Today's Morning Movers and Top Ratings: BP, PFE, WFC, TLRY and More

Morning Movers

Gapping up

$Taiwan Semiconductor(TSM.US$ stock increased by 2.8%, building on the previous session's gains, after the U.S. government provided a $6.6 billion subsidy for a new advanced semiconductor plant in Arizona, and the stock reached an all-time high in Taiwan.

$Pfizer(PFE.US$ stock went up by 0.4% following the announcement that its respiratory syncytial virus vaccine, Abrysvo, showed good tolerance and immune response in higher-risk adults under 60, similar to the response in older adults who are already approved for the vaccine.

$BP PLC(BP.US$ ADRs (American Depositary Receipts) grew by 1.2% as the energy giant projected first-quarter production of oil, gas, and low-carbon energy to exceed that of the prior quarter.

$HSBC Holdings(HSBC.US$ ADRs increased by 0.4% after the bank announced the sale of its Argentina operations to Grupo Financiero Galicia for $550 million, as a part of its strategy to streamline the business and concentrate on its core markets in Asia and Europe.

Gapping down

$Coinbase(COIN.US$ stock dropped by 1%, with the cryptocurrency exchange seeing losses that mirrored the decline in Bitcoin's price.

$Wells Fargo & Co(WFC.US$ stock declined by 0.4% after Compass Point downgraded the bank to 'neutral' from 'buy', citing concerns ahead of the bank's quarterly earnings report on Friday.

$Tilray Brands(TLRY.US$ stock tumbled by 13% after the cannabis company reported a quarterly loss that was wider than expected, with revenue also falling below forecasts.

$Trump Media & Technology(DJT.US$ stock decreased by 0.5%, continuing its significant losses from the previous session after the company reported substantial losses earlier in the month and indicated difficulties in meeting its financial obligations.

$Tesla(TSLA.US$ stock fell by 0.3% after UBS analysts indicated that survey results suggest a challenging future for the electric vehicle manufacturer, with leveling EV demand and increased competition in China potentially affecting its short- to medium-term growth.

$Maxeon Solar Technologies(MAXN.US$ stock plunged by 14% after the company provided revenue guidance for the current quarter that was below expectations, citing slowing demand for distributed solar generation and the need to accelerate inventory reduction of its Maxeon 6 panels, which led to increased costs.

