ETF Basics

Features of ETFs

Key Takeaways

· ETFs provide better diversification than a single stock in terms of portfolio and risks.

· Compared with mutual funds, most ETFs provide more transparency regarding holdings, are easier to trade, typically provide more tax efficiency, and in many cases, have lower operating costs.

· The most common disadvantage pertains to ETFs that are designed to track indexes - tracking errors can create discrepancies. Thinly traded ETFs may also have wide bid/ask spreads, and depending on your broker, trading costs could be a concern.

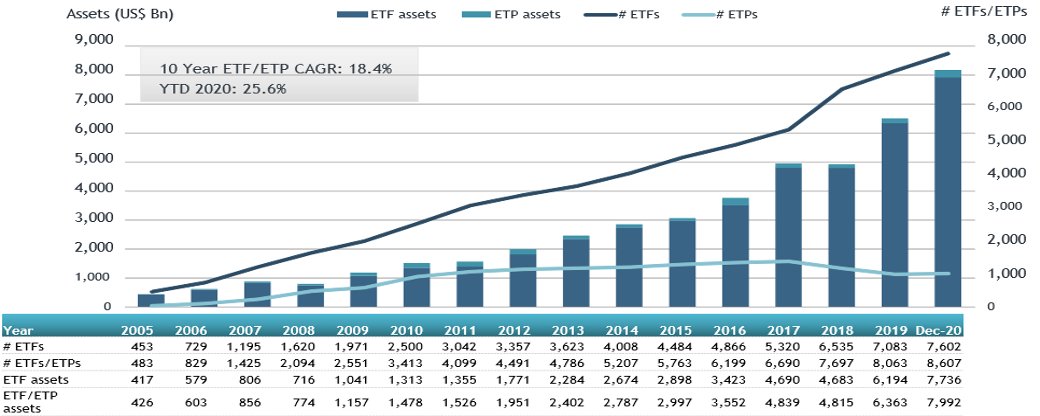

From 2003 to 2020, assets under management (AUM) of ETFs grew steadily by about 36 times in 17 years, reaching US$7.7 trillion in 2020. Giants like BlackRock, Vanguard, and State Street dominate the market.

Source ETFGI - data sourced from ETF/ETP sponsors, exchanges, regulatory filings, Thomson Reuters/Lipper, Bloomberg, publicly available sources, and data generated in-house. Note: This report is based on the most recent data available at the time of publication (01/14/21). Asset and flow data are subject to change.

ETFs have become an investment choice for many people, and the Federal Reserve is no exception.

In March 2020, amid the coronavirus sell-off, the central bank said it would buy ETFs to stabilize the financial system (a first for the U.S. central bank) – namely, the bond market.

The Fed may have achieved its goal better than anyone could have expected. That's because actual Fed purchases of ETFs have been a lot smaller than the overall inflows. There have been flows of $150.1 billion into bond ETFs through August 31, 2020 (about $132 billion of that is U.S. funds). As of the end of August 2020, however, the Fed had only bought $8.7 billion worth of such funds, according to Marketwatch.

As a Central Bank, why would the Fed send such a friendly signal toward ETFs? We are not sure what the answer is, but it may be related to the features of ETFs.

Features of ETFs

How are stocks and ETFs different? We could provide multiple examples, but we cover a few below.

Diversification

To get any meaningful portfolio diversification with stocks, you have to buy shares in many different companies separately. However, a single share of an ETF is inherently a mix of different investments. So, you can typically use ETFs to achieve more diversification with much less invested money than you'd need to buy the same stocks individually.

Also, the multiple investment themes and strategies available through ETFs give investors multiple choices for portfolio construction.

Simplicity

Since investors can also increase portfolio diversification, they can spread risks by holding many securities in one fund. This can be a simpler investment approach for many investors when compared to keeping an eye on various individual securities simultaneously, which can be time-consuming.

ETFs may be an easier option. ETFs are professionally managed based on the goals outlined in the fund's prospectus. All the work of researching, buying, and selling individual stocks is done for you.

How are mutual funds and ETFs different? Again, we could provide multiple examples, but we cover some below.

Transparency

Many, but not all, ETFs publish holdings daily, while mutual funds report their holdings quarterly.

The real-time intraday net asset value (NAV) of an ETF is also published by some, but not all, ETFs. This can serve as a useful tool for some investors and traders.

Flexibility

You can buy and sell ETF shares directly on major stock exchanges throughout the day. Mutual funds trade once a day after the market closes.

Tax-efficiency

ETFs usually charge comparatively lower management fees (known as the expense ratio) than traditional mutual funds. This is partly due to tax efficiency.

From the perspective of the IRS, the tax treatment of ETFs and mutual funds is the same. Both are subject to capital gains tax and taxation of dividend income. However, ETFs can be more tax-efficient than mutual funds because they traditionally experience fewer taxable events. For many funds, this is due in part because passive funds generally are index-tracking ETFs and don't typically have a lot of changes to holdings unless the underlying index changes.

Also, unlike mutual funds, ETFs generally don't sell securities to raise cash to meet redemptions. They instead employ an "in-kind" mechanism that allows them to meet redemptions without selling securities and realizing capital gains. Mutual funds, on the other hand, have to constantly buy and sell securities to rebalance the fund and accommodate shareholder redemptions. The sale of securities within the mutual fund portfolio creates capital gains for the shareholders, even for shareholders who may have an unrealized loss on the overall mutual fund investment.

We could check the ETF expense ratio on moomoo via the "Summary" section: