Credit Suisse: Elasticity overdone; Gross margin hit bottom; Maintain Simply Good Foods Co. at Outperform

$The Simply Good Foods(SMPL.US$ reported F3Q22 EPS $0.44, up 2% YoY and 10c ahead of FS consensus. Upside came from better retail takeaway, higher customer inventory levels, and increased advertising. Despite lower-than-expected sales guide for F4Q largely due to timing of shipments, sell-through remains robust, margin progression is on track (supported by more pricing this summer), and long-term opportunity is intact. Credit Suisse maintains $45 target price and Outperform.

Key takeaways:

1. Elasticity overdone; No signs of demand destruction.

Seasonally high customer inventories at quarter-end and a slowdown in recent scanner data drove SMPL shares down 8% at close. Credit Suisse thinks this is overdone. Simply shipped ahead of consumption in front-half F22 and that dynamic is now reversing, albeit with a delay. Retail takeaway is stronger than expected and comps get easier in F4Q. Elasticity is ticking higher given broad-based inflation, but it seems no signs of demand destruction.

2. Gross margin contraction troughed in F3Q; There could be upside to FY23 margins.

Gross margin contraction likely troughed in F3Q and Credit Suisse expects trends to improve from here. Ingredient costs (mostly dairy/protein) appear to have at least stabilized over the last quarter, and pricing realization as planned was up around 8%. Gross margin in F4Q is likely to decline around 250bp (similar to FY22). With an additional round of price increases of similar magnitude expected this summer, there could be upside to FY23 margins.

3. Slower category growth in the back-half of F22;The number of buyers in the category continues to grow.

Slower category growth in the back-half of F22 was expected amid tougher comps. Importantly, the number of buyers in the category continues to grow, and the overall buy rate has not yet returned to historical levels, which provides potential additional upside. For Simply in particular, Credit Suisse still sees a long runway for continued innovation behind different product types, flavors, sizes, as well as adjacent opportunities and new daily occasions.

4. Estimates and Valuation.

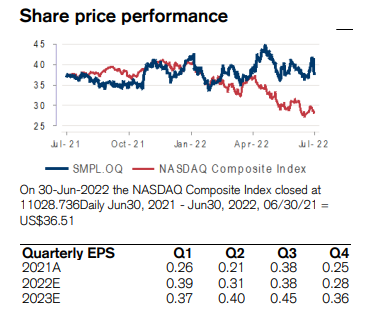

Reduced F4Q’22 sales/EPS given timing of shipments and expected customer inventory draw down next quarter. Sales are expected to be up 2% (prior +7%) and EPS $0.28. The new F22/23 EPS estimates are $1.36/$1.58 (prior $1.30/$1.54).

Maintain $45 target price based on 27x F26 EPS of $2.15, discounted at 8%. Risks include weaker consumer, higher elasticity, supply chain disruptions.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment