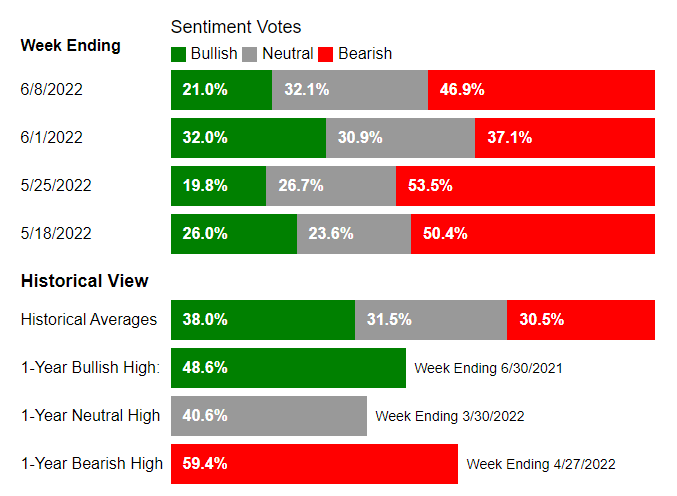

AAII Sentiment Survey: Optimism pulls back while pessimism rebounds

The latest AAII Sentiment Survey shows a big reversal from last week. Optimism plunged while pessimism jumped.

Sentiment

Bullish sentiment

- Expectations that stock prices will rise over the next six months, pulled back by 11.0 percentage points to 21.0%.

- The drop puts optimism back at an unusually low level.

- It also keeps bullish sentiment below its historical average of 38.0% for the 29th consecutive week.

Neutral sentiment

- Expectations that stock prices will stay essentially unchanged over the next six months, increased 1.2 percentage points to 32.1%.

- This is the first time in seven weeks that neutral sentiment is above its historical average of 31.5%.

Bearish sentiment

- Expectations that stock prices will fall over the next six months, rose 9.8 percentage points to 46.9%.

- The increase puts pessimism back at an unusually high level.

- It also keeps bearish sentiment above its historical average of 30.5% for the 28th time out of the past 29 weeks.

Opinion: The reversal in corporate earnings has heightened concerns among individual investors about further falls in the stock market.

- Bullish sentiment is at an unusually low level for the 18th time out of the last 22 weeks. Bearish sentiment is at an unusually high level for the 17th time out of the last 21 weeks. The bull-bear spread (bullish minus bearish sentiment) is unusually low for the 19th time in 22 weeks.

- The reversal in the major stock indexes along with corporate earnings may have heightened concerns among many individual investors about the possibility of further downside in the stock market. Also influencing sentiment are inflation, interest rates, the coronavirus pandemic, politics, the ongoing invasion of Ukraine by Russia, stock market volatility and the economy.

Current AAII Sentiment Bull-Bear Spread:

About AAII Semtiment Survey

- Measures the percentage of individual investors who are bullish, bearish, and neutral on the stock market short term.

- Individuals are polled from the AAII Web site on a weekly basis.

Source: AAII

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

搞经济 抄底 加仓 : Many Good companies did show a good earnings call but was pull back by the strong index fall. Those companies are what we should keep in mind as when market rebound ,that will sure hit sky high

and have a wonderful weekend

and have a wonderful weekend

Recently CN market been holding back strongly. exploreable

Still,research must be done before investing. Trade safe, Trade wisely

whqqq : thanks for your sharing