Alibaba Shows A New Trajectory

New trend in low margin businesses

Alibaba is currently undergoing a process that is opposite to Amazon (AMZN). Amazon started with a low-margin retail business and added the profitable AWS and advertising business which now form the core of its valuation. On the other hand, Alibaba started with a highly profitable e-commerce business and is now adding lower-margin businesses like physical retail, delivery, digital media, and others. This has led to a significant fall in overall margins for Alibaba as the new businesses cannot match the margins of the core e-commerce business.

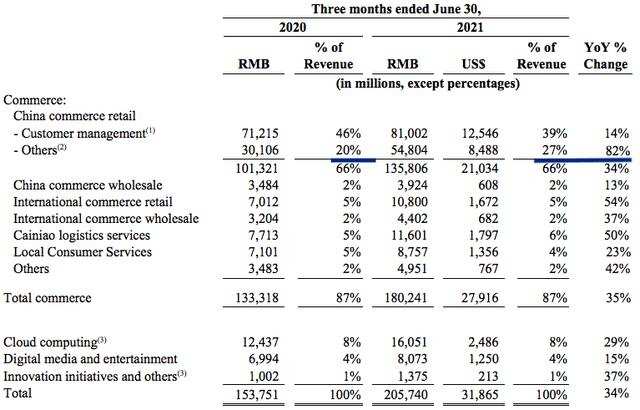

We can see from the above image that there was a whopping 82% YoY growth in Others segment. This is the revenue from physical retail stores, which is generally a very low-margin business. It has also had an impact on the employee numbers of the company. The consolidation of Sun Art has increased the headcount of the company to over 250,000 in the last quarter compared to close to 120,000 in the previous quarter.

The revenue share of Others segment has increased from 20% in the year-ago quarter to 27% in the last quarter. If Alibaba continues to acquire other physical retail chains, we could see the revenue share from Others segment increase further.

Importance of standalone valuation

Due to the above trend, it is very important to look at the standalone valuation of different segments. We can see that Alibaba's core Customer Management business reported 14% YoY growth, which is quite good considering the revenue base of this segment. This is the business that contributes most of the profits for Alibaba.

Alibaba has also reported 29% YoY growth rate in the cloud segment. The annualized revenue from this segment is close to $10 billion, which makes it one of the main players in this industry. The revenue share of cloud business is only 8%, but Alibaba has managed to report profitability within this segment. The operating margin of Amazon's AWS is 30% while Alibaba's cloud business has a margin close to 2%. It is likely that Alibaba will be able to narrow this gap in margins in the next few quarters, which can improve the sentiment for the overall stock.

Alibaba's Digital media business had modest growth of 15% compared to the year-ago quarter. However, Alibaba was able to improve the margins from negative 19% in the year-ago quarter to negative 5% in the previous quarter. This is a 14 percentage point improvement in a single year, which has helped the company save close to $0.8 billion on an annualized basis. Even though the revenue growth is quite low in this business, Alibaba has reported a healthy 30% growth rate in average daily subscribers for Youku. According to Variety, Youku's membership base is at 90-100 million compared to 112 million for Tencent Video and 119 million for $iQIYI(IQ.US$ . Rapid membership growth in Youku could help Alibaba replicate Amazon Prime's success and also build better loyalty for its retail platform to defend against competition from $JD.com(JD.US$ and $PDD Holdings(PDD.US$.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Harper lee : Unfortunately the detail of this analysis (which is good) is meaningless as long as the CCP is in control

Wyatt lincoln Harper lee: So tired of hearing that malarkey. Think longterm

just like banking sector and Fed in US…..

The CCP has been in charge of China for 100 years. When BABA was 330 a share it was in charge. When everyone rushed to buy Chinese stocks it was in charge. When everyone rushed out it was in charge. The CCP has always been the CCP, the risk hasn't changed at all. Just because some people are just now realizing the risk, doesn't change the actual risk or the potential reward.

Every investment is a calculation of risk vs reward, is the risk worth the reward? How much of my portfolio am I willing to risk for the potential payoff? Would you risk 1% of portfolio for potential %10,000 gain if you estimated a 50/50 chance?

Sounds like you don't think the risk for BABA is worth the risk, many disagree and are willing to risk some amount for the potential payoff.

styleomileo : Company has huge cash stockpile so where is the risk? Management will comply and even lead the way in doing social good, build charities, schools, etc to appease the authorities. It is the best time to accumulate stock if you are investor, not trader.

DHLS Harper lee: Tuniu seems to have been invested by Tencent