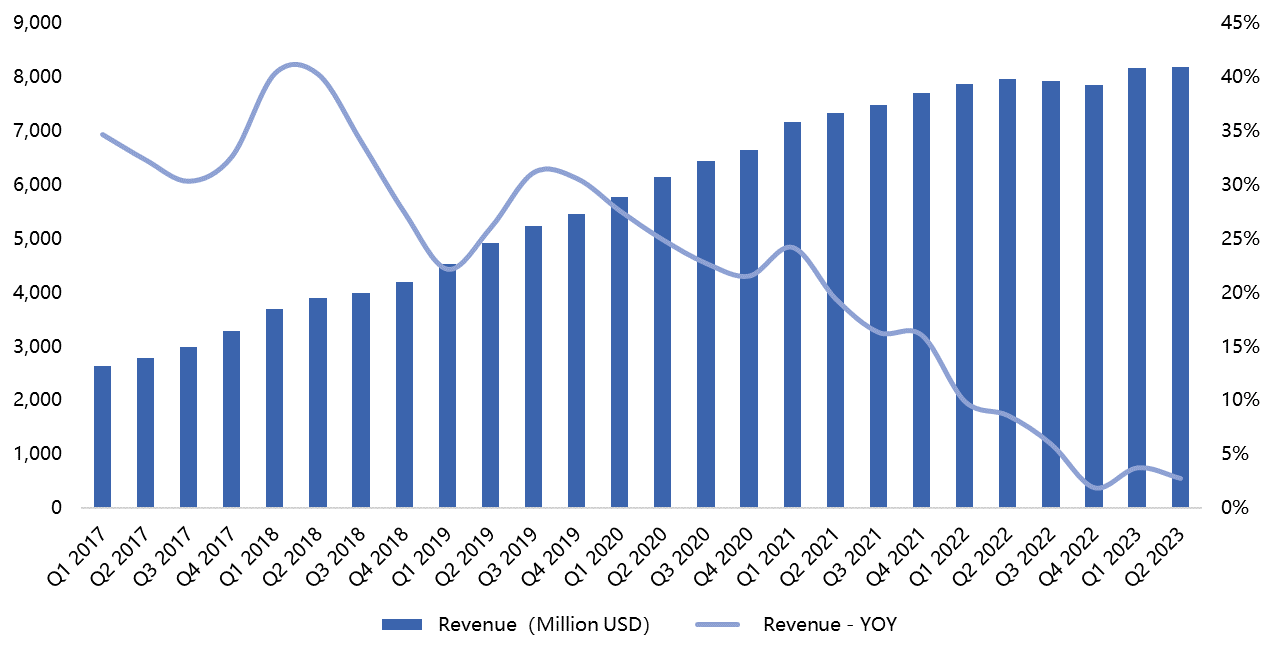

1. Revenue fell short of market expectations

Revenue growth was primarily driven by paying user growth. In 23Q2, the company achieved revenue of US$8.187 billion, YoY+2.7%, and the growth rate of revenue slowed down compared with the previous quarter. The company's revenue growth in this quarter was mainly driven by the increase in the number of paying users, and ARM declined slightly.

Figure 1 : Netflix operating income and year-on-year growth rate

The company maintains strong profitability. 23Q2 operating profit was US$1.83 billion, YoY+22.3%, and operating profit margin was 22%, an increase of 1 percentage point from the previous quarter, mainly due to the company’s continuous cost optimization, a significant decline in R&D expenses and management expenses, and the adjustment of content expenditure time Content costs were lower than expected in the second quarter. 23Q2 diluted EPS was $3.29, YoY +3%.

Figure 2 : Operating Margin (%)

The company's realization speed is slow, and its performance guidance is lower than market expectations. The company expects 23Q3 revenue to increase significantly by 7.5% year-on-year to US$8.52 billion, which is lower than market expectations of US$8.67 billion, mainly due to the impact of exchange rate fluctuations and the decline in ARM due to lower subscription fees in some regions. At the same time, advertising and payment sharing revenue has not yet formed support. The company's revenue is expected to accelerate significantly in the fourth quarter. 23Q3 operating profit is expected to increase by 22.2% year-on-year to US$1.89 billion, the operating profit margin will remain at a relatively high level of 22%, net profit will increase to US$1.58 billion, and diluted earnings per share will be US$3.52. It is expected that the annual operating profit margin target will remain at the level of 18%-20%.

2. The number of new user subscriptions in the second quarter exceeded expectations

The number of new users exceeded expectations. In 23Q2, the company's total number of subscribers was 238 million, of which 5.89 million were new users, a significant increase from the previous quarter (1.75 million), exceeding market expectations, and basically in line with our forward-looking expectations. From the perspective of new user regions, the EMEA region has the largest number of new users this quarter, reaching 2.43 million; followed by LATAM, UCAN and APAC regions, respectively achieving 1.22 million, 1.17 million and 1.07 million new users. The increase in the number of new users mainly benefited from the crackdown on shared accounts and low-priced advertising packages. It is expected that the number of new users in the second half of the year will still be an important driving force for the company's revenue growth.