Source: CNBC; Investing.com

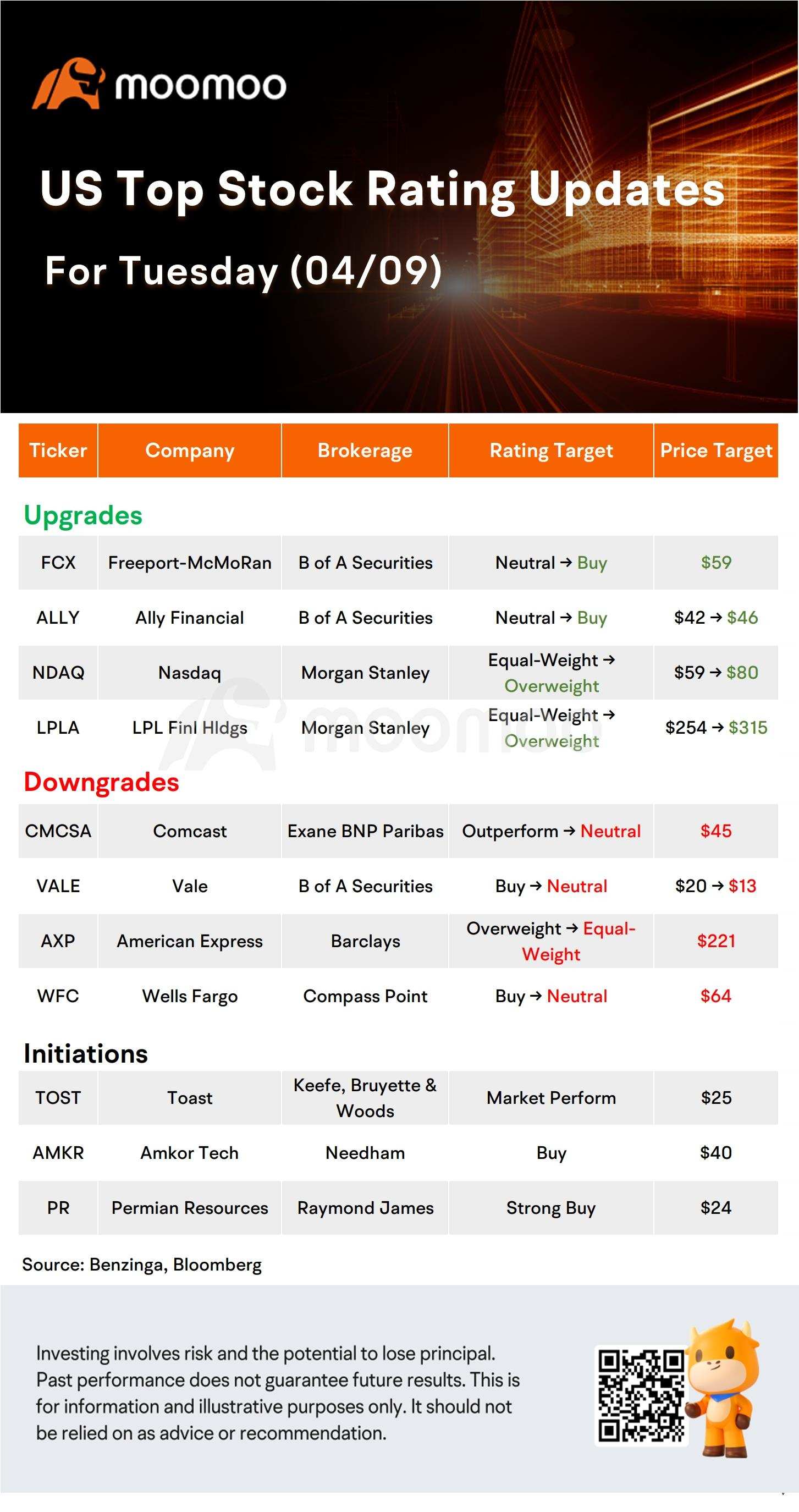

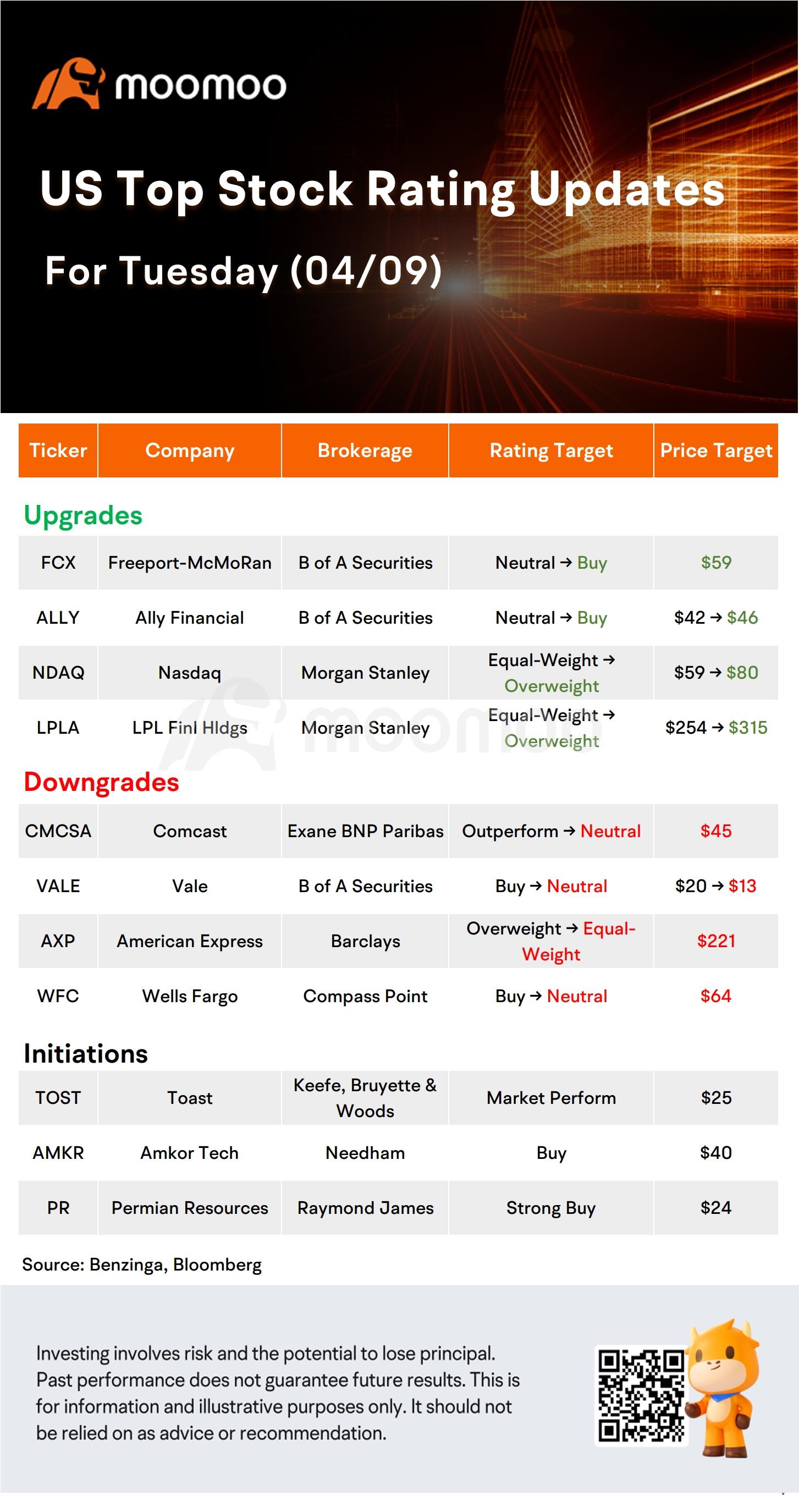

US Top Rating Updates on 04/09

Source: Dow Jones

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment