Navigating the Open Interest of Options on 6/9

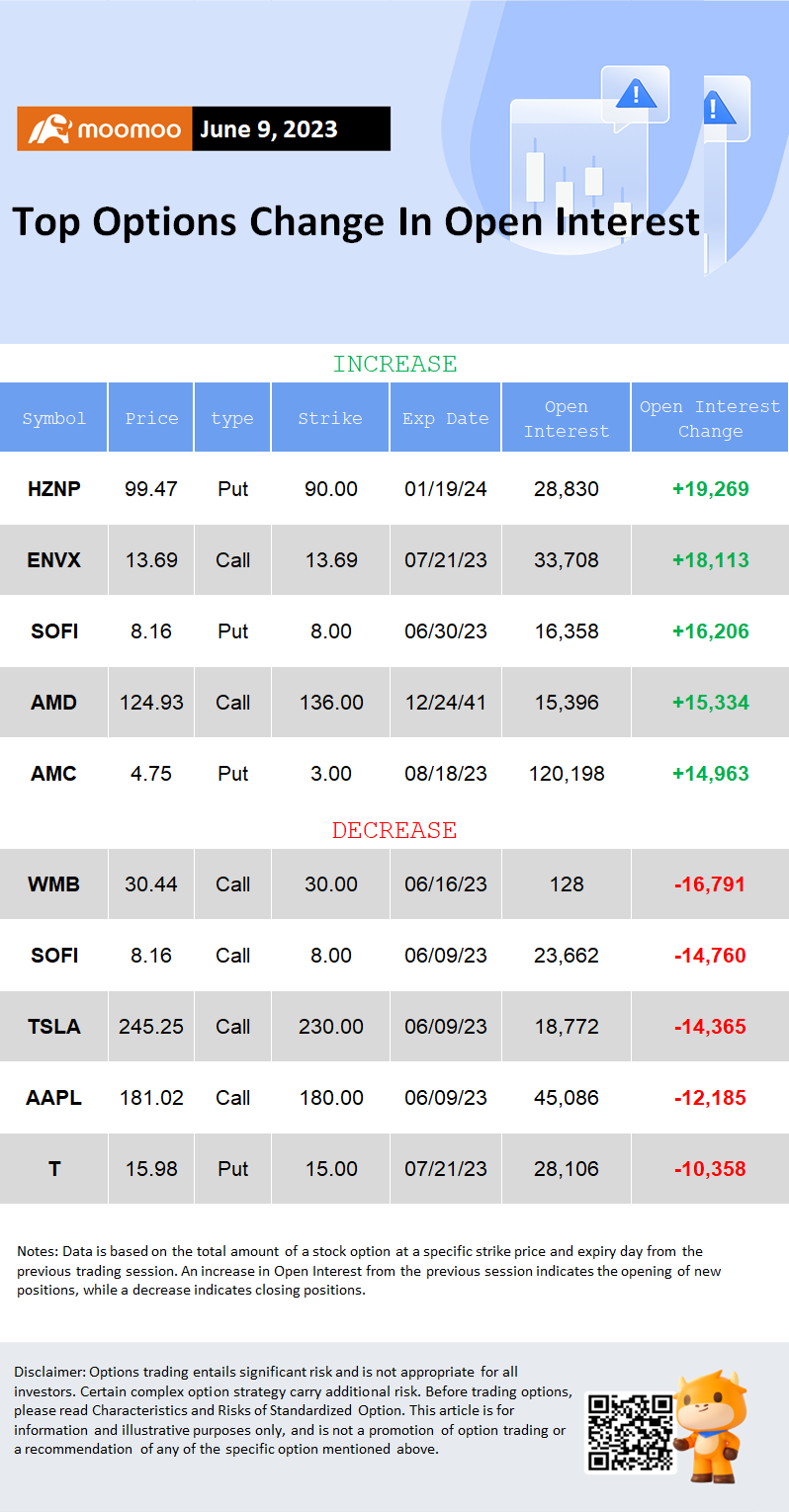

The open interest of $Horizon Therapeutics(HZNP.US$ call options experienced a substantial increase of 19,269 contracts, signaling bullish sentiment among traders.

And today saw the largest decline in open interest for $Williams(WMB.US$, as the number of contracts decreased by 16,791. This decrease is primarily driven by a decline in the open interest of put options.

The open interest put/call ratio in $DaVita(DVA.US$ jumped the most, with an increase of 63.3% to an OI PCR of 0.82 compared to the previous day.

The sentiment in $Expeditors International(EXPD.US$ has been seen to turn positive compared to the previous day, with OI PCR falling the most by 55.5% to a level of 1.04.

What is Open Interest Put Call Ratio? An indicator to help with market sentiment analysis within specific time-frames.

OI PCR can be used to determine market sentiment -- if it is greater than 1, it is considered bullish, and if it is lower than 1, it is considered bearish. And computed by total open interest of all the puts divided by total open interest of all the calls.

Its utility, however, goes beyond this simple interpretation. The OI PCR can be used to determine market sentiment. If the OI PCR is greater than 1, it is considered bullish, and if it is lower than 1, it is considered bearish. However, its utility goes beyond this simple interpretation. The indicator can detect the dangerous consensus we discussed earlier, which can lead to drastic price movements.

To provide context, when the OI PCR goes significantly above 1, it indicates a shift from a bullish sentiment to an extremely bullish sentiment. Similarly, if the OI PCR is close to 0, it suggests an extremely bearish mood.

Disclaimer:

Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Option before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment