Apple may become a leader in the Advertising industry by 2026

$Apple(AAPL.US$Let's revisit a few facts about the company:

1. As of January 2021, Apple has an active installed base of 1.65 billion devices compared with 1.5 billion devices a year ago. At the time, Apple had over 1.0 billion active iPhone devices globally. By now, this number is very likely even higher, thus further increasing the reach of advertisers on iOS and on Apple's products, all the while protecting the privacy of consumers and freedom of choice (opt in or opt out from app tracking - your choice).

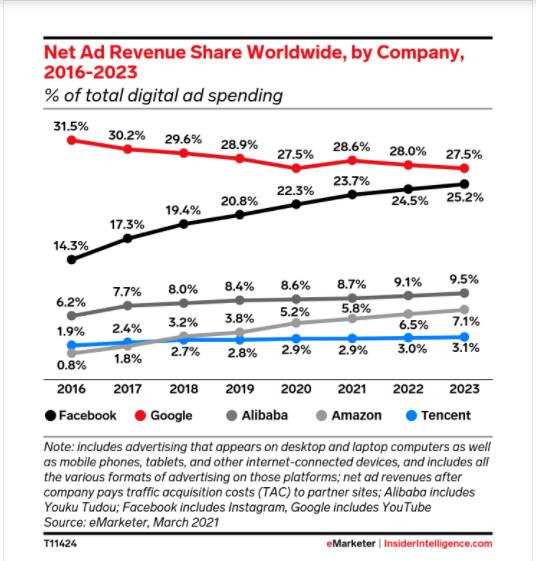

2. The company is expected to generate ~$3 billion in advertising revenue in 2021 compared to a mere $300M in 2017. Has anyone paid attention to the meteoric rise of Amazon's advertising revenue over the past 5 years? Facebook investors might not have, but Apple management certainly has. As I mentioned in my articles on Facebook - entry into the advertising business is not a high barrier - any company with a sufficient network of users and global reach can do so, and Apple certainly can.Net ad revenue share worldwide

3. The TAM market for advertising is... well, very large. Some project that advertising could very well be as lucrative as $20B in sales annually for Apple, and this estimate might be low. The global advertising agencies market is expected to grow from $317.63 billion in 2020 to $348.4 billion in 2021 at a compound annual growth rate (CAGR) of 9.7%. The market is expected to reach $455.38 billion in 2025 at a CAGR of 6.9%.

Some projections place it as high as $786.2B by 2026. Let's take the lower projection for now.

- $20B would only be a miniscule 4.4% for Apple - surely Apple can beat $TENCENT(00700.HK$? At a more optimistic 5.5% by 2025, Apple would capture $25B in advertising revenue (or more).

- With approximately $347B in FY 2021 revenues, this would be 7% of current revenues and closer to 4% to 5% of future revenues - a minor enhancement for Apple, perhaps enough to offset any losses due to App Store fee changes and new regulatory anti-steering rules.

The implication here is positive nonetheless: most negative / pessimistic cases for Apple's stock involve projections of doom and gloom for Apple's Services business due to regulatory action and forced App Store fee changes, as if Apple's stellar management and R&D team would simply sit back and continue popping pink-balloons and sangria drinking parties at their new headquarters in Cupertino while wearing colorful COVID masks.

However, I believe Apple is poised to gain closer to 10% to 15% of the Advertising market because it is disrupting the digital Advertising industry. It is leading the innovation and cultural changes backed by regulatory (government) and social (consumer) trends.

- Thus, at 10% to 15% we'd see revenues of $45.5B to $68.3B by 2025 (using the lower CAGR projection)

- At the higher CAGR projection,by 2026, we'd see revenues of $78.6B to $118B

This would be anywhere from 13% to 34% of current revenues, or ~10% to 26% of future revenues.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

enderspawn : AAPL slow and steady success continues