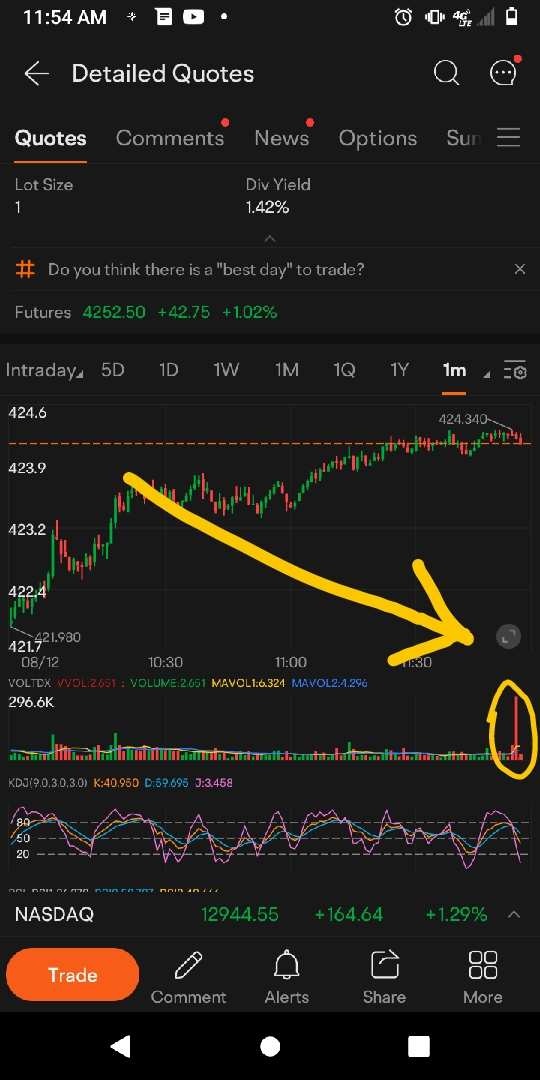

WATCH OUT FOR THE SHORT-TERM RESISTANCE

the day is looking very bullish so far. but you can see by this volume candle that the short-term traders are stepping in at this previous high which is a resistance level on the short-term Outlook. I have a long position as a day trade but I'm waiting to see which direction the market chooses at this resistance level then I will manage my trade accordingly

in the chart below you can see the resistance level that I'm talking about. just watch out for the market to reverse here. it is very bullish day like I said so shorting the market may not be a good idea. but it's always something you should watch out for at resistance levels like this at the end of the week

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

James Tober : It’s going over $425 stop with this bullshit saying anything else

SpyderCallOP James Tober: if you would have read the whole post then you would already know that I'm long on spy today and I have not sold my long position yet. I was just watching this resistance level just in case. I even mentioned that it might not be a good idea to go short on a bullish day like this.

SpyderCallOP James Tober: I'm long on spy and Microsoft today. parabolic. but I trade options. and when you get to these resistance levels your premiums can change greatly. you always got to watch the resistant levels

Violets James Tober: why so angry? looking at both sides helps because there's a very good possibility of a hard drop next week before it continues up.

SpyderCallOP Violets: that is exactly what I was saying. I mean look at that volume candle. apparently there was a lot of orders that were either open or closed at that candle which was at resistance. it's all good though I hope you made lots of money just like we did