AAII Sentiment Survey: Pessimism plunges, but stays unusually high

Pessimism among individual investors plunged this week but remains at an unusually high level in the latest AAII Sentiment Survey. Additionally, both bullish and neutral sentiment rose.

Sentiment

Bullish sentiment

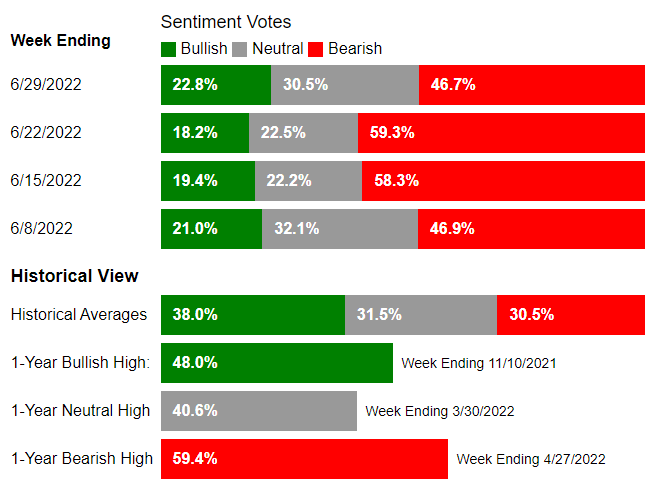

- Expectations that stock prices will rise over the next six months, rose 4.6 percentage points to 22.8%.

- It is below its historical average of 38.0% for the 32nd consecutive week and at an unusually low level for the 21 of the last 25 weeks.

Neutral sentiment

- Expectations that stock prices will stay essentially unchanged over the next six months, jumped 8.1 percentage points to 30.5%.

- It is below is below its historical average of 31.5% for the ninth time in 10 weeks.

Bearish sentiment

- Expectations that stock prices will fall over the next six months, pulled back by 12.6 percentage points to 46.7%.

- It is above its historical average of 30.5% for the 31st time out of the past 32 weeks and at an unusually high level for 20 of the last 24 weeks.

Opinion: Influencing sentiment are monetary policy, the coronavirus pandemic, politics and the ongoing invasion of Ukraine by Russia.

- The bull-bear spread (bullish minus bearish sentiment) is –23.9% and is unusually low for the 22nd time in 25 weeks.

- Historically, the S&P 500 index has gone on to realize above-average and above-median returns during the six- and 12-month periods following unusually low readings for bullish sentiment and for the bull-bear spread. Unusually high bearish sentiment readings historically have also been followed by above-average and above-median six-month returns in the S&P 500. The S&P 500 has underperformed following periods of below-average neutral sentiment, though the link is weaker.

- Continued volatility in the major stock indexes along with inflation, corporate earnings and increased chatter about the possibility of a recession are all likely weighing on individual investors’ short-term expectations for the stock market. Also influencing sentiment are monetary policy, the coronavirus pandemic, politics and the ongoing invasion of Ukraine by Russia.

Current AAII Sentiment Bull-Bear Spread:

About AAII Semtiment Survey

- Measures the percentage of individual investors who are bullish, bearish, and neutral on the stock market short term.

- Individuals are polled from the AAII Web site on a weekly basis.

Source: AAII

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Join✅Discord : Bidenomics make the market