Figure 3: Net increase in subscribers from Q1 in 2019 to Q2 in 2023

High-quality content continues to drive user growth. The second quarter is the off-season for content, but Netflix has also released some high-quality popular works, such as Queen Charlotte, Black mirror, Bloodhounds, etc., all of which scored more than 7 points on the IMDb website and had a high number of hits.

Figure 4: Netflix's statistics on the number of English-language film and television works played from June 12 to June 18

3. ARM has declined slightly, and there is still room for price increases in the future

Thanks to the high stickiness of the ad-free paid package, ARM remains at a high level. In 23Q2, the company's ARM was US$11.6, down 3% year-on-year, and only slightly down 1% quarter-on-quarter. In terms of regions, ARMs in all regions are facing declines. The decline of ARM is mainly due to the fact that the company has not adopted price increases this year. At the same time, most of the new users come from regions with relatively low subscription prices, as well as the increase in users of low-priced advertising packages, which to some extent drag down the growth of ARM. . But thanks to the stickiness of high-paying users , ARM has not been significantly impacted. According to a market survey in May 2022, 72% of users who have subscribed to a premium package will not re-select a cheaper package that includes advertising.

In the short term, ARM is still under pressure. New users mainly come from regions with low-priced advertising packages and subscription prices; There is still room for price increases.

Figure 5: Netflix ARM (average revenue per subscriber)

Figure 6: Survey statistics on the willingness of existing Netflix users to change to low-priced packages in May 2022

4. The company adjusted its pricing strategy to accelerate cash realization

Netflix’s account pay-sharing policy has worked well. As of May, Netflix has implemented a paid account sharing policy in more than 100 countries and regions around the world. On the day when the financial report was released , the company implemented a payment sharing strategy to all remaining regions. According to company disclosures, there are as many as 100 million shared accounts worldwide, including 30 million users in the United States and Canada. The paid sharing policy may cause some users to lose in the short term, but in the long run, it will help promote the transformation of free sharing accounts into new subscribers, and paid sharing will also help improve the company's ability to monetize. Judging from the data released by the company, the revenue in all regions is higher than before the release of the paid sharing policy, which proves that the number of new subscribers has exceeded the number of canceled subscriptions, and the short-term adverse effects have been gradually digested.

The company adjusted its pricing strategy to drive users to shift to low-priced advertising packages. The company announced that it will cancel the basic ad-free package of $9.99/month in Canada, the United States, and the United Kingdom, and the cheapest version of the ad-free subscription package has become a standard package of $15.49/month. The company’s pricing changes further differentiate price-sensitive users and high-paying users. On the one hand, it can increase the attractiveness of low-priced advertising packages, increase the number of advertising package members, and further accelerate the realization of advertising. The overall ARM (including subscription fees and advertising revenue) of advertising packages is high. Based on the basic ad-free paid package. According to company data, the number of advertising members exceeds 5 million, and 25% of new subscribers choose this package. On the other hand, it is expected to increase the stickiness of high-paying users. Whether users are migrating to lower-priced advertising packages, or to higher-paid packages, is expected to boost the company's ARM.

The company has not yet disclosed the detailed revenue of the advertising business. Currently, due to the small advertising base, the contribution to the company's performance is limited. It is estimated that as the advertising business revenue matures, this business is expected to account for 10% of its future total revenue.

5. Benefiting from the increase in the market share of streaming media, it is expected to accelerate the release of monetization capabilities

As a streaming media giant, the company continues to benefit from the increase in streaming media market share. According to Nielsen's data, the market share of online streaming media in the United States has increased to 37.7%, pushing Netflix's market share to 8.2%, maintaining a large gap with competitors such as Disney and Amazon. With high-quality content, the company is expected to continue to maintain its leading position in the streaming media market and continue to benefit from the increase in streaming media market share. However, the strike of screenwriters in the United States is expected to have a certain negative impact on the company's content schedule, and it is expected that the company's compromise will cause a significant increase in content production costs.

Looking forward to the second half of the year, the company’s revenue is still mainly driven by the increase in the number of new users. ARM is still under pressure. Considering that it will take time to realize monetization methods such as advertising and paid sharing, it is expected that the performance growth in the third quarter will be under pressure . Guidance was lower than market expectations. In the fourth quarter, the company's revenue is expected to increase significantly, and the acceleration of advertising monetization is expected to further increase profit growth.

I believe that Netflix’s performance in this quarter is not bad. The stock price fell after the financial report was announced. On the one hand, the performance guidance was lower than expected. In the short term, considering that it still takes time for the company's business to be realized, and the company's stock price has a risk of correction, it is recommended to adopt the Covered Call strategy to sell high-priced call options to earn option premiums. In the long run, with the acceleration of realization, ARM is expected to have room for improvement. If the company's stock price is fully corrected, it will be a better buying point before the fourth quarter financial report comes out.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment