AAII Sentiment Survey: Optimism Drops as Pessimism Jumps to an Eight-Week High

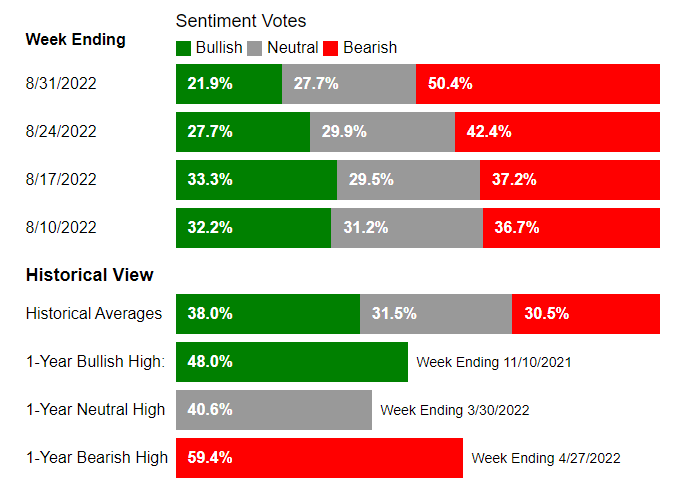

The results from the latest AAII Sentiment Survey show optimism about the short-term direction of the stock market falling to an eight-week low. At the same time, pessimism rose to an eight-week high.

Sentiment

Bullish sentiment

- Expectations that stock prices will rise over the next six months, dropped 5.8 percentage points to 21.9%.

- The pullback puts optimism back at an unusually low level.

- Bullish sentiment below its historical average of 38.0% for the 41st consecutive week.

Neutral sentiment

- Expectations that stock prices will stay essentially unchanged over the next six months, decreased 2.2 percentage points to 27.7%.

- Neutral sentiment is below its historical average of 31.5% for the 17th time in 19 weeks.

Bearish sentiment

- Expectations that stock prices will fall over the next six months, jumped 8.0 percentage points to 50.4%.

- It is above its historical average of 30.5% for the 40th time out of the past 41 weeks and is at an unusually high level for the 25th time out of the last 33 weeks.

- The breakpoint between typical and unusually high readings is currently 40.5%.

Opinion: Continued volatility in the major stock indexes along with inflation

The bull-bear spread (bullish minus bearish sentiment) is –28.5% and is unusually low for the 26th time in 32 weeks. The breakpoint between typical and unusually low readings is currently –10.9%. The bull-bear spread has also tied its second-longest streak of negative readings as sentiment has remained in favor of bears for the 22nd week in a row.

Historically, the S&P 500 index has gone on to realize above-average and above-median returns during the six- and 12-month periods following unusually low readings for the bull-bear spread.

Continued volatility in the major stock indexes along with inflation, corporate earnings and increased chatter about the possibility of a recession are all likely weighing on individual investors’ short-term expectations for the stock market. Also influencing sentiment are monetary policy, politics and the ongoing invasion of Ukraine by Russia.

Current AAII Sentiment Bull-Bear Spread:

About AAII Sentiment Survey

- Measures the percentage of individual investors who are bullish, bearish, and neutral on the stock market short term.

- Individuals are polled from the AAII Web site on a weekly basis.

Source: AAII

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

shy Cheetah_0241 : Let go Brandon